- Bitcoin is edging nearer to a high-stakes showdown. A large $332 million quick at 40x leverage is on the road.

- Is a liquidation-fueled squeeze incoming?

Whereas the market takes a breather, one dealer positioned a extremely leveraged 40x quick on Bitcoin [BTC]. The dealer has risked a whole $8.3 million account to open a $332 million place.

Presently, the quick is sitting on an unrealized lack of $1.3 million, with a liquidation worth set at $85,290. With Bitcoin buying and selling close to $83,245, the place hangs in a fragile steadiness.

If Bitcoin pushes greater, a brief squeeze might gasoline a breakout. But when bears defend resistance, a pointy pullback might comply with. Nevertheless, the battle gained’t be simple.

Crossing this vary places 699.2K BTC in focus, as profit-taking stress builds. A key stakeholder pool that purchased BTC at a peak of $86,391 might be able to money in.

Supply: IntoTheBlock

For bulls to take management, this sell-side liquidity should be absorbed by sturdy demand. Not like Bitcoin’s drop to $78K – the place 46k BTC flowed out, signaling sturdy spot demand – its $84k worth stage noticed no such capital inflow.

This raises considerations about purchaser power, particularly with Quick-Time period Holder Web Unrealized Revenue/Loss (STH-NUPL) nonetheless within the capitulation zone, that means many short-term holders stay underwater.

If BTC hits $85K–$86K, profit-taking might intensify, main some holders to capitulate and break even moderately than HODL, rising promote stress and risking a protracted squeeze.

With provide more likely to outweigh demand, this dealer has positioned the quick round a crucial resistance zone. If bears maintain their floor, a pullback to $81K appears to be like more and more possible.

Volatility in Bitcoin derivatives market

Regardless of weak demand, Open Curiosity (OI) surged by $2 billion in simply two days, signaling aggressive positioning in Bitcoin derivatives.

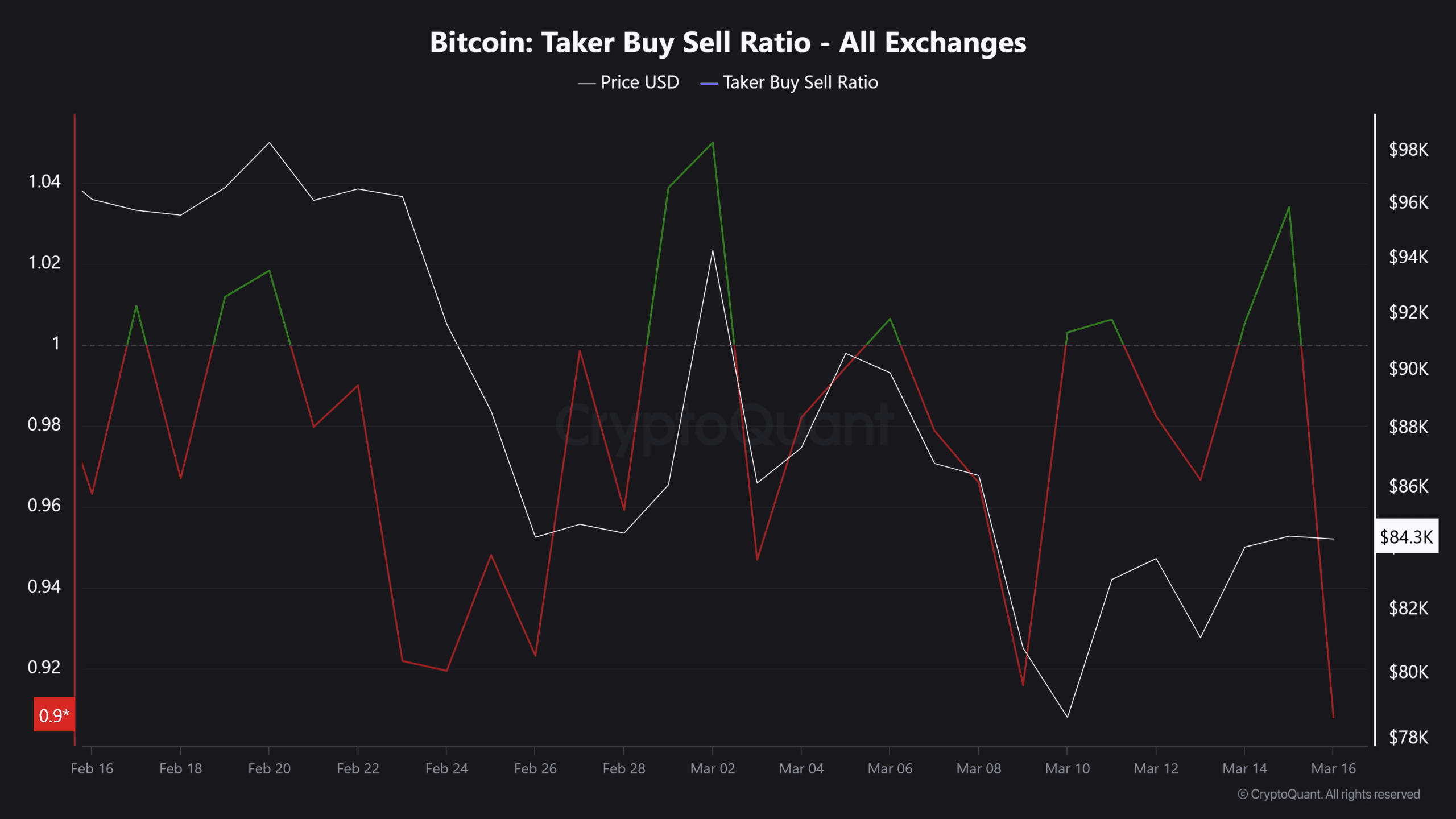

Nevertheless, with the Taker Purchase/Promote Ratio nonetheless under 1, sell-side liquidity continues to dominate in perpetual markets.

Supply: CryptoQuant

This means merchants are front-running a possible reversal, with many positioning for profit-taking. If momentum weakens, a wave of OI liquidations or closures might amplify volatility within the days forward.

To set off a brief squeeze on the $332M quick place and break the $85K–$86K resistance, sturdy spot and futures demand is required.

Nevertheless, with taker purchase/promote ratio nonetheless under 1, sell-side dominance alerts bearish management.

If market situations shift, a brief squeeze might propel Bitcoin greater. In any other case, a pullback to $80K–$81K stays a robust chance.