- Bitcoin ETFs noticed a resurgence, with inflows reaching $365.7 million as of the twenty sixth of September.

- BlackRock’s spot Bitcoin ETF recorded a $184.4 million influx, the month’s highest single-day surge.

After dealing with weeks of uncertainty, Bitcoin [BTC] ETFs are as soon as once more gaining momentum.

Regardless of September’s bearish status for BTC, each the cryptocurrency and its related ETFs have defied expectations with a pattern reversal.

Bitcoin ETF, analyzed

As of the newest knowledge on the twenty sixth of September, complete inflows for all Bitcoin ETFs have reached a powerful $365.7 million.

Main the cost was Ark’s ARKB with $113.8 million, adopted by Blackrock’s IBT at $93.4 million.

Constancy’s FBTC recorded $74 million, whereas Bitwise’s BITB sits at $50.4 million.

VanEck’s HODL, Invesco’s BTCO, and Franklin’s EZBC additionally contributed inflows of $22.1 million, $6.5 million, and $5.7 million, respectively.

Though two extra smaller ETFs confirmed modest inflows under $5 million, the general surge underscores the renewed investor confidence in BTC ETFs.

Notably, on the twenty fifth of September, BlackRock, the world’s largest asset supervisor, witnessed a rare surge of $184.4 million in inflows for its spot Bitcoin ETF, making it the best single-day influx of the month for any fund.

What’s behind this?

This spike comes amid rising market hypothesis, doubtlessly influenced by developments in Asia.

For these unaware, Chinese language shares rallied following stories that the Chinese language authorities could inject as much as ¥1 trillion($142 billion) into its main state banks, geared toward boosting an economic system that has confronted challenges just lately.

Earlier within the week, the Folks’s Financial institution of China (PBOC) took easing measures by chopping the reserve requirement ratio for mainland banks by 50 foundation factors and decreasing the seven-day reverse repo price by 20 foundation factors to 1.5%.

These actions have seemingly fueled optimism, which can be taking part in a job within the inflows seen in world markets, together with Bitcoin ETFs.

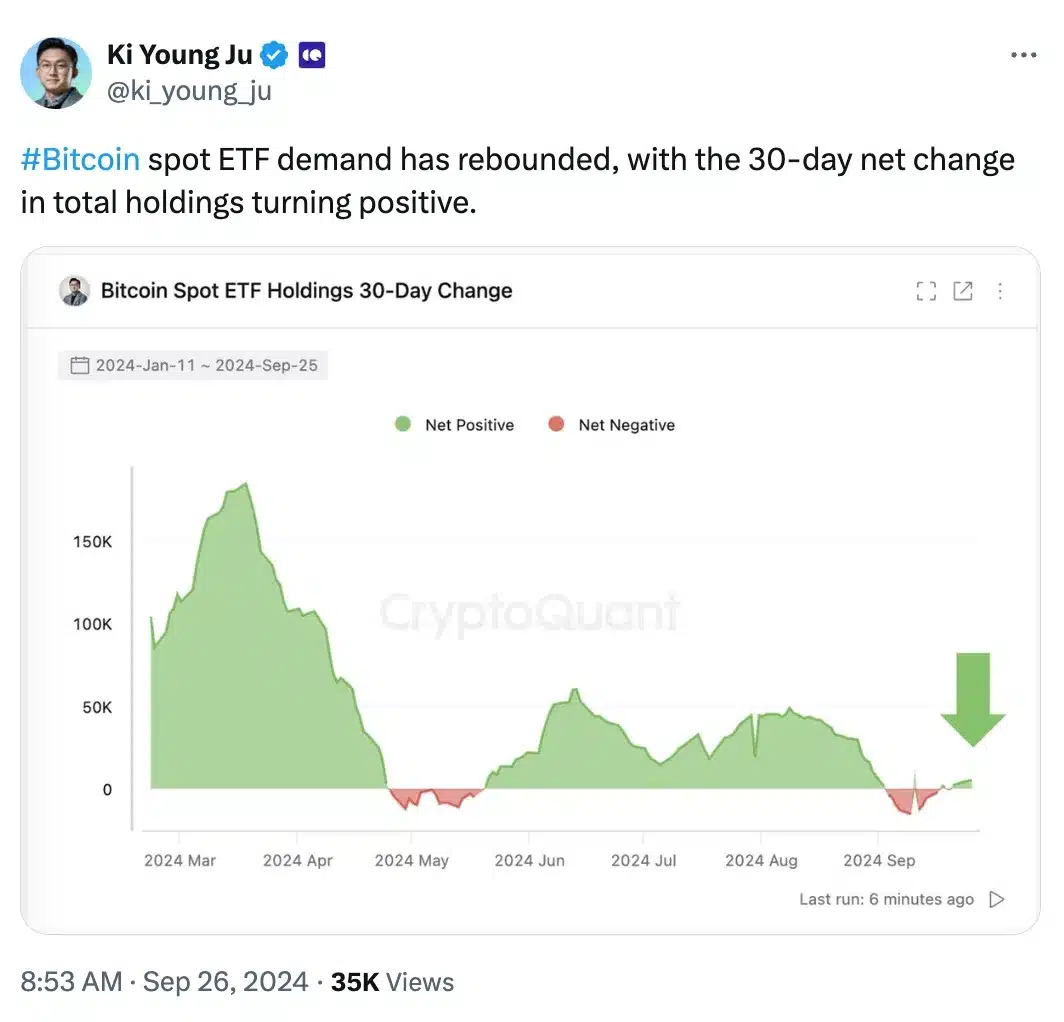

Remarking on the matter, Ki Younger Ju, Founder and CEO of CryptoQuant, mentioned,

