- BTC’s open curiosity additionally dropped by 3% within the final 24 hours, reflecting decrease curiosity or worry amongst traders.

- If BTC value falls to $61,670, practically $192 million of lengthy positions shall be liquidated.

Binance, the world’s largest cryptocurrency alternate, was discovered to have made some inner changes on twenty seventh August.

In response to a report, the Binance Bitcoin Chilly pockets which holds 75,177 Bitcoin [BTC], transferred a major 30,000 BTC to its scorching pockets and the remaining 45,177 BTC to a different pockets tackle “3PXB”.

Binance transfers 75,177 BTC

As of press time, Binance has not disclosed the rationale behind this notable BTC switch. Nonetheless, this switch occurred following the continuing cash laundering controversy replace in Nigeria towards Binance and its government.

With these vital BTC transactions, knowledgeable technical evaluation signifies a bearish outlook for Bitcoin. At the moment, BTC is in an uptrend because it maintains itself above the 200 Exponential Shifting Common (EMA) on a every day timeframe.

Apart from this uptrend, it’s presently there at a vital breakout stage of $61,850 stage, which it beforehand broke following the speed minimize announcement.

Supply: TradingView

Based mostly on the value motion and historic value momentum, if BTC experiences a value reversal from this significant stage, there’s a excessive risk of a major value rally to the $68,000 stage within the coming days.

Conversely, if BTC continues to fall, we may even see a significant crash within the coming days.

At press time, BTC was buying and selling close to the $61,900 stage and has skilled a value decline of over 2.6% within the final 24 hours. In the meantime, its buying and selling quantity has elevated by 33% throughout the identical interval, indicating greater participation from merchants amid the latest value decline.

Moreover, BTC’s open curiosity additionally dropped by 3% within the final 24 hours, reflecting decrease curiosity or worry amongst traders relating to the continuing value drop.

Main liquidation ranges

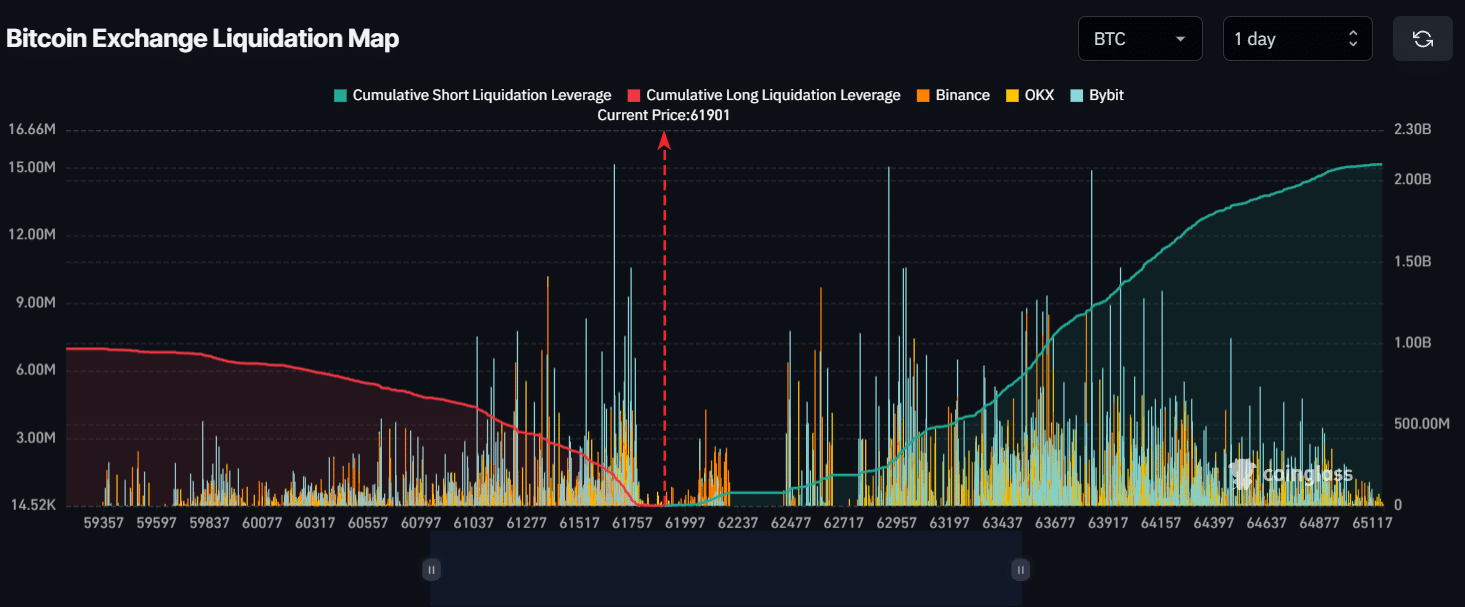

At the moment, the key liquidation ranges are close to $61,670 on the decrease facet and $63,900 stage on the higher facet, as merchants are over-leveraged at these ranges, based on the on-chain analytic agency CoinGlass.

Supply: CoinGlass

Learn Bitcoin’s [BTC] Value Prediction 2024-25

If the sentiment stays bearish and the value falls to $61,670, practically $192 million of lengthy positions shall be liquidated.

Conversely, if sentiment shifts and the value rises to the $63,900 stage, practically $271 million price of brief positions shall be liquidated.