- Bitcoin and Ethereum netflows pictured comparable patterns round Christmas

- Open Curiosity developments revealed cautious sentiment amongst merchants

Bitcoin [BTC] tends to see a Santa Claus rally within the week main as much as Christmas, earlier than relinquishing these good points the next week. This has been the pattern lately, beginning in 2021. The 12 months earlier than that didn’t conform to this sample.

Because of this alongside Bitcoin, different main altcoins equivalent to Ethereum [ETH] and Dogecoin [DOGE] have tended to see their costs slashed within the week following Christmas. Will this pattern proceed in 2024?

Main property’ alternate flows and the worth correlation

Supply: Santiment

AMBCrypto examined the stream of BTC and ETH to and from exchanges round Christmas time. A 7-day transferring common was used to clean out the readings. In 2023, BTC noticed the 7-day MA attain 1,481 BTC influx on 22 December, and the 7-day ETH influx was 32,805. A number of days later, they went the other approach.

The transferring averages for alternate netflows for BTC and ETH reached -5,915 and -9,626 for BTC and ETH, respectively, on 26 and 27 December – An indication of accumulation.

In the meantime, the worth developments for the tokens had been sideways for BTC and a ten% hike for ETH, main into the ultimate week of the 12 months. Collectively, the metrics revealed that individuals most well-liked to ship tokens to exchanges to e-book some earnings, and collected extra the next week.

2024 introduced a Santa Claus rally to crypto, taking BTC to $99.6k, ETH to $3,560, and DOGE to $0.342 – Gaining by 6%-9% in three days main as much as Christmas.

At press time, alternate netflows had been trending greater, displaying that promoting stress was possible imminent. In the meantime, the costs of BTC and ETH have already fallen 5% and 6% respectively. Dogecoin shed nearer to 9%.

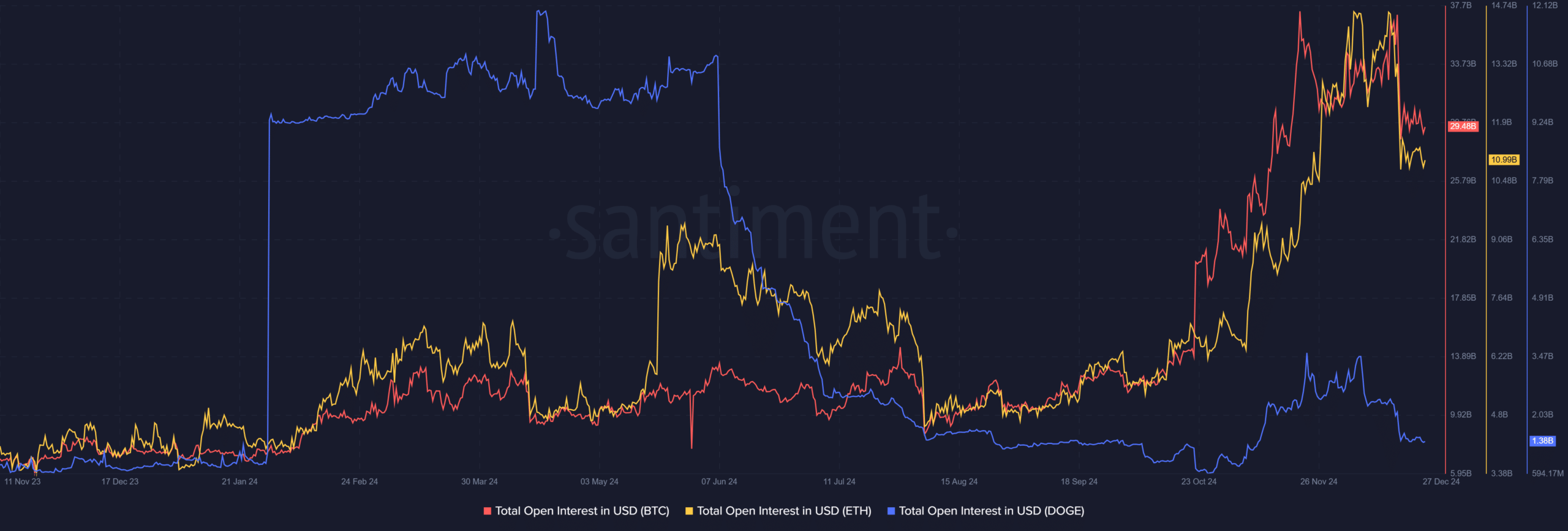

Open Curiosity confirmed muted sentiment main into the festive week

Supply: Santiment

The Open Curiosity of Dogecoin, Ethereum, and Bitcoin may be in contrast too. In 2023, the OI fell sharply from 22 to 25 December, earlier than recovering rapidly within the first two weeks of January.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

In 2024, 17 December noticed a pointy OI fall. This may be attributed to the market-wide drop, following bearish information from the Federal Reserve that introduced the Dow down 1,250 factors final Wednesday.

The OI continued to meander sideways, a robust trace that market individuals remained sidelined. Merchants might search for lengthy entries. And, an OI and quantity surge within the coming days might see the early 2024 good points repeated in January 2025.