- Germany transferred massive quantities of BTC throughout accounts, inflicting uncertainty out there.

- Correlation of BTC with conventional investments and asset lessons declined.

The current Bitcoin [BTC] crash has precipitated a surge of adverse sentiment across the crypto market.

Germany makes a transfer

In a transfer with vital monetary implications, the German authorities has transferred 700 Bitcoin on seventh July, in keeping with blockchain information evaluation agency Arkham.

The switch, valued at roughly $40.55 million, was despatched to an unmarked deal with, elevating questions on its function.

Whereas the particular purpose for the transaction stays unclear, the deal with could also be related to a monetary establishment or an over-the-counter (OTC) service.

OTC companies cater to massive buyers trying to commerce massive volumes of cryptocurrency exterior of conventional exchanges.

This transaction comes amidst Germany’s continued holdings of a considerable quantity of Bitcoin. The German authorities at present holds roughly 39,826 BTC, valued at round $2.31 billion.

This sizeable holding suggests a possible long-term technique for the German authorities with regard to cryptocurrency.

The unmarked deal with related to the switch creates uncertainty in regards to the function. Some may concern it’s a precursor to a big sell-off by the German authorities, main buyers to dump their holdings earlier than the value drops additional.

Supply: Arkham Intelligence

Co-relation declines

Individually, the connection between Bitcoin and conventional inventory markets has weakened considerably. Which means that Bitcoin’s worth actions are not intently following the ups and downs of equities, not like what was noticed in earlier years.

This decline in correlation was at its strongest in over 4 and a half years.

Analyst Will Clemente believes that is doubtless as a result of a singular scenario the place there may be an extra provide of Bitcoin overhanging the market.

This provide overhang is considered originating from a number of sources, together with Germany, the USA, and Mt. Gox, a now-defunct Bitcoin alternate that misplaced an enormous variety of Bitcoins years in the past.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The presence of extra provide is placing downward strain on Bitcoin’s worth, and this strain is unbiased of what’s occurring within the inventory market.

Supply: X

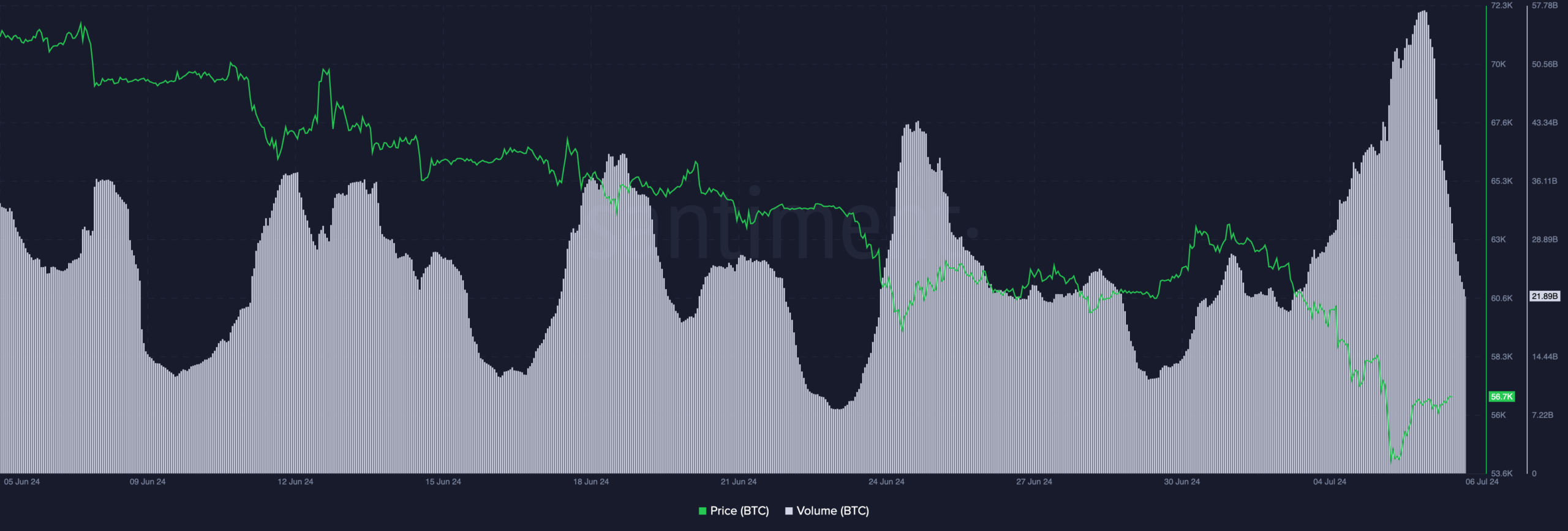

At press time, BTC was buying and selling at $57,482.70 and its worth had surged by 1.42% within the final 24 hours. Coupled with that, the quantity at which BTC was buying and selling at had declined by 47.14% throughout the identical interval.

Supply: Santiment