- Average losses rising, however no indicators of mass panic amongst holders.

- Worth dropped 17%, however dormancy and accumulation proceed.

Bitcoin [BTC] has entered a consolidation section, exhibiting indicators of cooling with out triggering widespread promoting.

On-chain information reveals a market marked by average losses, fading high-profit holdings, and rising mid-range positioning.

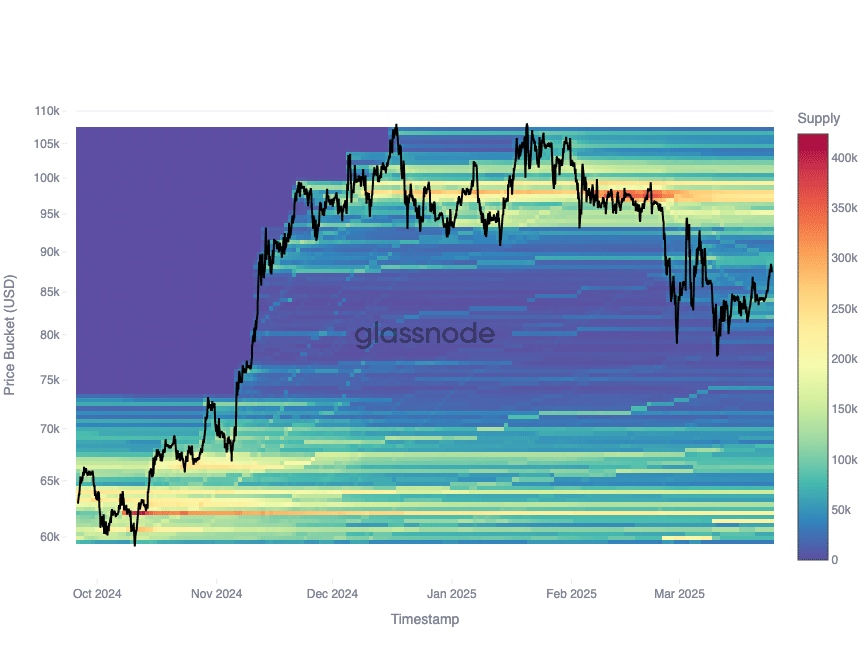

Glassnode shared that the share of Bitcoin held at average unrealized losses has grown considerably in 2025.

Swimming within the crimson—however staying afloat

Holdings within the -23.6% to -10% loss vary rose 7.75% this 12 months, pointing to extra underwater holders. On the similar time, high-profit holdings (40–60%) fell 3.57%, whereas mid-profit positions (20–40%) rose 3.45%.

This shift suggests cash are migrating from high-profit bands to mid-range ranges, per a market in cooldown mode however not exhibiting panic habits.

Supply: Glassnode

However there’s extra strain constructing elsewhere.

The strain mounts

There’s mounting strain on short-term holders, who acquired Bitcoin throughout the previous 155 days. Over 2.8 million BTC from this group sits underwater, posing vital unrealized losses.

Nonetheless, it should be famous that the majority traders are holding slightly than promoting at a loss.

The typical acquisition value for short-term holders stands close to $92,500. Bitcoin stays just under this degree, making it a important resistance threshold.

CryptoVizArt, a senior analyst at Glassnode, recognized the $90K–$93K vary as a provide zone.

Supply: X

This space types a provide zone, since traders who purchased right here could promote if costs attain $90K–$93K. Above that vary lies the trail to a brand new all-time excessive, whereas under it indicators ongoing consolidation.

However some are merely… ready

Nonetheless, not all holders are reacting the identical method.

