- Bitcoin has been in a stoop since April.

- The Tether and BTC dominance charts pointed towards a bullish future for crypto’s prime canine.

Bitcoin [BTC] was buying and selling at $62.5k at press time, with the New York session just some hours away. Although cryptos commerce 24/7, the New York session on Mondays usually marks a development reversal or continuation.

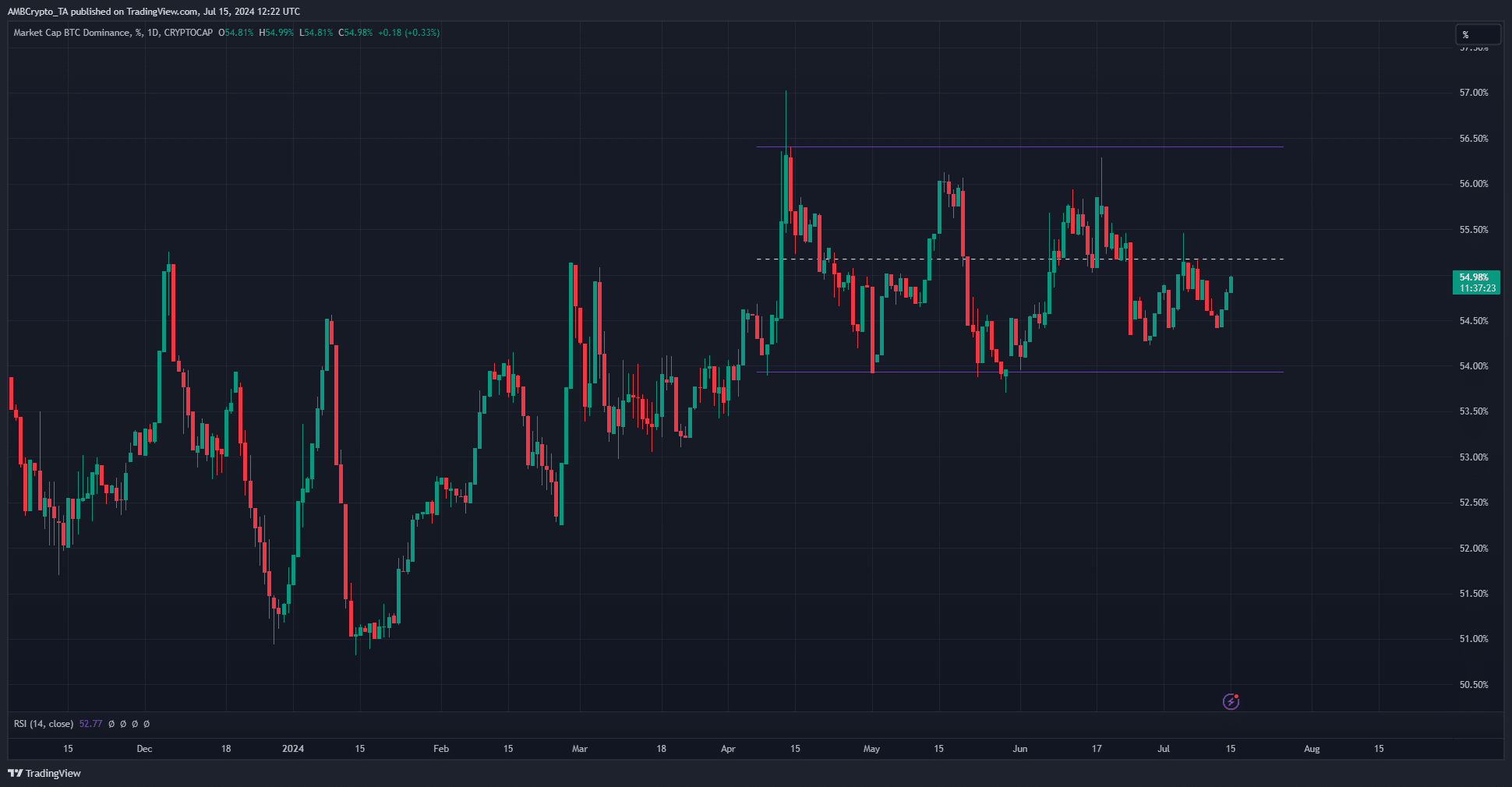

AMBCrypto’s evaluation of the Bitcoin dominance gave clues about the place the broader market may very well be headed subsequent.

Combining it with the Tether dominance confirmed that altcoin bulls may face some problems within the coming weeks.

Bitcoin Dominance reveals a verdict

Supply: BlockchainCentre

In June, the altcoin season index scores have been round 25, signaling a robust Bitcoin season. Over the previous two weeks, this development has begun to reverse. The index jumped as excessive as 46 on the twelfth of July however fell to 35.

