- Metrics revealed that Bitcoin was overvalued.

- A continued worth drop would possibly push BTC all the way down to $53k once more.

Bitcoin [BTC] bulls managed to push the coin’s worth up final week by a promising quantity. However the development modified previously few hours because the king coin’s every day chart turned pink once more. Notably, simply earlier than the worth dropped, a whale bought a considerable quantity of BTC.

Are Bitcoin whales promoting?

Lookonchain not too long ago posted a tweet revealing a transfer made by a whale. In line with the tweet, a whale bought 500 BTC, price $30.07 million, a couple of in the past earlier than the BTC worth dropped. This whale has made three swing trades on BTC however solely made cash the primary time; the following two trades had been losses.

For the reason that quantity of BTC bought by the whale was substantial, AMBCrypto checked different datasets to search out out whether or not the general promoting stress exerted by whales was excessive.

As per our evaluation of Glassnode’s knowledge, the variety of addresses with a steadiness of 10 or extra BTC dropped final week. A decline within the metric implies that the massive gamers within the crypto area had been promoting BTC, which could have precipitated BTC’s worth to fall within the final 24 hours.

Supply: Glassnode

To be exact, BTC was down by greater than 2% within the final 24 hours. At press time, it was buying and selling at $58,789.75. Other than this, Hyblock Capital’s knowledge revealed that whale publicity available in the market additionally dropped within the final 24 hours.

This was the case as Bitcoin’s whale vs retail delta fell from 64 to 0. For starters, when the whale vs retail delta drops to 0, it implies that retail buyers and whales have equal publicity available in the market.

Supply: Hyblock Capital

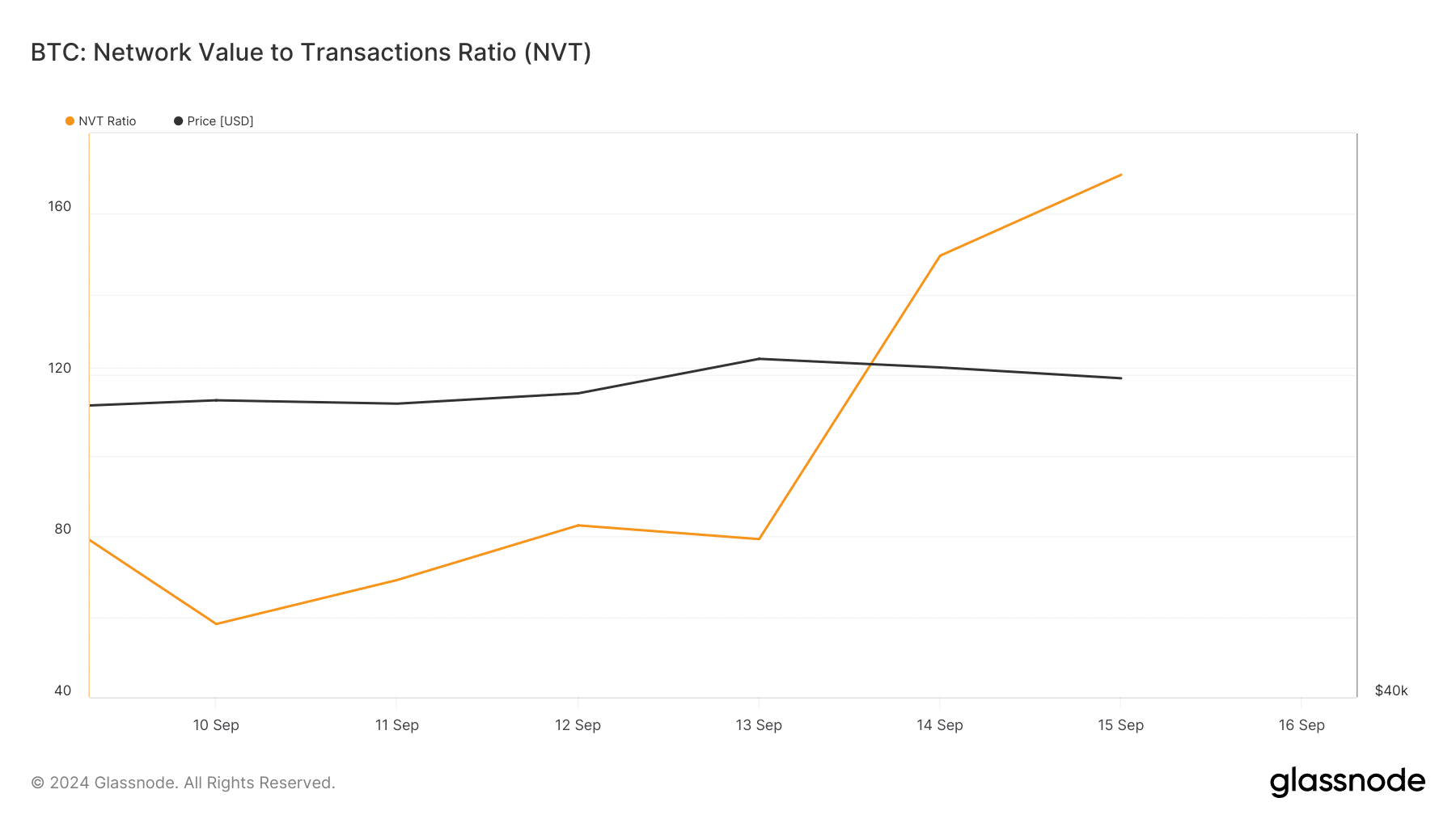

Nevertheless, whales’ actions weren’t the one factor in charge for this worth decline. AMBCrypto additionally discovered that BTC’s NVT ratio elevated. Usually, an increase within the metric implies that an asset is overvalued, which regularly leads to worth corrections.

