- Bitcoin dominance weakens as altcoin efficiency rises.

- A possible value correction could also be tempered if this pattern holds.

Bitcoin [BTC] bears have thwarted one other breakout try, sustaining strain as bulls maintain above $62K. At $63,390 at press time, a reversal towards $70K might not be imminent.

Whereas some analysts predict a rebound, others counsel BTC dominance may be topping out, hinting at a possible dip. May this set the stage for an altcoin season?

Bitcoin dominance may be in danger

Traditionally, Bitcoin dominance has performed a vital function in forecasting market tops, reflecting Bitcoin’s large share within the crypto market.

Sometimes, when BTC approaches a key resistance degree, a corresponding peak in its dominance is usually noticed.

Nonetheless, the chart under revealed a divergence throughout BTC’s ATH of $73K in March. Regardless of the value surge, BTC dominance stayed flat, suggesting a decoupling between value motion and market dominance.

Supply : BGeometrics

Per AMBCrypto, this hinted at rising altcoin curiosity, with buyers viewing them as much less dangerous options to Bitcoin amid its worth surge.

Curiously, Ethereum’s [ETH] current value motion supported this speculation, as ETH has outpaced BTC with a double development charge over the previous week, surging greater than 15% to $2,656 at press time.

In abstract, ought to altcoin buyers monitor BTC’s essential resistance degree for a possible surge? This could possibly be key to predicting the subsequent market strikes.

Diversification indicators potential market prime

Based on this information, 15 altcoins have outperformed Bitcoin within the final 90 days, with TAO main the group, boasting a formidable 80% achieve over BTC.

Whereas this quantity is half of what’s wanted for an altcoin season, the numerous distinction actually challenges Bitcoin dominance.

Moreover, TAO has recorded a staggering 18% surge within the final 24 hours, far exceeding BTC’s 2%, which reinforces AMBCrypto’s earlier speculation.

Notably, TAO’s surge coincided with Bitcoin breaching the important thing $63K vary.

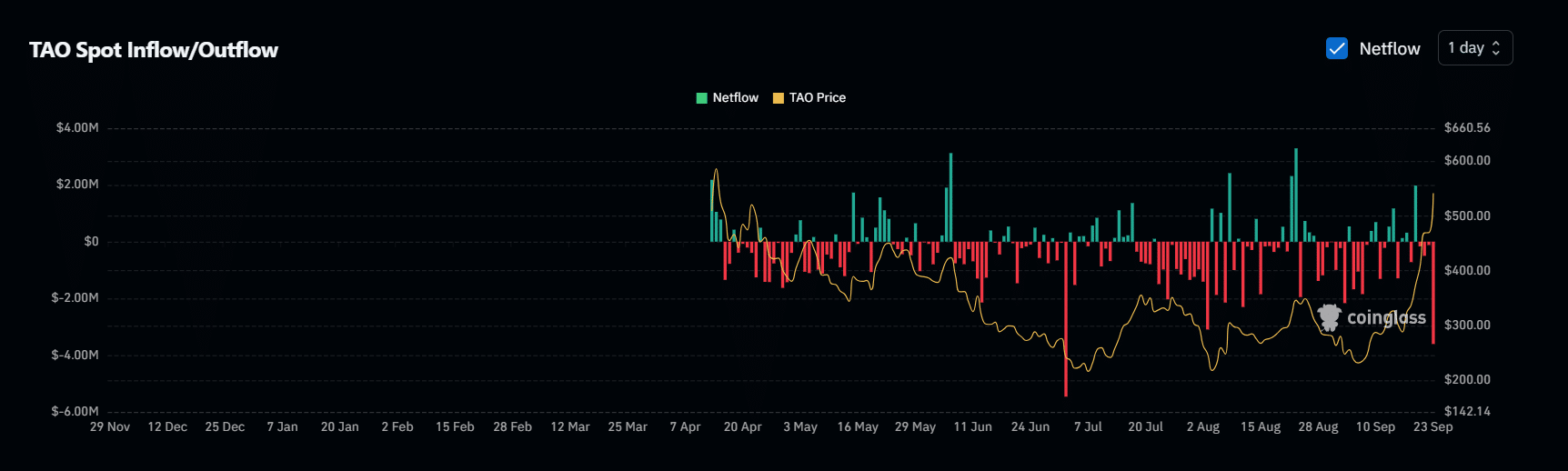

At present, a spike in TAO outflows has reached a two-month excessive of $3M, indicating that buyers are shifting into altcoins as BTC costs rise, signaling a direct correlation between the 2.

