- Bitcoin ETFs surpassed $20 billion in inflows of their debut 12 months, outpacing Gold ETFs by 10 instances.

- BTC trade inflows drop by 95.93% in 48 hours, whereas its social quantity rises steadily.

U.S. Bitcoin [BTC] ETFs have surpassed a formidable $20 billion in inflows inside their first 12 months, as talked about in a current tweet by MartyParty.

This stands in nice distinction to Gold ETFs, which attracted a lot decrease inflows of their first 12 months.

The fast adoption of BTC ETFs underlines growing curiosity in digital property, additional cementing Bitcoin’s place as a key participant within the funding universe.

Bitcoin trade inflows dip

Whereas ETFs are seeing heavy inflows, Bitcoin’s trade inflows have dropped considerably by over 95.93% within the final 48 hours.

This means a shift in investor conduct as fewer contributors are shifting their BTC to exchanges.

Consequently, the discount in influx could also be an indicator of the holders’ bullish angle, as they’re opting to carry the property somewhat than promote.

Supply: CryptoQuant

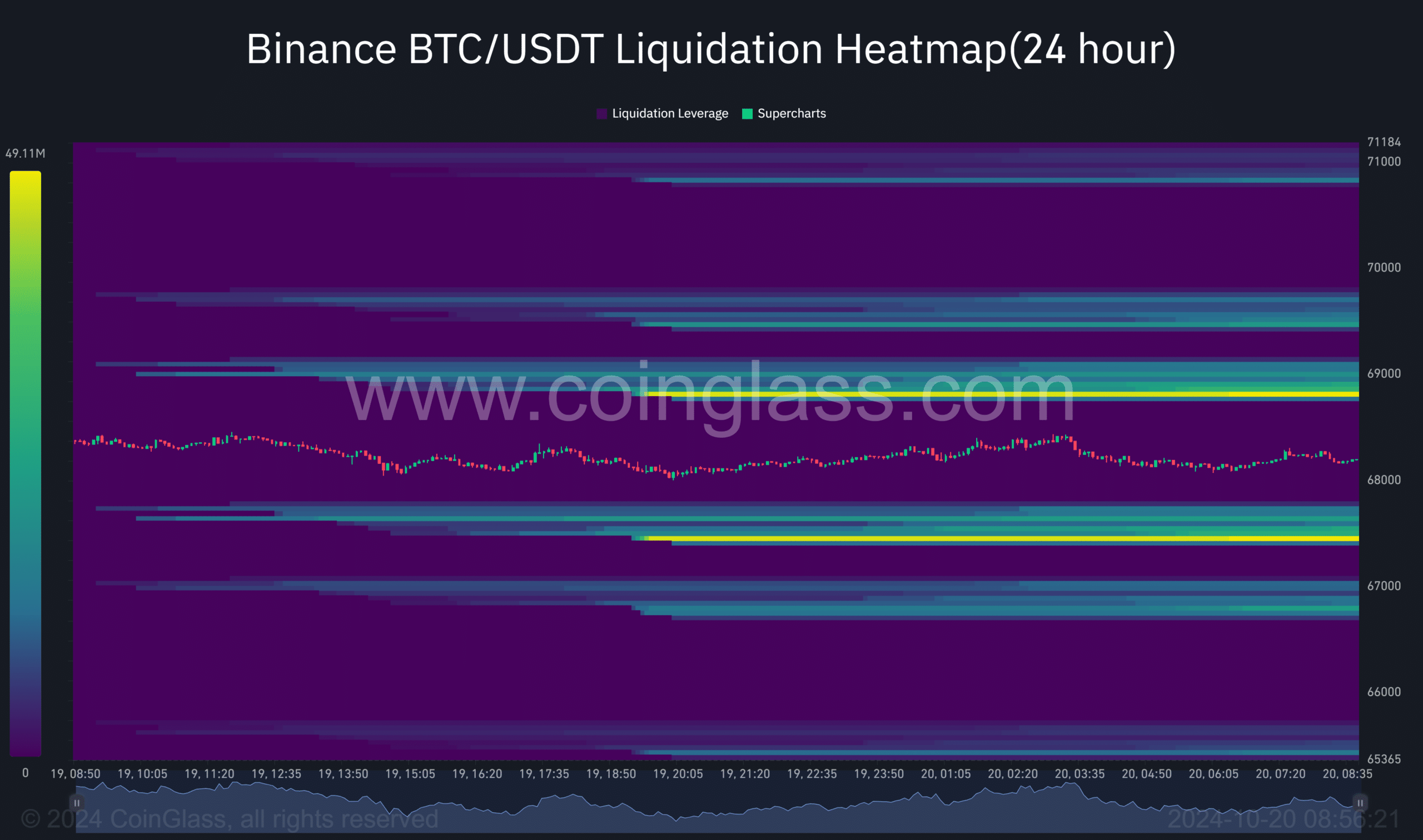

Liquidity heatmap settles at equilibrium

