- Community hashrate surged to a report excessive of 742 EH in September.

- This elevated mining prices and slashed miners’ income, tipping them to promote 3000 BTC.

Bitcoin [BTC] miners had a tough begin in September as community hashrate hit a report excessive and strained income. The community hashrate tracks the computational energy wanted to mine BTC. On the first of September, the metric hit a report excessive of 742 EH.

Supply: CryptoQuant

The report hashrate is great as a result of community safety is significantly better than earlier than.

Nonetheless, the community problem, which tracks how tough it’s for miners to search out the subsequent BTC block, remained close to its report degree of 90 trillion.

Put in another way, miners wanted extra computation energy to mine Bitcoin, which was getting more durable to search out. In brief, the common manufacturing price to mine a single BTC would probably enhance. This might exert extra pressure on subscale miners.

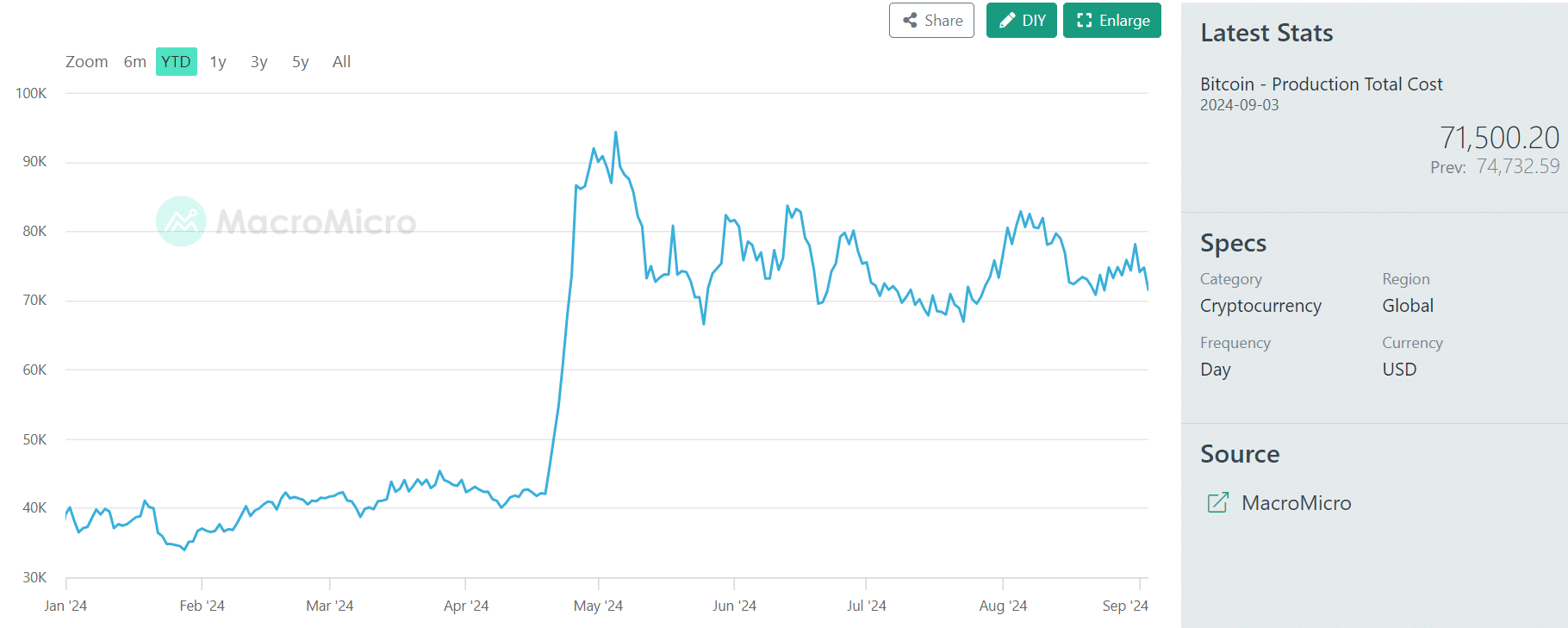

As of third September, the full manufacturing price to mine a single BTC was estimated at $71.5K. The common spot value for the asset on the identical day was $57.4K. That’s a in need of +$14k to mine a single coin.

Supply: MacroMicro

BTC value tends to rally close to its manufacturing price in the long term. Nonetheless, the large distinction firstly of September strained miners’ income. Miner each day income had dropped from over $36 million in late August to round $26 million in September.

Because of this, miners may very well be pressured to dump their BTC holdings to cowl elevated manufacturing prices amid declining income.

