- Bitcoin dominance has reached an area excessive, warning buyers of a possible market overheating.

- THIS highlights the subsequent finest “dip” alternative.

Two days in the past, Bitcoin [BTC] dominance surged to a formidable 57%, following a day by day achieve of over 5% that pushed BTC above the $66K mark – a stage it hadn’t breached in additional than 150 days.

Now buying and selling at $67,350, Bitcoin has risen over 10% in only one week. This fast ascent has led analysts at AMBCrypto to invest whether or not the market is nearing an overextension.

If so, a pullback to an area low might happen earlier than BTC makes an attempt to retest its all-time excessive.

Excessive bitcoin dominance indicators overheating

Previously week, day by day beneficial properties exceeding 2% have helped Bitcoin get well from its $60K droop, confirming the extent as a brand new help.

Moreover, the surge was strengthened by a rising RSI, indicating sturdy momentum. Commerce quantity additionally spiked to a brand new native excessive, signaling elevated help from retail buyers.

Because of this, Bitcoin dominance additionally climbed to a brand new excessive. Nevertheless, this bullish momentum has pushed BTC into “greed” territory, hinting at potential indicators of overheating out there.

Supply : BGeometrics

Traditionally, a shift into greed typically coincides with the part in a cycle the place Bitcoin hits a market prime, ceaselessly resulting in a subsequent value crash.

At this stage, many merchants exit, doubling down on their beneficial properties, whereas new consumers hesitate, fearing the inevitable correction.

Due to this fact, these merchants often await a dip-buying alternative, capitalizing available on the market backside when Bitcoin dominance resurges.

At the moment, with Bitcoin dominance at a brand new excessive and different indicators pointing to a market prime, Bitcoin could also be primed for a correction.

This correction might shake out weaker palms, leaving contemporary consumers to benefit from a possible dip.

Bitcoin might retrace to an area low

Bitcoin beforehand confronted rejection at $64K, which should be transformed into help to sign the potential dip. This situation unfolds when new curiosity perceives this value vary as a gorgeous entry level.

Moreover, as BTC turns into extra susceptible to speculative swings, the probability of elevated brief positions in futures buying and selling rises, with merchants concentrating on $64K as the subsequent dip.

This case additional reinforces the concept BTC is perhaps awaiting a correction earlier than trying to check its ATH.

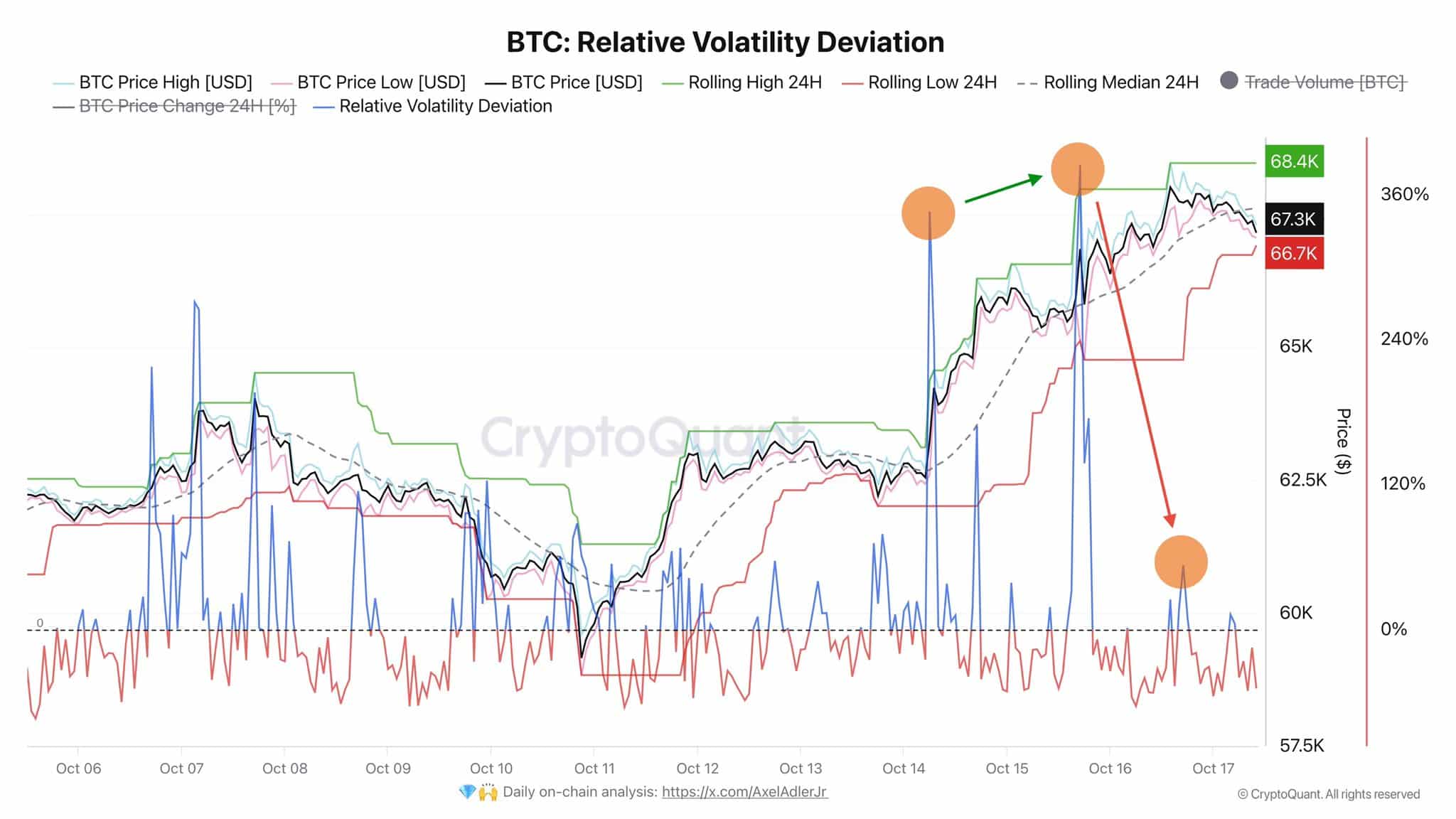

Supply : CryptoQuant

Moreover, a distinguished analyst has additionally cautioned buyers as volatility has shifted into detrimental territory, influenced by the surge in Bitcoin dominance.

At the moment, the value fluctuates between $68.4K and $66.7K, whereas Open Curiosity on prime exchanges has risen to $20.3B, making BTC much more susceptible to sudden value swings.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

General, the excessive Bitcoin dominance indicators a market overextension, backed by different variables. The fast ascent to $67K has pushed the market into greed, suggesting that the present value represents a market prime.

Whereas AMBCrypto evaluation means that $64K is the subsequent goal for a possible native low, this presents one of the best dip-buying alternative.