Supply: Ki Younger Ju/X

He additional added,

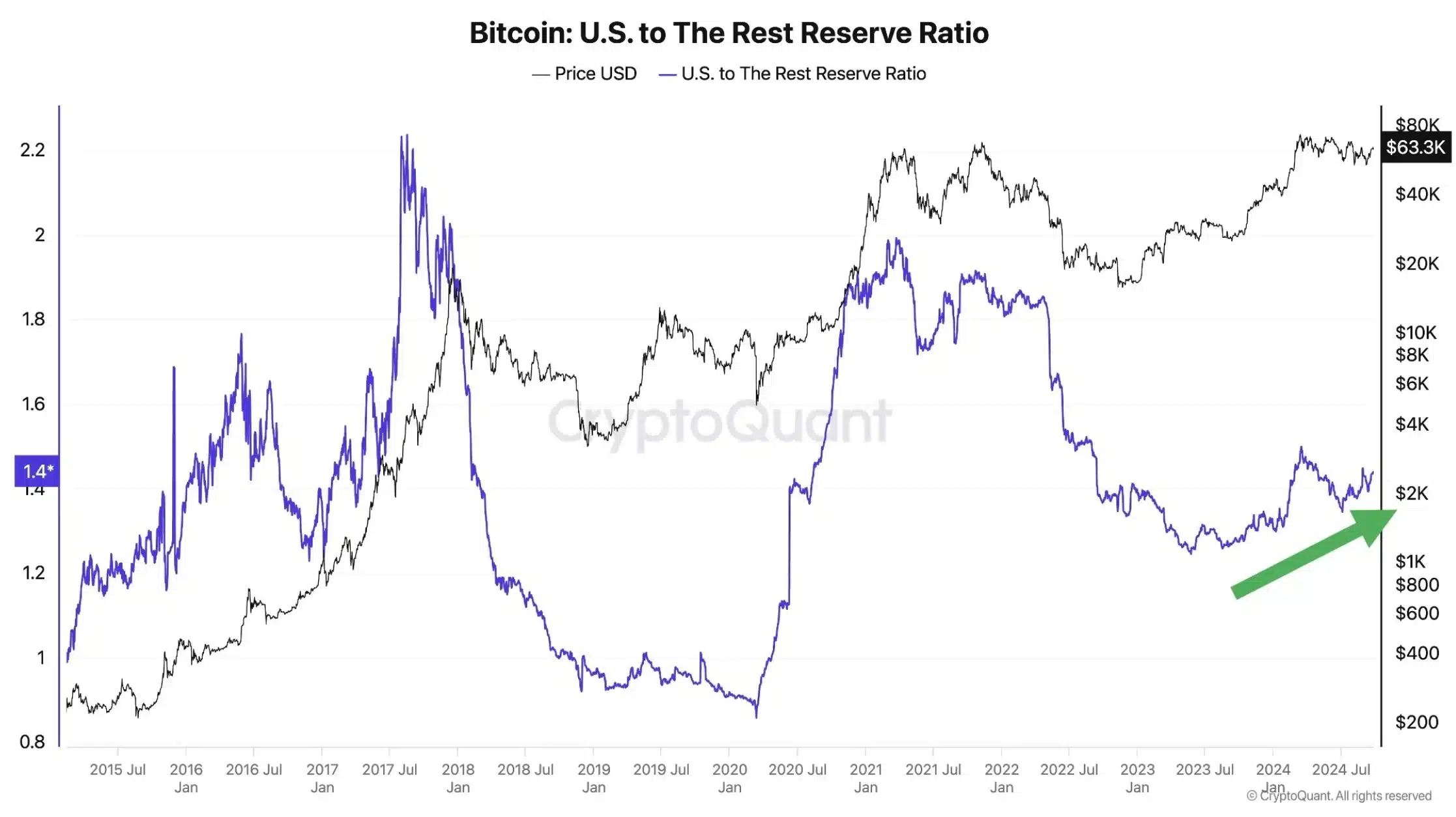

“The U.S. is regaining dominance in #Bitcoin holdings. Its ratio compared to other countries is rising, driven by spot ETF demand. Only known entities are included.”

Supply: Ki Younger Ju/X

A take a look at the value entrance

In the meantime, on the value entrance, BTC’s value motion has proven outstanding resilience.

After struggling to interrupt previous the $60,000 barrier for days, the main cryptocurrency surged, reaching $65,642. This marked a 2.89% acquire within the final 24 hours.

Because the month attracts to an in depth, Bitcoin has exhibited a powerful bullish pattern with a powerful month-to-month rise of 10.98%, signaling sustained upward momentum out there.