AMBCrypto evaluation of the liquidity heatmap information revealed a steadiness in Bitcoin’s liquidity ranges.

Over the previous 24 hours alone, liquidity on the $68.8k and $67.5k value ranges has reached equilibrium, with 49.12 million at each factors.

Maybe this is able to point out that BTC goes into consolidation, gathering power to propel costs.

Supply: Coinglass

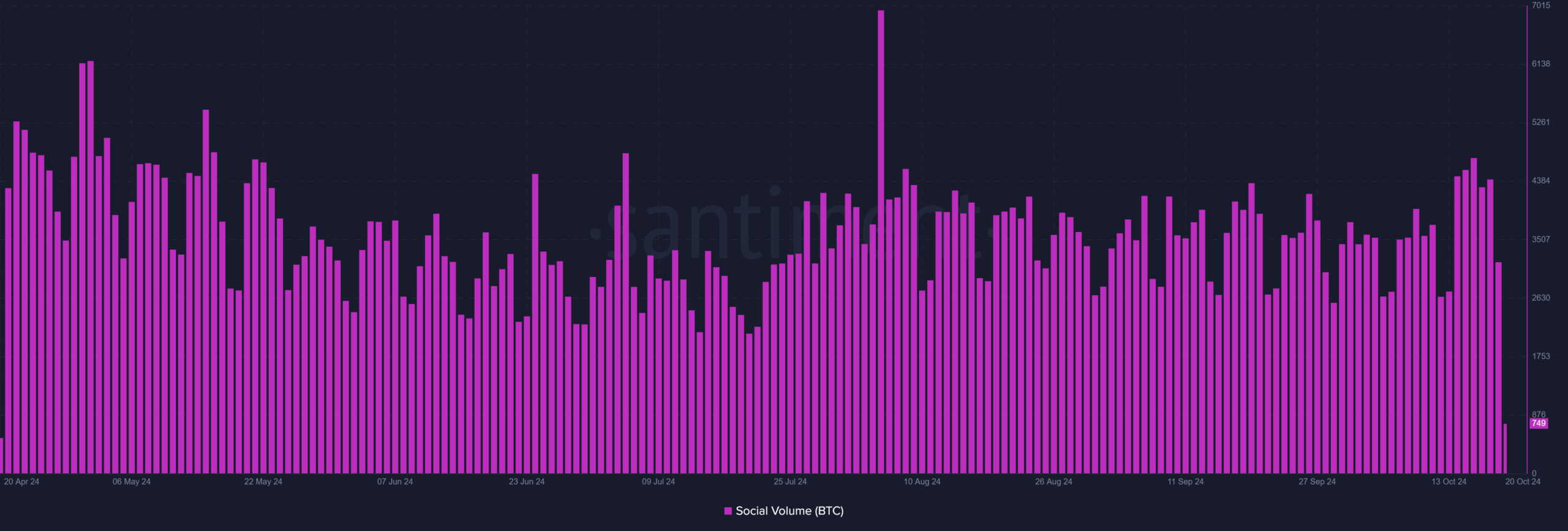

Bitcoin social quantity on the rise

Complementing the inflows into the ETF and stability of the market is the regularly growing BTC social quantity.

Because the twelfth of October, the social quantity of Bitcoin has saved upwards, indicating increased engagement and curiosity throughout communities.

This surge in social exercise means that Bitcoin is as soon as once more a sizzling subject, and extra folks than analysts and traders are speaking about its value, know-how, and future potential.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Traditionally, as social quantity rises, so does market curiosity and exercise.

Supply: Santiment

BTC ETFs’ success, declining trade inflows, balanced liquidity, and rising social engagement all level to a bullish market outlook for Bitcoin.