This indicated an altcoin season is likely to be across the nook, however different metrics disagreed.

Supply: BTC.D on TradingView

AMBCrypto’s have a look at the Bitcoin dominance chart on the each day timeframe confirmed a variety formation between 54% and 56.4%. Over the previous month, the metric has been beneath the mid-range stage.

The implication was that, like the costs, the dominance chart additionally lacked a robust development. It confirmed that the altcoin market has suffered alongside Bitcoin.

The upper timeframes confirmed that the BTC.D was trending larger. This was an indication that BTC bets are more likely to outperform the broader market in Q3 2024.

Why Bitcoin can be within the limelight

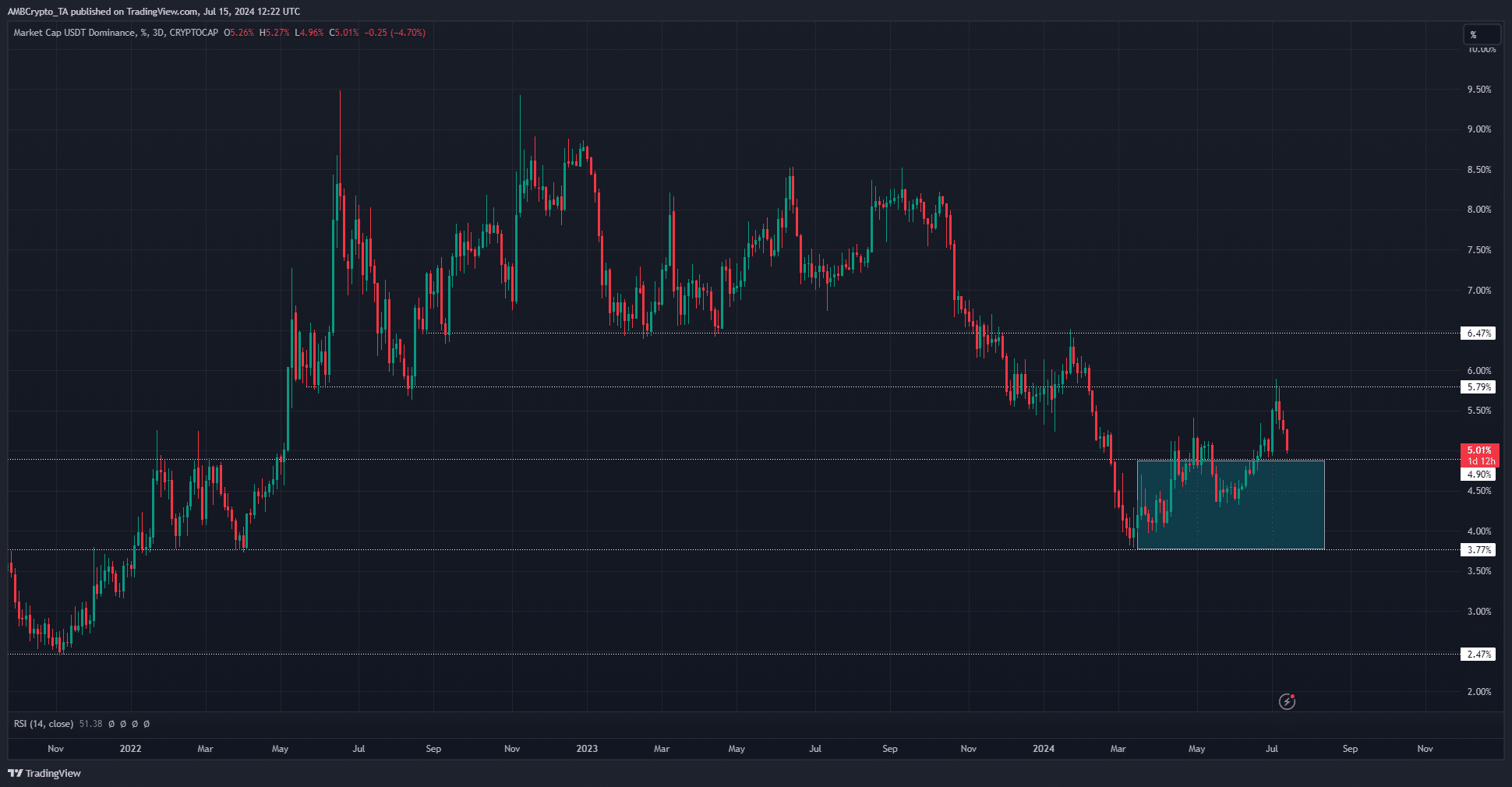

Supply: USDT.D on TradingView

Bitcoin is the king of crypto cash and is the first wind vane for understanding market sentiment.

