- Bitcoin faces resistance at $60K, with costs down 23% from its March peak.

- Analysts counsel blended indicators, debating whether or not it is a non permanent droop or the beginning of a bear market.

Bitcoin’s [BTC] worth efficiency has remained beneath stress in current months, with the cryptocurrency persevering with to battle at key ranges. Regardless of earlier optimism, the asset has persistently confronted resistance at any time when it approaches the $60,000 mark.

This lack of ability to interrupt via the resistance has saved Bitcoin from regaining its March peak of over $73,000. As of press time, Bitcoin was buying and selling at $56,584, down 1% up to now 24 hours and 23.3% from its excessive earlier this 12 months.

Based on IntoTheBlock, the market sentiment round Bitcoin has shifted considerably since earlier within the 12 months. At the moment, each retail and institutional traders had been hopeful that the asset would proceed its rally and attain new heights.

Nevertheless, macroeconomic circumstances and a slowdown in crypto adoption have led to elevated uncertainty about Bitcoin’s future. Many traders at the moment are questioning whether or not it is a non permanent lull or the start of a extra extended bear market.

Market tendencies and Bitcoin’s struggles

IntoTheBlock, highlighting the shift in market sentiment round Bitcoin in a not too long ago uploaded publish shared the components that may have contributed to its present worth struggles.

One of many key challenges talked about was the broader macroeconomic panorama. IntoTheBlock stated that with the potential of a recession looming, markets have been beneath stress, and danger belongings like Bitcoin have been no exception.

They added that whereas some anticipate that potential rate of interest cuts may ultimately profit cryptocurrencies, the affect of such measures might take time to materialize.

Till then, the macro setting will proceed to weigh on market sentiment and Bitcoin’s worth efficiency.

Moreover, curiosity in cryptocurrencies seems to be declining, as indicated by a number of metrics. Search tendencies for cryptocurrency-related matters have seen a noticeable drop, reflecting a cooling of the market in comparison with the joy throughout bull market intervals.

Supply: Loris on X

This decline is additional illustrated by consumer exercise on platforms similar to Coinbase, the place app rankings have fallen, suggesting that fewer individuals are actively partaking with crypto belongings.

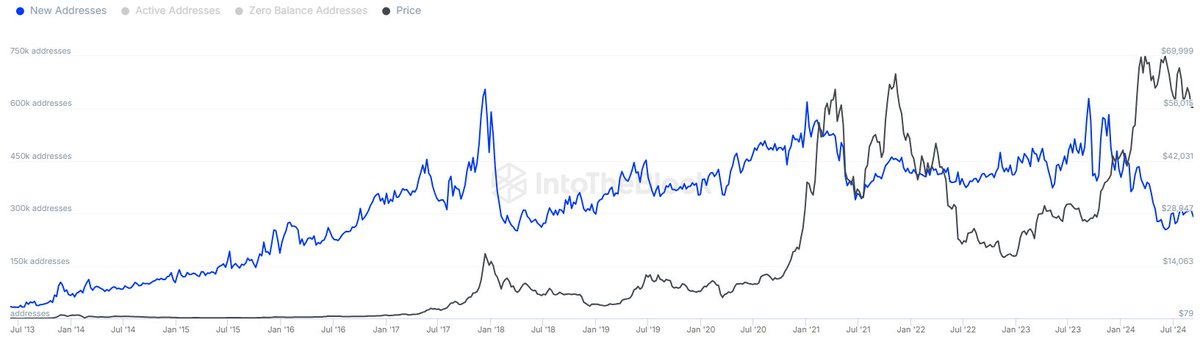

IntoTheBlock additionally identified that on-chain information paints an image of stagnation in Bitcoin’s market exercise. The variety of new Bitcoin addresses stays low, signaling a slowdown within the inflow of recent members into the market.

Supply: IntoTheBlock

This lower in new customers factors to waning enthusiasm in comparison with earlier within the 12 months, when Bitcoin’s worth surge attracted a flood of recent traders.

The shortage of recent market members might hinder Bitcoin’s capability to regain its earlier highs within the close to time period, IntoTheBlock revealed.

