- BTC’s value elevated by greater than 3% within the final 24 hours.

- Most metrics and indicators had been bullish on the coin.

Bitcoin [BTC] has, after a number of weeks, proven indicators of restoration because it crossed the $60k mark. Whereas this growth appeared optimistic, the most recent evaluation instructed that BTC may attain new highs in 2024. Let’s take a look at BTC’s metrics to see whether or not that’s more likely to occur.

Bitcoin’s street to new highs

CoinMarketCap’s information revealed that within the final 24 hours, the king of crypto’s value elevated by greater than 3%, permitting it to cross $60k as soon as once more. On the time of writing, BTC was buying and selling at $60,172 with a market capitalization of over $1.17 trillion.

Because of that, greater than 83% of BTC buyers had been in revenue.

Issues may get even higher within the coming days, as Titan of Cryptos, a well-liked crypto analyst, posted a tweet stating an attention-grabbing growth. As per the tweet, a right-angled descending broadening wedge sample appeared on BTC’s chart.

If BTC checks the sample, then the current value rise may simply be the start of an enormous rally. In actual fact, the upcoming rally may push BTC to $88k in September. If that truly occurs, then 100% of BTC buyers will likely be in revenue.

Supply: X

Is Bitcoin prepared for a pump?

For the reason that evaluation revealed the opportunity of an enormous bull rally, AMBCrypto deliberate to take a look at its metrics to search out out what they counsel.

Our evaluation of CryptoQuant’s information revealed that BTC’s internet deposit on exchanges was decrease in comparison with the typical of the final seven days. Which means that the shopping for strain on the coin was excessive.

Its binary CDD was inexperienced, indicating that long-term holders’ actions within the final 7sevendays had been decrease than common. They’ve a motive to carry their cash.

Moreover, the miners had been additionally exhibiting confidence in BTC. This was evident from the truth that its Miners’ Place Index (MPI) was inexperienced, hinting that miners had been promoting fewer holdings in comparison with its one-year common.

Supply: CryptoQuant

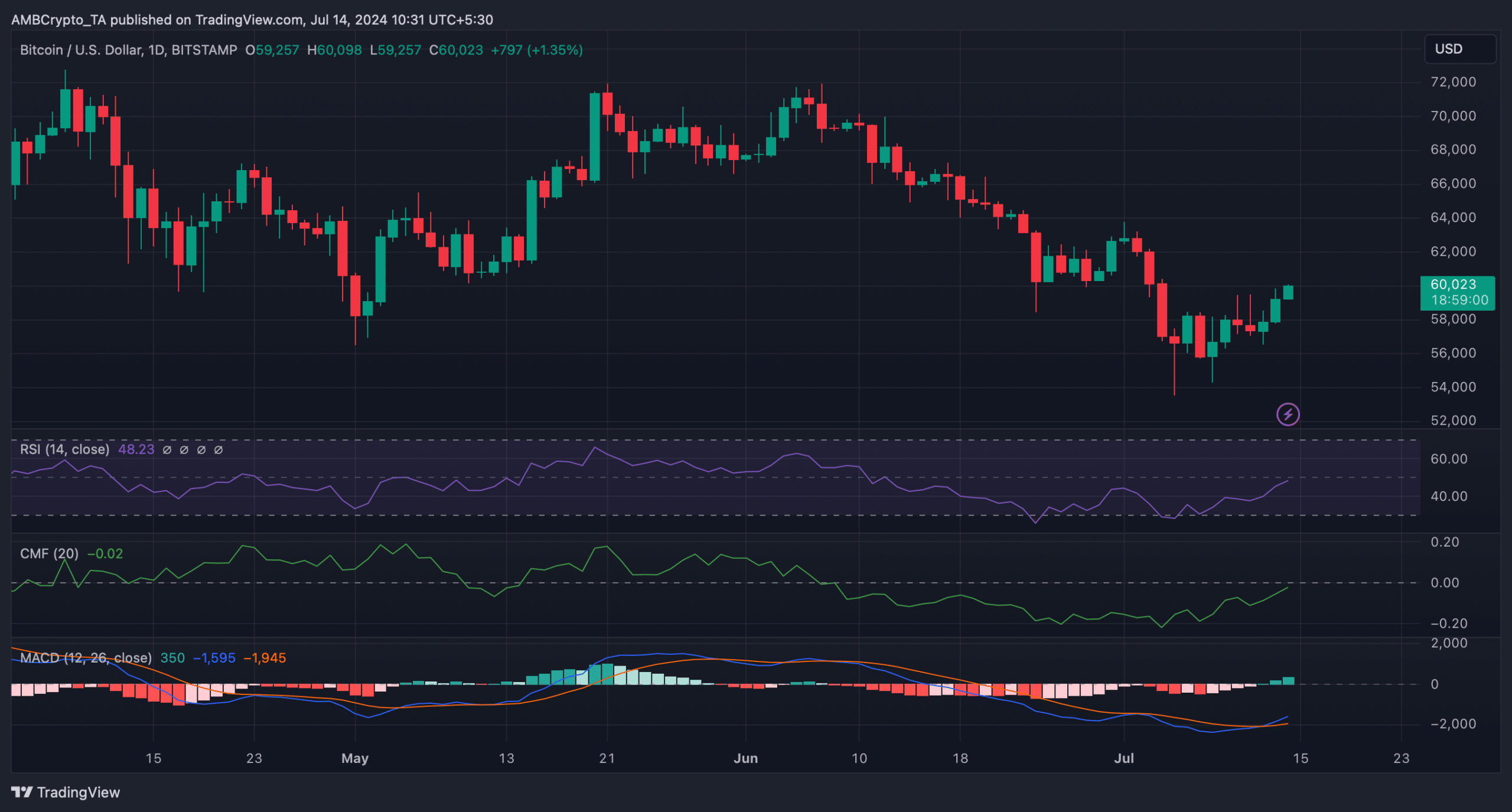

We then took a take a look at the coin’s day by day chart to see what market indicators instructed. We discovered that many of the indicators had been within the bulls’ favor and hinted at a continued value rise.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

As an illustration, the MACD displayed a bullish crossover. Its Relative Power Index (RSI) registered an uptick.

An analogous growing pattern was additionally famous on the coin’s Chaikin Cash Circulate (CMF) chart, suggesting that BTC may proceed to extend its worth and attain a brand new excessive by September.

Supply: TradingView