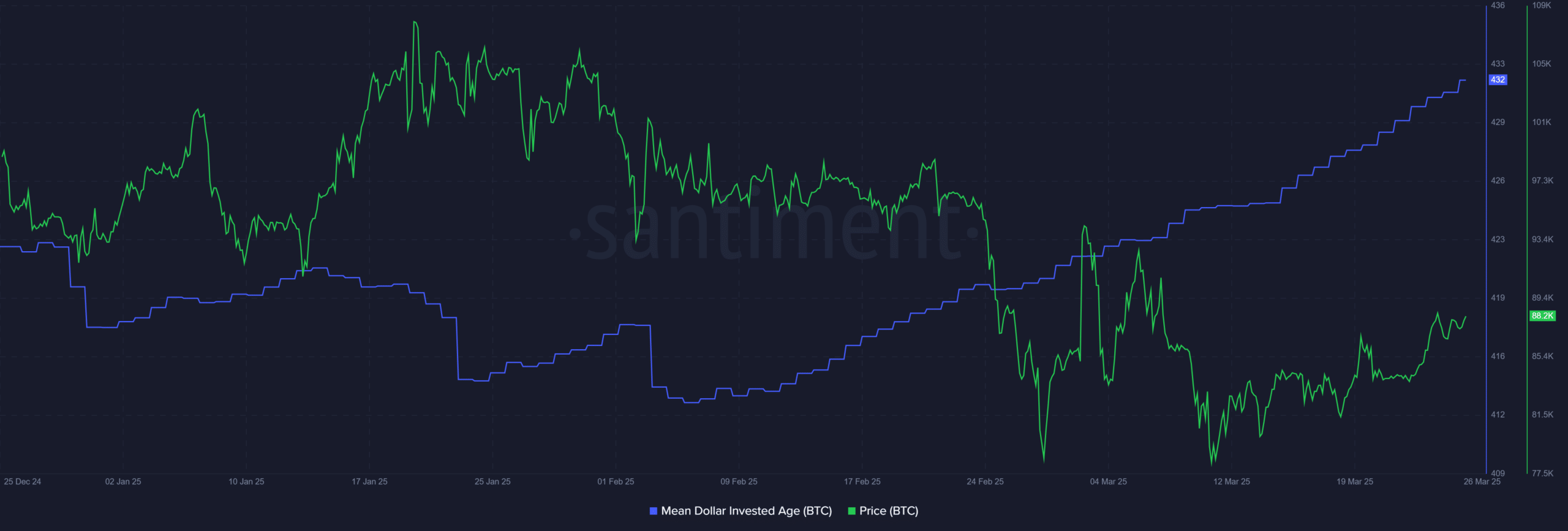

Bitcoin’s Imply Greenback Invested Age climbed from 418 to 432 days between the 4th of February and the twenty sixth of March. This means outdated cash are dormant, suggesting accumulation over distribution.

Supply: Santiment

Worth falls, however Bitcoin HODLing stays robust

Bitcoin’s value slipped from $101,403 to $84,330 over that interval, but MDIA saved rising.

This divergence displays long-term holder confidence. Traders seem prepared to carry by way of volatility, hinting at a quiet accumulation section.

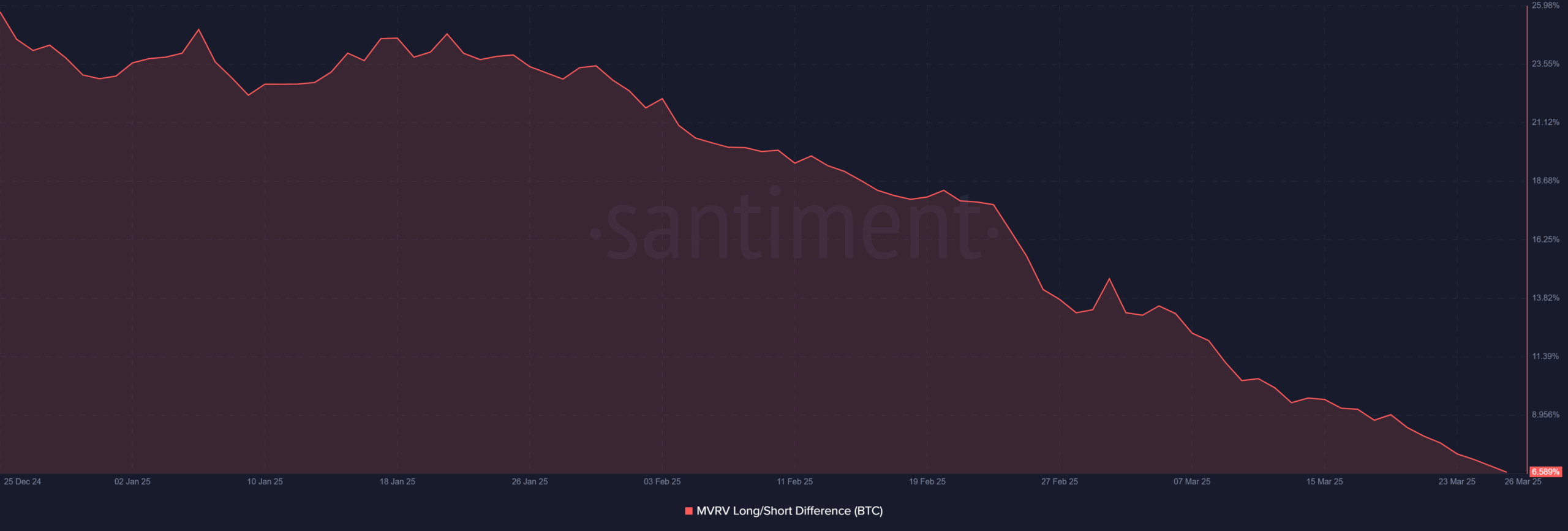

Now, let’s zoom in on one other key metric. The MVRV Lengthy/Quick Distinction, which tracks holder profitability, dropped from 22.12% on the third of February to six.59% on the twenty sixth of March.