A big influx of capital into BTC is required earlier than it may be rotated into altcoins, resulting in the fabled altcoin season.

The Tether dominance chart noticed a retracement whereas BTC costs rose over the previous three days. This recommended a market-wide worth rally over the weekend.

Nonetheless, the USDT.D is anticipated to renew its downtrend after this bounce, which may very well be nice information for Bitcoin costs.

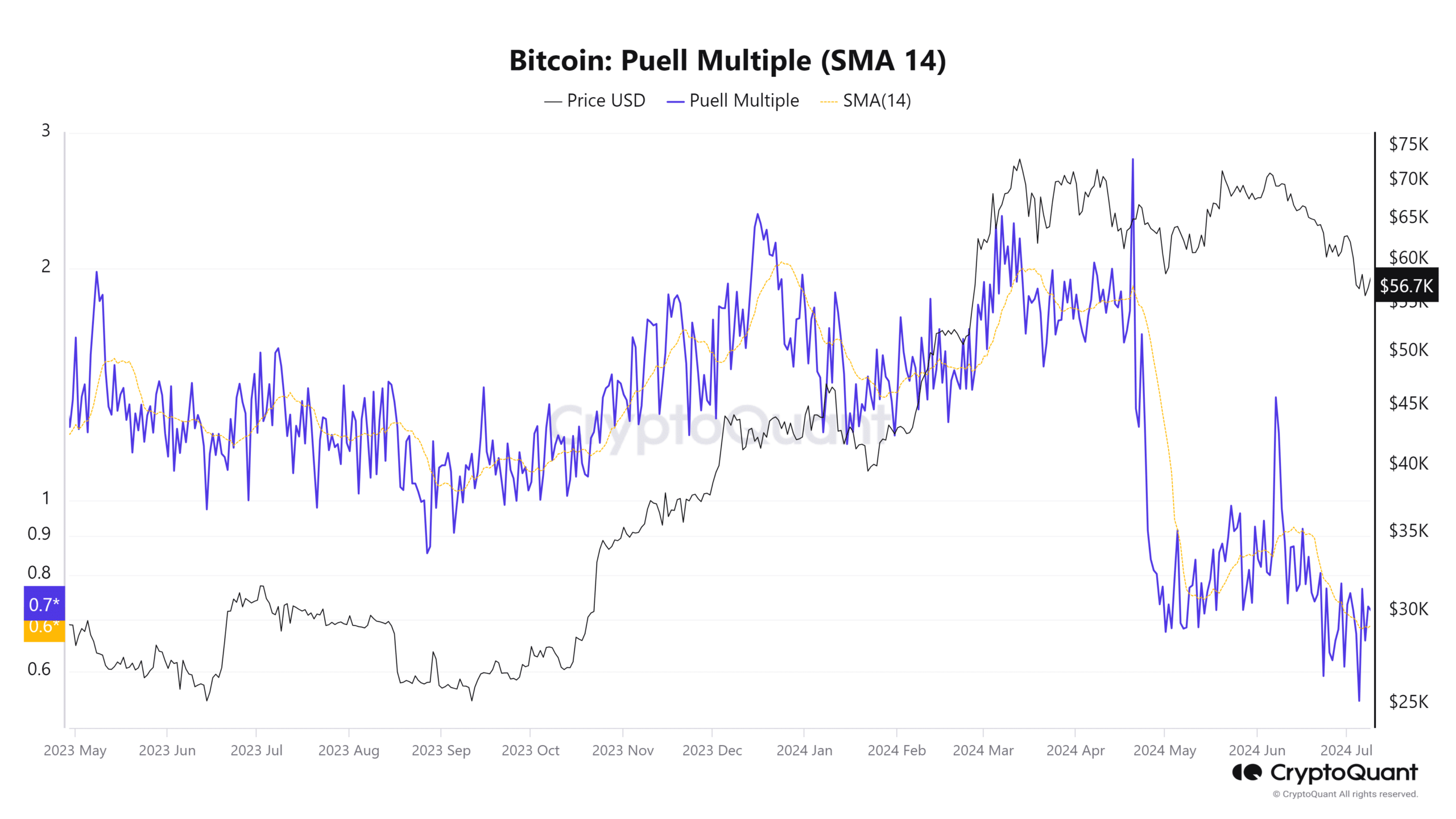

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The Puell A number of is a measure of how worthwhile mining swimming pools are in comparison with the earlier 12 months. At press time, the metric was at 0.72. A studying of 0.5 or decrease can be a robust purchase sign.

This was one other signal that worth appreciation is in retailer for Bitcoin within the coming months.