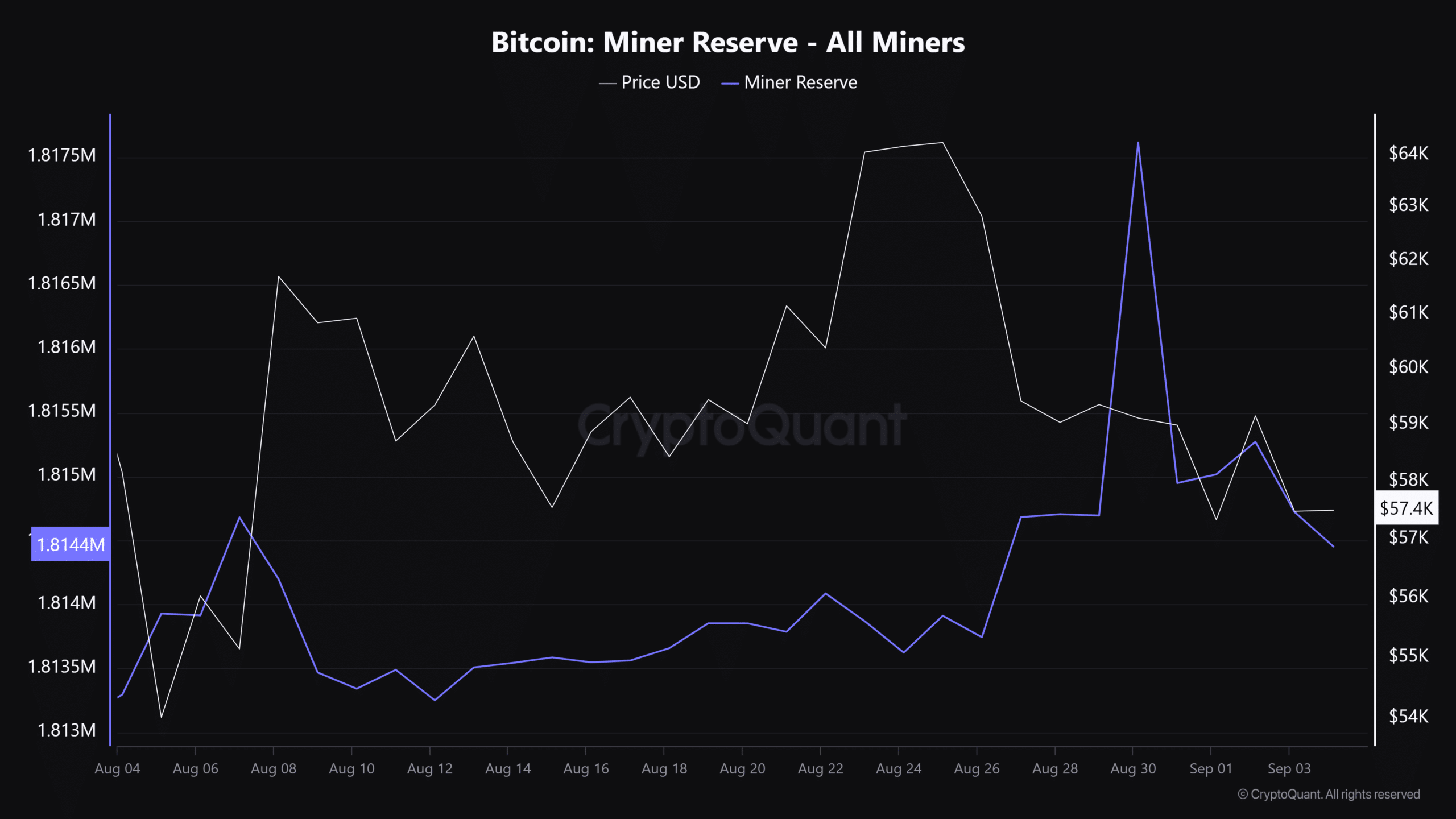

In accordance with CryptoQuant knowledge, the Miner Reserve dropped from 1.817 million BTC to 1.814 million cash previously few days.

The metric tracks the full BTC held by miners, and it trended upwards in August. This meant that miners held their mined BTC and, by extension, painted a mildly bullish outlook for BTC value.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Nonetheless, the pattern reversed on the finish of August, that means miners bought off a part of their holdings. To this point, miners bought off 3000 BTC in September, more likely to cowl the rising operational prices.

On the time of writing, BTC was valued at $57.9K. A sustained minor sell-off may put extra downward stress on the BTC value. Therefore, it’s price watching this entrance alongside macro updates.