- Bitcoin and Ethereum have risen to turn out to be one of the vital priceless belongings globally.

- There was a pause within the uptrends that BTC and ETH noticed within the earlier week.

Current knowledge exhibits that Bitcoin [BTC] and Ethereum [ETH] have achieved dominance not solely inside the cryptocurrency market but in addition within the broader monetary panorama.

Their market capitalizations have grown considerably, now rivaling the valuations of many conventional firms.

Bitcoin and Ethereum options amongst prime belongings

A research of information by Crypto Rank revealed that Bitcoin and Ethereum featured prominently among the many prime belongings by market capitalization.

The information confirmed that Bitcoin ranked ninth with a market cap of $1.33 trillion. Additionally, BTC was simply behind Silver, which had a market cap of $1.8 trillion.

Moreover, the most important asset by market capitalization was Gold, at $15.7 trillion.

Moreover, Ethereum ranked twenty fourth with a market cap of $455 billion, notably surpassing Mastercard, which had a market cap of $413 billion.

Bitcoin and Ethereum proceed dominance

Evaluation of cryptocurrency knowledge from CoinMarketCap confirmed that the entire market capitalization of cryptocurrencies exceeded $2.5 trillion. Bitcoin accounted for over $1.3 trillion of this, giving it a market dominance of virtually 53%.

Additionally, Ethereum’s market capitalization was over $453 billion, representing practically 18% of the entire market.

Mixed, Bitcoin and Ethereum make up over 70% of all the cryptocurrency market capitalization, which means their value actions considerably influence the general market.

Though the entire cryptocurrency market capitalization is far smaller in comparison with Gold, it nonetheless holds substantial worth.

BTC and ETH sees pause in uptrends

Bitcoin has not too long ago dropped farther from the $70,000 value vary, resulting in a decline in its market capitalization. Evaluation of the each day timeframe chart confirmed that after fluctuating between $68,000 and $69,000 for a number of days, it fell to round $67,000.

By the top of the buying and selling session on twenty ninth Could, it had decreased by over 1% to roughly $67,500. As of this writing, Bitcoin was buying and selling at round $67,900, reflecting a slight improve of lower than 1%.

Supply: TradingView

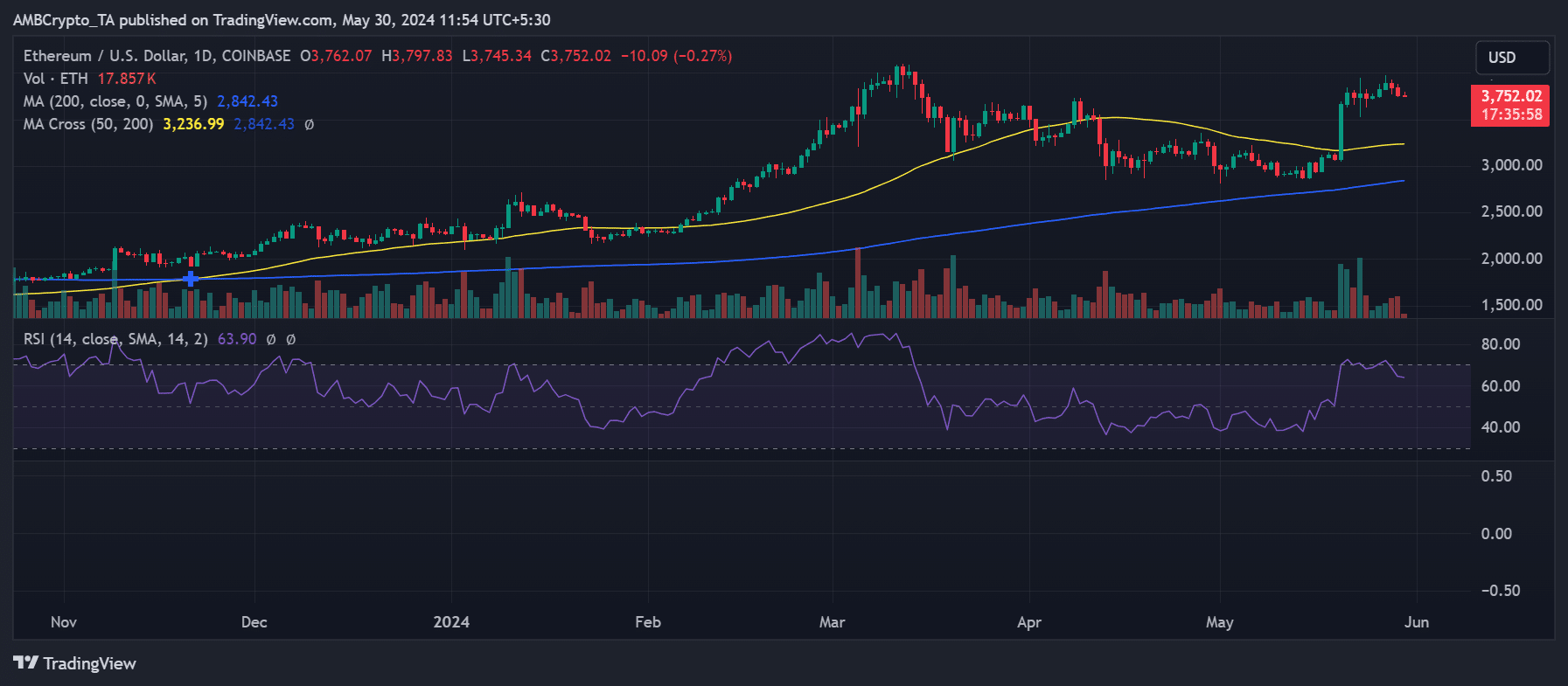

Moreover, Ethereum has not too long ago skilled a pause in its upward pattern.

Supply: TradingView

Lifelike or not, right here’s ETH market cap in BTC’s phrases

It reached round $3,890 on twenty seventh Could, the very best degree because it rose to about $4,000 in March. Nonetheless, subsequent downtrends rapidly halted this rise.

By the top of the buying and selling session on twenty ninth Could, Ethereum had declined by over 2%, buying and selling at round $3,762. As of this writing, it was buying and selling at roughly $3,750 after a slight additional decline.