- The FOMC minutes for the July 30-31 assembly revealed {that a} overwhelming majority of Fed officers agreed to an rate of interest minimize in September.

- Bitcoin briefly reclaimed $61K following the information, as Open Curiosity surged by almost $2 billion.

The Federal Open Market Committee (FOMC) launched its highly-anticipated minutes for the July 30-31 assembly.

The minutes eliminated any doubt of rate of interest cuts in September, with a overwhelming majority of Federal Reserve officers agreeing that inflation has eased.

Such macroeconomic information tends to stir worth strikes throughout the crypto market. Most prime ten cash by market capitalization noticed small bouts of volatility, with Bitcoin [BTC] breaking the psychological degree of $60,000.

First Fed price minimize since 2020

Per the minutes of the July 30-31 assembly, most Fed officers are supporting an rate of interest minimize in September. Some members have been additionally prepared to help a 25 foundation level minimize in the course of the July assembly.

The minutes learn,

“The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.”

The officers additional famous that whereas inflation remained elevated, it had lowered considerably and was on monitor to achieve the two% goal. Different financial indicators such because the labor market have been additionally robust.

The minimize will mark the primary time the Federal Reserve has deserted money-tightening measures since 2020.

69% of buyers on the CME FedWatch Device additionally anticipate the identical drop. Nonetheless, 30% of buyers anticipate a steeper minimize of fifty foundation factors.

Bitcoin jumps on “dovish” minutes

Bitcoin has jumped by 2.6% to commerce at $61,189 earlier than falling all the way down to $60,890.81 on the time of writing. BTC’s buying and selling volumes have additionally spiked by 26% per CoinMarketCap information, as market curiosity across the coin grew.

The spike comes amid an increase in shopping for strain, as seen within the Chaikin Cash Circulation (CMF) index.

The CMF was within the constructive area at press time, spiking considerably on the twenty second of August, coinciding with the FOMC minutes launch.

Supply: TradingView

Nonetheless, the uptrend remained weak, as seen within the Superior Oscillator (AO). The AO was constructive on the hourly chart and likewise shifted inexperienced at press time.

Whereas this means an uptrend, extra affirmation is required to verify its energy.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Information from Coinglass additionally confirmed a virtually $2 billion enhance in Open Curiosity from round $30 billion on the twenty first of August to $32 billion at press time.

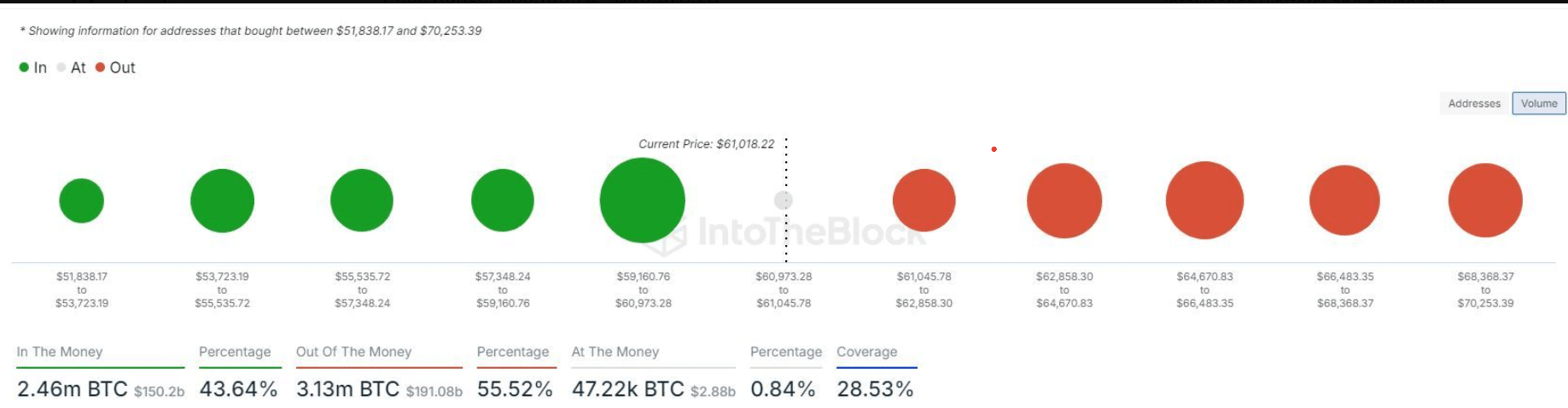

Bitcoin’s key resistance continued to lie on the $64K-$66K vary, as a majority of cash have been purchased at these ranges per IntoTheBlock information. Due to this fact, sellers would possibly emerge as soon as BTC approaches this worth vary.

Supply: IntoTheBlock