Supply: Santiment

This 70% decline reveals long-term holders shedding their profitability edge, although sentiment stays regular. And that’s not the one sign of calm.

Whales watching, not dumping

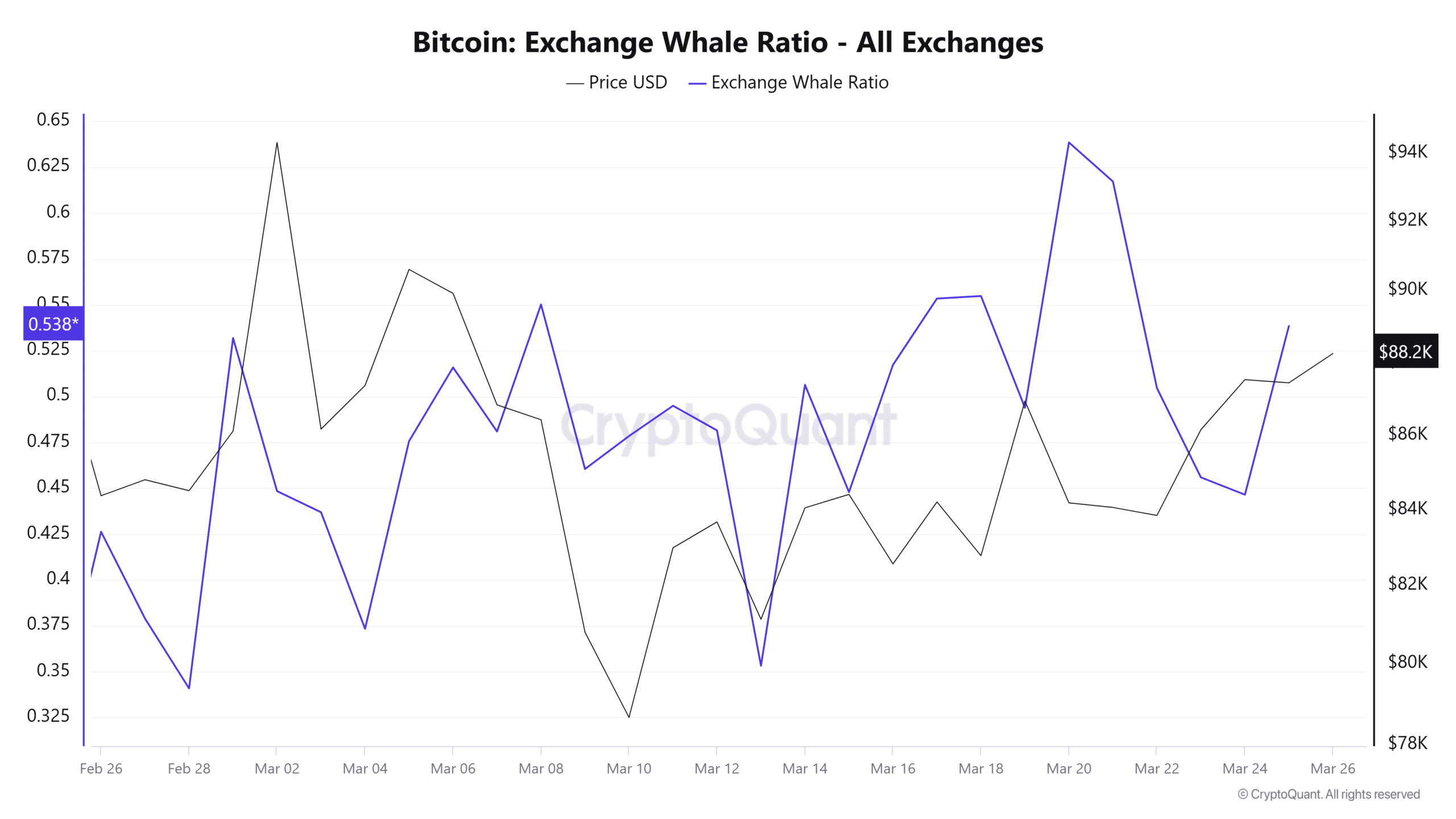

CryptoQuant information reveals a relaxed market, supported by the Alternate Whale Ratio staying above 0.50 in March.

Supply: CryptoQuant

Peaks on the 14th of March and the twentieth of March aligned with stabilization close to $84,000 and a restoration to $88,200. This sample suggests whale exercise throughout low volatility, with out triggering main sell-offs.

Bitcoin is in a cooling section, not a breakdown.

Metrics throughout platforms present regular accumulation, decrease short-term profitability, and dormant long-term holdings. Resistance holds close to $90K-$93K; assist sits at $87K-$89K.