- The Bitcoin concern and greed index has shifted to a impartial rating of 48, indicating balanced market sentiment.

- Bitcoin has damaged previous its 200-day transferring common, presently buying and selling round $64,850 after a 3% improve.

The previous few days have been a rollercoaster for Bitcoin [BTC], with its value transferring via risky traits. Nevertheless, latest knowledge means that the market sentiment is starting to stabilize.

The Bitcoin concern and greed index reveals that the emotional response of merchants has shifted from extremes of concern and greed to a extra impartial outlook.

Bitcoin concern and greed index turns impartial

In accordance with Glassnode, the Bitcoin concern and greed index was 48 at press time, signaling a impartial sentiment out there. This marks a shift from the heightened concern and greed that adopted latest value fluctuations.

The index, which gauges market sentiment based mostly on elements like volatility, quantity, and social media traits, means that merchants are adopting a wait-and-see strategy after a interval of intense market actions.

Supply: Glassnode

Earlier within the week, on the eleventh of October, the index dropped to 32, reflecting a state of concern amongst merchants. Curiously, this coincided with a Bitcoin value improve to roughly $62,000.

Regardless of this upward value motion, the sentiment on the time remained cautious, doubtless in response to earlier value declines.

BTC strikes with concern and greed sentiment

AMBCrypto’s evaluation of Bitcoin’s value pattern revealed that the decline within the Bitcoin concern and greed index on the eleventh of October was a response to prior value motion.

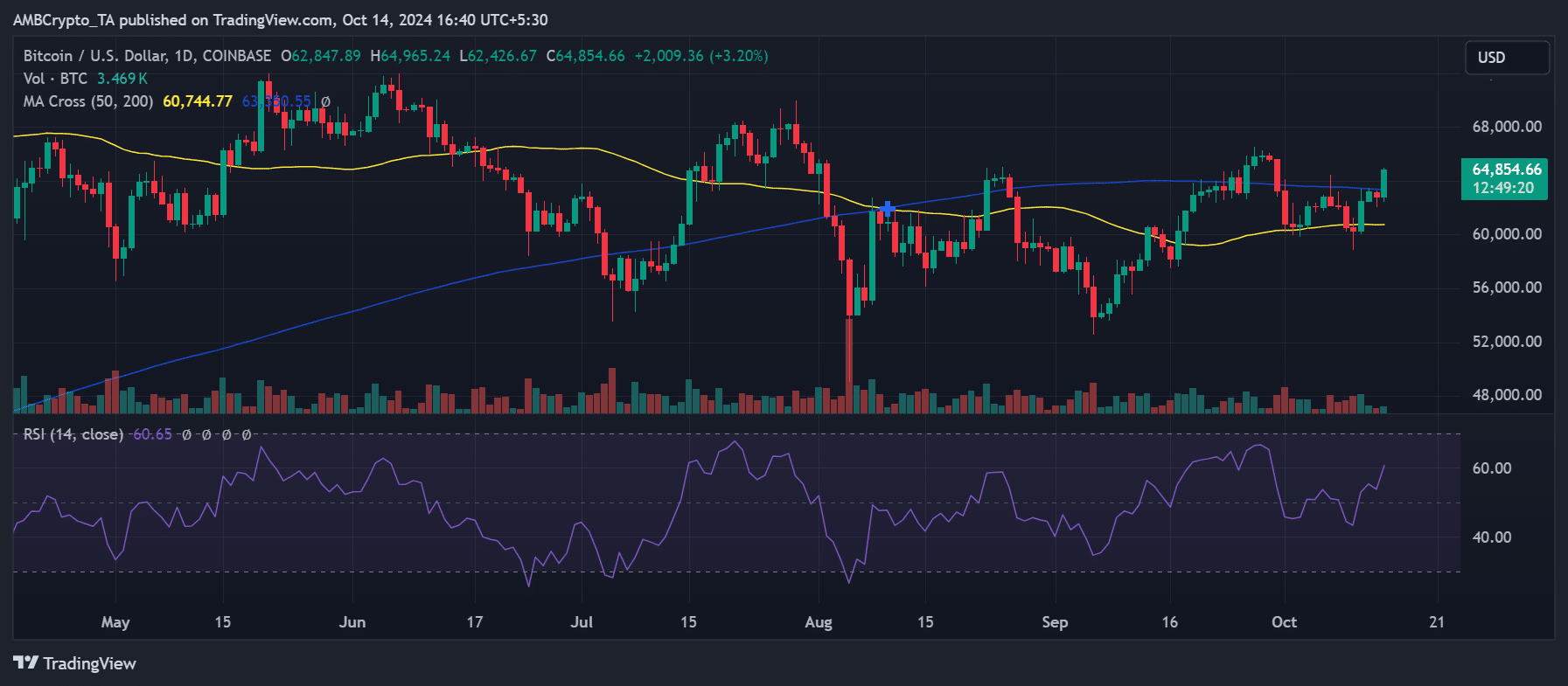

Earlier than the value improve, Bitcoin had confronted a collection of declines, dropping its worth to round $60,000—a degree beneath its 50-day transferring common (yellow line), which acted as a key help degree.

Supply: TradingView

Nevertheless, the market rebounded on the eleventh of October. Bitcoin noticed a 3% improve that introduced its value again as much as $62,500, pushing it above the 50-day transferring common.

Regardless of this, the value remained beneath its 200-day transferring common (blue line), a stronger resistance degree.

As of this writing, Bitcoin is buying and selling at roughly $64,850, gaining one other 3%.

This upward pattern has allowed BTC to interrupt previous the 200-day transferring common, which had served as resistance across the $63,000 value mark.

The mixture of those value actions and the impartial sentiment on the Bitcoin concern and greed index means that the market is in a state of cautious optimism.

Energetic addresses stay steady

Though the Bitcoin concern and greed index mirrored a impartial sentiment, the variety of energetic addresses has stayed remarkably steady.

Knowledge from Santiment confirmed that the seven-day common of energetic addresses had remained constant, with round 3.5 million energetic addresses.

As of this writing, there have been roughly 3.52 million energetic addresses, reflecting sustained engagement with the community.

Supply: Santiment

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This regular variety of energetic addresses indicated ongoing curiosity from long-term holders, which might function a basis for future value will increase.

Regardless of the shifting sentiment, the steadiness in community exercise could also be an indication that Bitcoin’s long-term outlook stays optimistic.