- Bitcoin ETFs recorded $555.9 million in inflows on the 14th of October, the best since June.

- ETFs held 869,000 BTC, about 4% of Bitcoin’s circulating provide.

On the 14th of October, Bitcoin [BTC] ETFs noticed record-breaking inflows, with a complete worth of $555.9 million—their largest every day internet influx since June, in line with Farside Traders.

This surge in ETF curiosity coincided with BTC reaching a two-week peak. The coin was buying and selling at $66,500, at press time.

Constancy’s FBTC led the cost and logged a formidable $239.3 million, marking its highest influx because the 4th of June.

Different notable ETFs included Bitwise’s BITB with inflows of $100.2 million, BlackRock’s IBIT at $79.5 million, and Ark 21Shares’ ARKB with just below $69.8 million.

Grayscale’s GBTC had its first inflow in October, at $37.8 million, the biggest since Might.

Execs weigh in…

Remarking on the identical, ETF Retailer President Nate Geraci famous,

Supply: Nate Geraci/X

Since their debut in January, BTC ETFs have amassed a notable $18.9 billion internet inflows.

Excluding GBTC, the 9 new Bitcoin ETFs owned round 646,000 BTC, with GBTC including 223,000 BTC to the whole.

These funds management 869,000 BTC, roughly 4% of Bitcoin’s circulating provide.

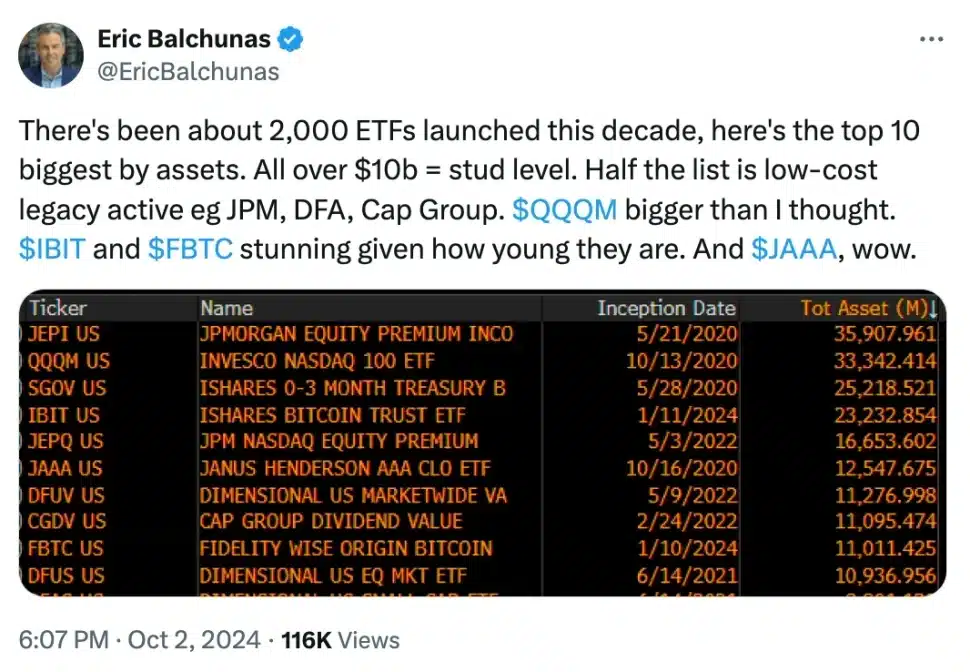

This yr has seen outstanding development within the ETF sector, with round 2,000 launches. This consists of prime funds like BlackRock and Constancy. Remarking on the matter, Bloomberg’s Eric Balchunas mentioned,

Supply: Eric Balchunas/X

Lingering considerations

Nonetheless, regardless of latest development, BTC ETFs signify solely a small slice of the whole Bitcoin buying and selling panorama.

In keeping with Checkonchain knowledge from the eleventh of October, the Bitcoin Futures market recorded $53.4 billion in trades, with the spot market reaching $4.5 billion.

In distinction, ETF trades totaled simply $2 billion, capturing roughly 3% of the day’s total BTC market quantity.

This little fraction demonstrates ETFs’ infancy within the bigger Bitcoin market ecosystem.

Nicely, that is additionally as a result of figuring out the precise share of ETF inflows pushed by the “basis trade,” or money and carry commerce, stays difficult.

Main gamers within the ETF market

Main establishments like Goldman Sachs and Jane Road Capital are engaged in creating and redeeming ETF shares, which stabilizes the ETF’s worth and liquidity.

Hedge funds, akin to Millennium Administration and Capula Administration, make use of “basis trading” methods to revenue from discrepancies between Bitcoin’s spot and futures costs.

Nonetheless, not all giant holders interact in foundation buying and selling.

For instance, the State of Wisconsin Funding Board holds the ETF for functions like portfolio diversification.

But, Bernstein, a personal wealth administration agency, means that foundation trades might act as a “Trojan horse” for broader adoption, as elevated liquidity and buying and selling quantity might encourage buyers to undertake long-term positions in Bitcoin.

What’s subsequent?

Subsequently, if choices tied to IBIT are authorised and bodily settled, it might entice extra refined buyers.

And, for that, methods like coated calls (promoting name choices whereas holding the underlying asset) would permit buyers to generate passive earnings, whereas miners might use these choices to hedge their holdings.

Collectively, these parts might convey extra maturity and quantity to the Bitcoin ETF market.