Supply : Coinglass

Put merely, this correlation signifies a possible market prime, as many buyers are dropping religion in a pattern reversal and shifting their capital towards much less dangerous options.

If this pattern holds, a value correction to $68K – the subsequent resistance – could possibly be tempered, particularly as Bitcoin dominance weakens with extra altcoins coming into the highest 50, setting the stage for a possible altcoin season – What are the percentages?

The market is at a vital juncture

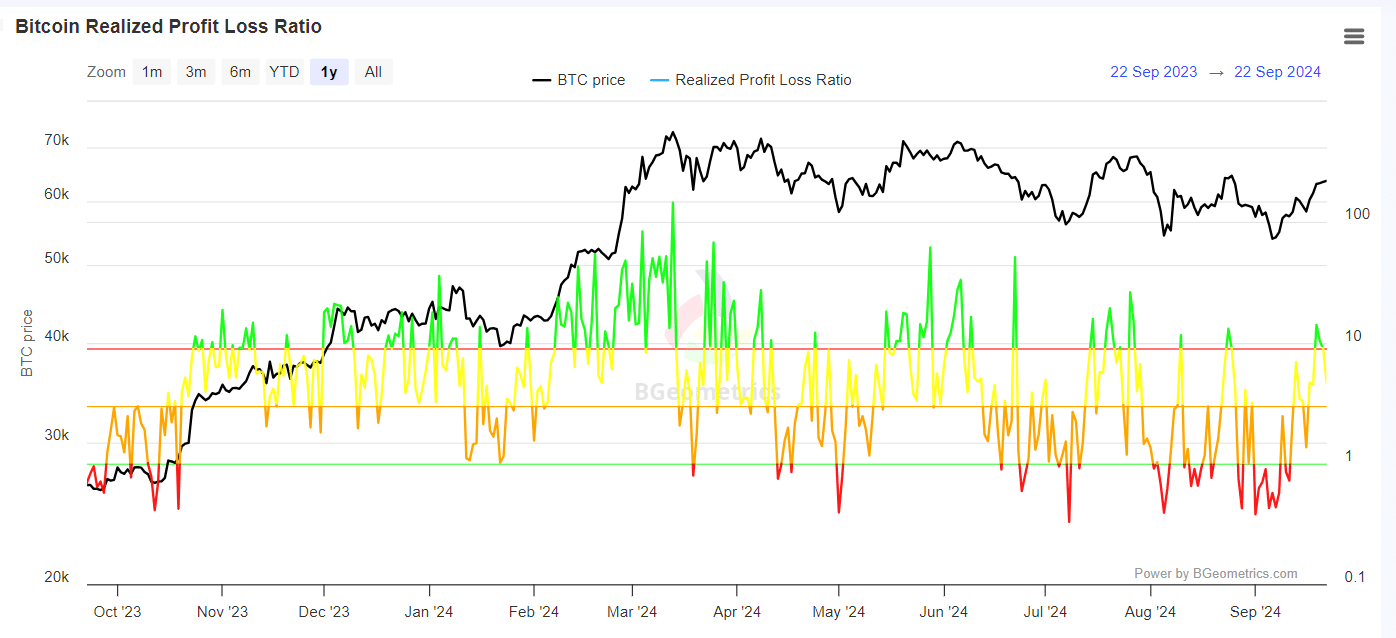

Curiously, on the day Bitcoin retested the $63K vary, a good portion of buyers have been in revenue, as highlighted by the inexperienced wig nearing 14.

Nonetheless, as bulls did not set off a breakout and bear dominance reasserted itself, a good portion of stakeholders started realizing losses.

Supply : BGeometrics

If these buyers lose confidence in a value correction, it might result in panic promoting, additional weakening Bitcoin dominance.

Moreover, this may occasionally set off a shift in asset allocation towards altcoins, which buyers would possibly view as a safer possibility.

In abstract, the market is at a vital juncture. If Bitcoin dominance holds and bulls assist a breakout, the altcoin season might falter until BTC reaches its subsequent resistance at $68K.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, if bulls fail to keep up the $64K vary and a retracement under $60K happens – which appears doubtless – many altcoins would possibly see a short lived surge.

But, for a sustained altcoin season, belief in future positive factors is crucial, which is straight or not directly tied to Bitcoin dominance. Thus, monitoring it’s important.