- Social media was agog with “buy the dip” calls, signaling market confidence in a rebound.

- Whereas the Concern and Greed Index instructed an accumulation part, on-chain information confirmed that BTC dangers an extra fall.

Requires market contributors to purchase the dip elevated on third July after Bitcoin [BTC] slipped under $60,000. Nonetheless, the coin was not the one one which dropped because it dragged virtually each different cryptocurrency with it, together with Ethereum [ETH].

At press time, BTC modified arms at $57,598. This represents a 4.88% lower within the final 24 hours. Regardless of the autumn, it appeared {that a} bigger a part of the market thinks the correction is a chance to purchase at low cost costs.

Santiment, the on-chain analytic platform, confirmed proof of this. Utilizing its social quantity metric, AMBCrypto observed that the “buy the dip” mentions have unfold like wild fireplace.

Supply: Santiment

Is the worry sufficient for a bounce?

Nonetheless, it isn’t each time that calls like this yield outcome. Particularly, a bounce happens when a big a part of the crypto market doubt that costs will enhance.

Santiment, in its publish on X, additionally agreed with this thesis, saying that,

“The crowd is showing signs of seeing this as a buy the dip opportunity. Ideally, we wait for their enthusiasm to settle down. The time to buy is when they are impatient and skeptical.”

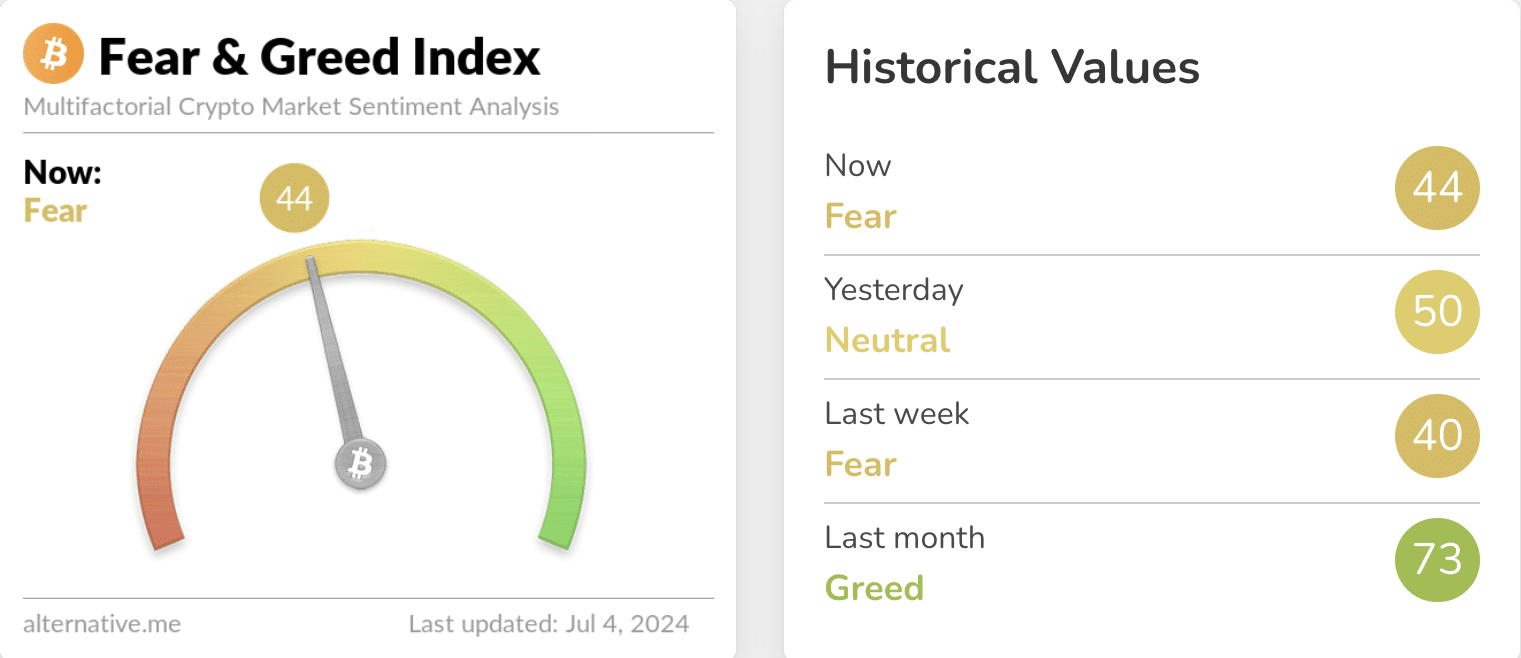

To have an thought if the broader market is skeptical or assured, we examined the crypto worry and greed index. The Concern and Greed Index for Bitcoin and different cryptocurrencies measures the emotional habits and sentiment of contributors.

The worth ranges from 0 to 100. Sometimes, individuals are usually fearful when the market is present process a correction and costs and hitting new crimson numbers. Nonetheless, greed seems when costs are rising in unbelievable figures and other people don’t need to miss out on the chance.

Nonetheless, if the index is in excessive greed stage, it implies that Bitcoin and the broader market is likely to be due for a correction. However in an excessive worry state, the market provides a “buy the dip” alternative.

At press time, the Concern and Greed Index was 44, which means the market was in worry. At this stage, it may very well be time to slowly accumulate. However that doesn’t indicate that worth wouldn’t hit new lows.

Supply: Various.me

In the event that they do, then the market would transfer into excessive worry which may function the right purchase the dip likelihood.

Bitcoin continues to face stress

Within the meantime, blockchain analytics platform IntoTheBlock revealed that Bitcoin had breached a important demand zone at $60,000. As such, the following main demand stage was between $40,000 and $50,000. It stated,

“Bitcoin has breached its $60,000 support level, a critical demand zone. This move leaves over 16% of BTC holders in a loss position. Historically, demand just below $60k has been weak, suggesting further downward pressure. The next significant demand zone lies between $40,000 and $50,000.”

Ought to Bitcoin proceed to fall as most likely drop under $56,000, it’d slip to the aforementioned area, and this might go away a ton holders in loss. To keep away from such incidence, bulls must defend BTC from falling beneath $55,000.

However that may very well be troublesome to realize as establishments proceed to promote BTC.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

For example, Lookonchain disclosed that the German authorities has despatched a mixed $249.50 million value of Bitcoin to Coinbase, Kraken, and Bitstamp.

When issues like this happens, the coin faces promoting stress and worth may not be capable to rebound. Due to this fact, market contributors may need no choice that to proceed to purchase the dip till costs stabilize.