Analyst outlook on BTC

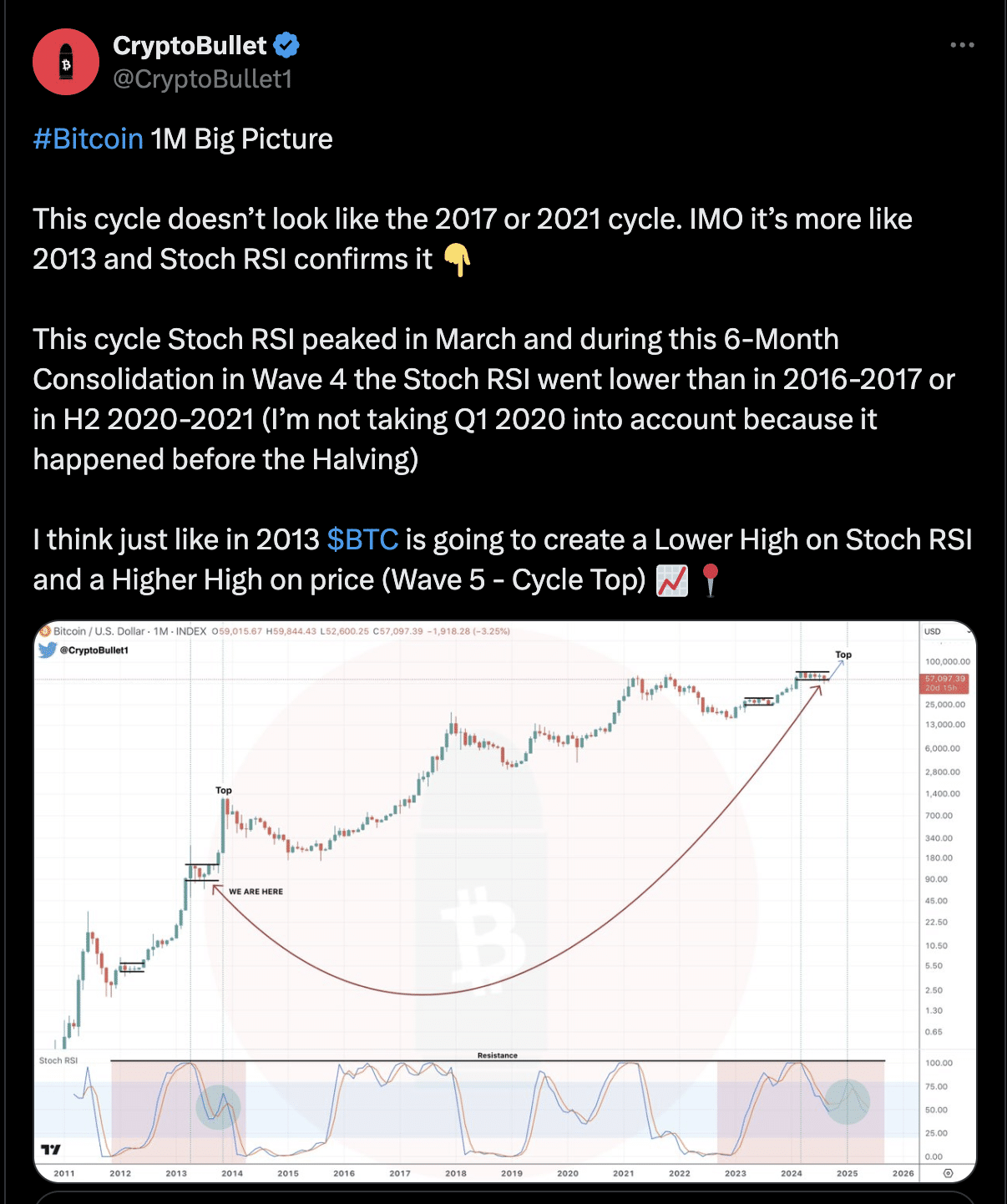

Taking a look at Bitcoin’s worth cycles, some analysts consider that the present section mirrors earlier intervals of consolidation.

Significantly, CryptoBullet, an analyst, has drawn comparisons to 2019, a 12 months wherein Bitcoin skilled an analogous slowdown after reaching a neighborhood excessive.

Throughout that interval, the market underwent a protracted consolidation earlier than ultimately turning bullish once more. CryptoBulle argue that Bitcoin may very well be following an analogous path now, with the present market dip being a part of a broader cycle.

The analyst shared the insights on Bitcoin’s worth cycles on X, evaluating the present market to earlier years.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Based on his evaluation, this cycle doesn’t resemble the 2017 or 2021 cycles however is extra just like the 2013 cycle.

Supply: CryptoBullet on X

He highlighted the behaviour of the Stochastic Relative Energy Index (Stoch RSI), suggesting that Bitcoin is present process a consolidation section earlier than getting into a fifth wave that might result in new highs.