- Bitcoin’s worth dropped by greater than 4% within the final seven days.

- Market indicators continued to stay bearish on BTC.

Bitcoin’s [BTC] efficiency over the past seven days was underwhelming, as its worth dropped beneath the $65k mark. The value corrections sparked worry amongst traders. Nevertheless, the development may finish quickly as historic developments trace at a doable market backside.

Bitcoin hits a market backside

CoinMarketCap’s knowledge revealed that BTC was down by almost 4.5% within the final seven days. In reality, within the final 24 hours alone, the king of cryptos’ worth dropped by over 2%.

On the time of writing, Bitcoin was buying and selling at $63,931.44 with a market capitalization of over $1.26 trillion.

In the meantime, Santiment lately posted a tweet highlighting an fascinating improvement. As per the tweet, the market was primarily fearful or disinterested in Bitcoin, as costs ranged from $65K to $66K.

The tweet talked about, “This extended level of FUD is rare as traders continue to capitulate. BTC trader fatigue, combined with whale accumulation, generally leads to bounces that reward the patient.”

To see whether or not Bitcoin was really close to its market backside, AMBCrypto analyzed Glassnode’s knowledge.

The Pi Cycle High indicator identified that BTC’s worth had dropped from its perceived market backside of $66.5k. This clearly hinted at a worth enhance within the coming days.

For starters, the Pi Cycle indicator consists of the 111-day transferring common and a 2x a number of of the 350-day transferring common of Bitcoin’s worth.

Going ahead, if issues flip bullish, then BTC may as effectively attain its market prime of $91k within the coming weeks or months.

Supply: Glassnode

Wanting forward

Just like the aforementioned knowledge, a couple of different metrics additionally appeared bullish. For instance, at press time, BTC’s worry and greed index had a price of 37%, which means that the market was in a “fear” part.

At any time when the metric hits this degree, it signifies that the probabilities of a bull rally are excessive.

Nevertheless, AMBCrypto’s take a look at CryptoQuant’s knowledge revealed a couple of bearish metrics. As an example, BTC’s trade reserve was rising.

Its web deposit on exchanges was excessive in comparison with the final seven days’ common, which means that promoting stress on Bitcoin was excessive.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

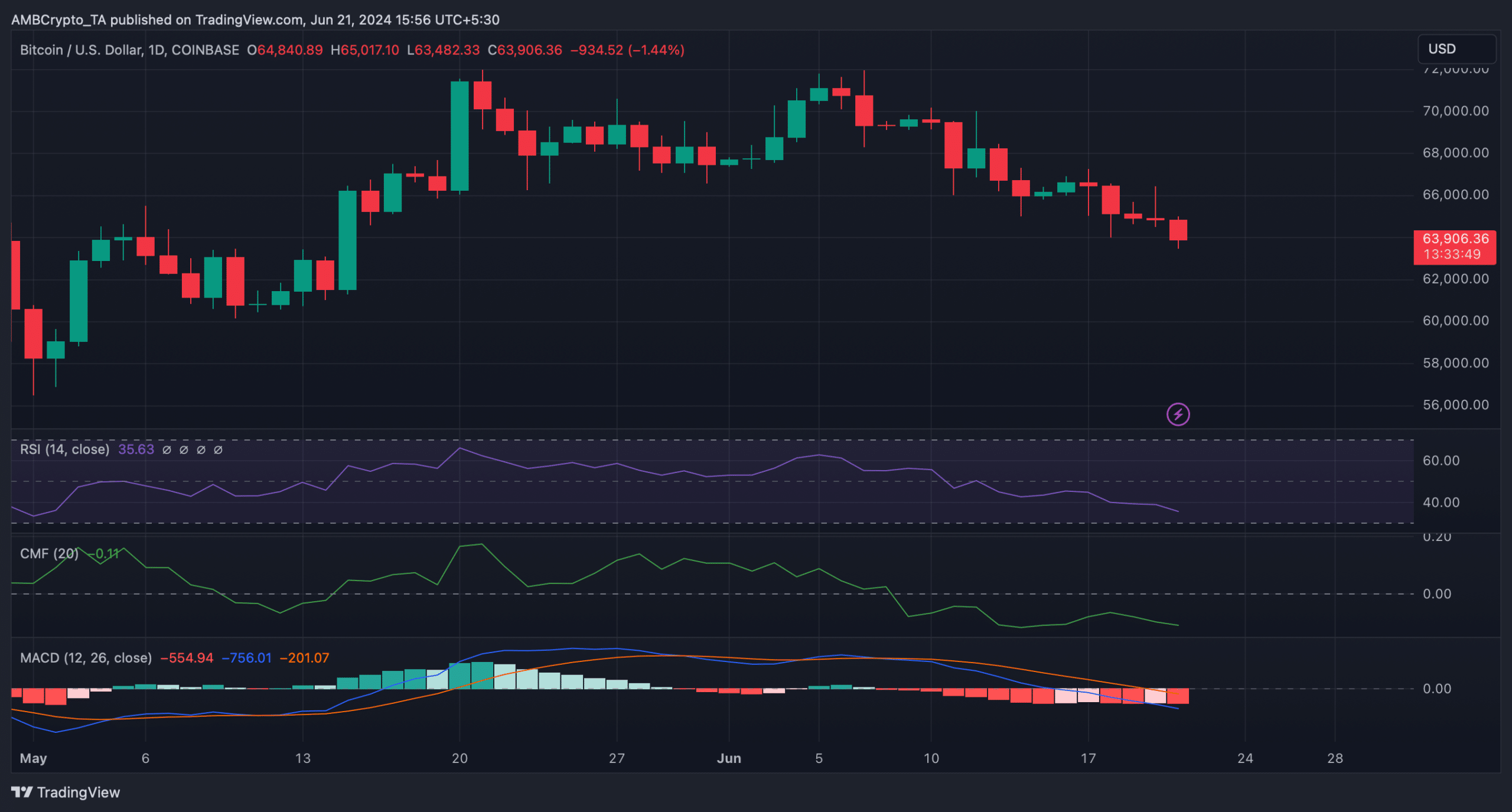

We then deliberate to take a look at BTC’s each day chart to higher perceive whether or not bulls had been making ready for a rally. We discovered that many of the indicators had been bearish.

The MACD displayed a transparent bearish upperhand available in the market. The Relative Energy Index (RSI) registered a downtick. BTC’s Chaikin Cash Circulate (CMF) additionally adopted an analogous declining development, hinting at a continued worth drop.

Supply: TradingView