Supply: Glassnode

What to anticipate from Bitcoin

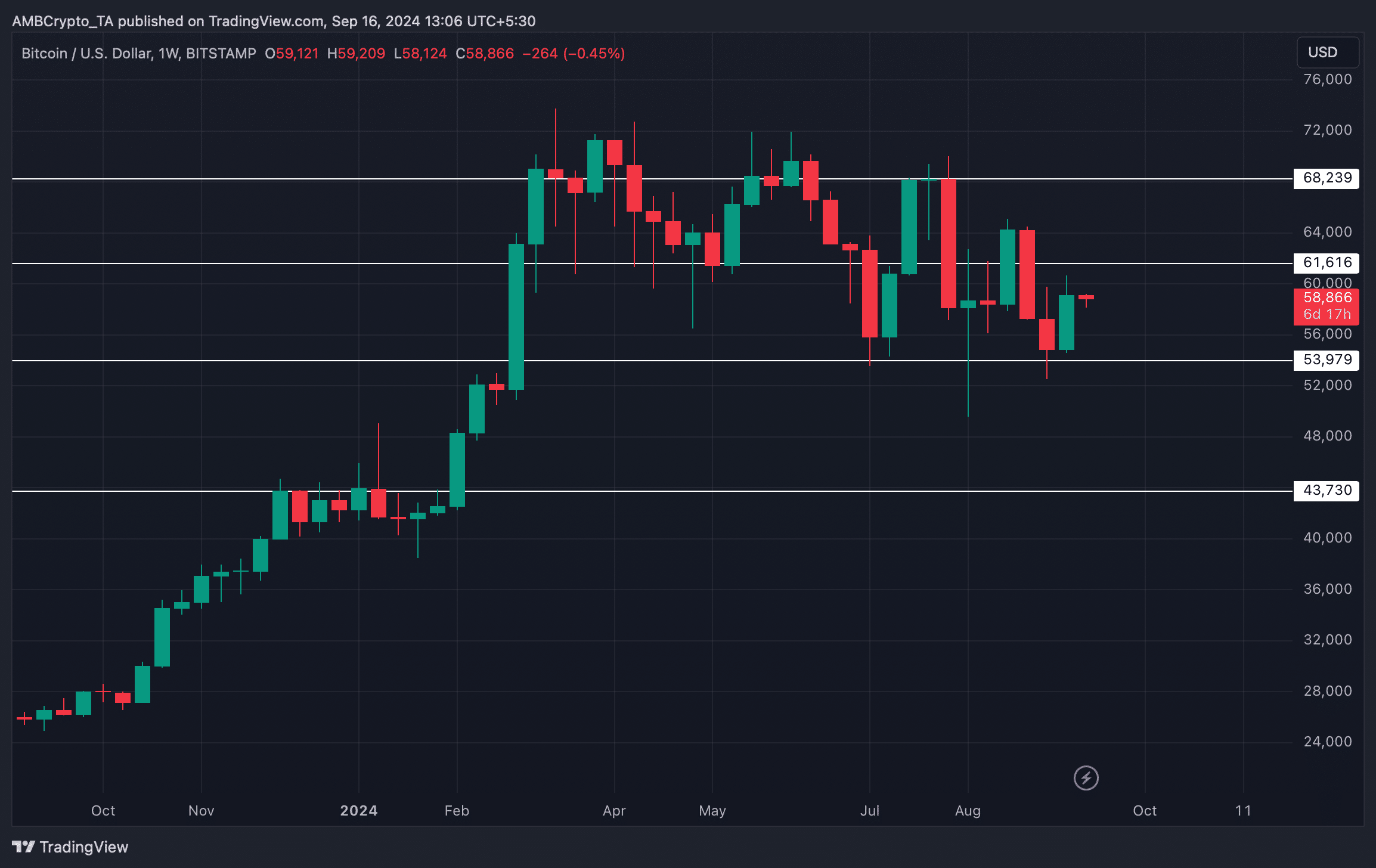

AMBCrypto then checked the king of cryptos’ weekly chart to search out out what would possibly occur if the bears proceed to push the coin’s worth down. As per our evaluation, a continued worth drop would possibly push BTC as soon as once more in the direction of its help close to $53k.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

A slip beneath the help may end in BTC dropping to $43k. Nevertheless, AMBCrypto reported earlier that there have been robust probabilities of BTC’s worth rising. One of many causes was Bitcoin’s NVM ratio, which dropped.

If BTC bulls take over, then the coin will first method its resistance close to $61k. A profitable breakout would possibly enable BTC to eye $68k within the coming weeks.

Supply: TradingView