- Bitcoin ATM installations surged considerably over the previous few weeks.

- Inflows in BTC funding merchandise throughout the globe grew.

Bitcoin’s [BTC] worth fell considerably in the previous few days, nevertheless, there might be causes for buyers to be optimistic in regards to the king coin.

ATM installations on the rise

Bitcoin ATM installations had been experiencing a resurgence after a dip in late 2022.

As of July 2024, there at the moment are over 38,000 Bitcoin ATMs put in worldwide.

Extra Bitcoin ATMs imply simpler entry factors for brand spanking new buyers. With ATMs acquainted and broadly used, shopping for Bitcoin turns into much less intimidating for these unfamiliar with cryptocurrency exchanges.

This broader accessibility can result in an increase in demand, probably halting or reversing the worth slide.

Furthermore, the rising variety of ATMs instructed a maturing and probably extra steady crypto ecosystem. This could enhance investor confidence, which is a vital issue influencing worth.

Persons are extra more likely to spend money on an asset class perceived as legit and right here to remain.

Supply: X

Nevertheless, heightened inflows may assist BTC develop.

A brand new report by CoinShares paints a optimistic image for Bitcoin, revealing a complete of $441 million in inflows final week. It is a important turnaround after a number of weeks of outflows.

The report on the eighth of July dove into the main points, highlighting a considerable influx into Bitcoin. Traders poured $398 million into Bitcoin merchandise, which translated to roughly $57,207 per Bitcoin.

Based on CoinShares, this shopping for spree was probably triggered by a mix of things, together with the latest weak spot in Bitcoin costs, exercise from Mt. Gox, and promoting stress from the German authorities.

These occasions could have been interpreted by some buyers as a beautiful entry level.

Wanting geographically, the inflows had been primarily concentrated in america, which noticed a whopping $384 million.

Different areas like Hong Kong ($32 million), Switzerland ($24 million), and Canada ($12 million) additionally witnessed inflows, whereas Germany bucked the pattern with $23 million in outflows.

Supply: CoinShares

Learn Bitcoin’s [BTC] Value Prediction 2024-25

How are addresses doing?

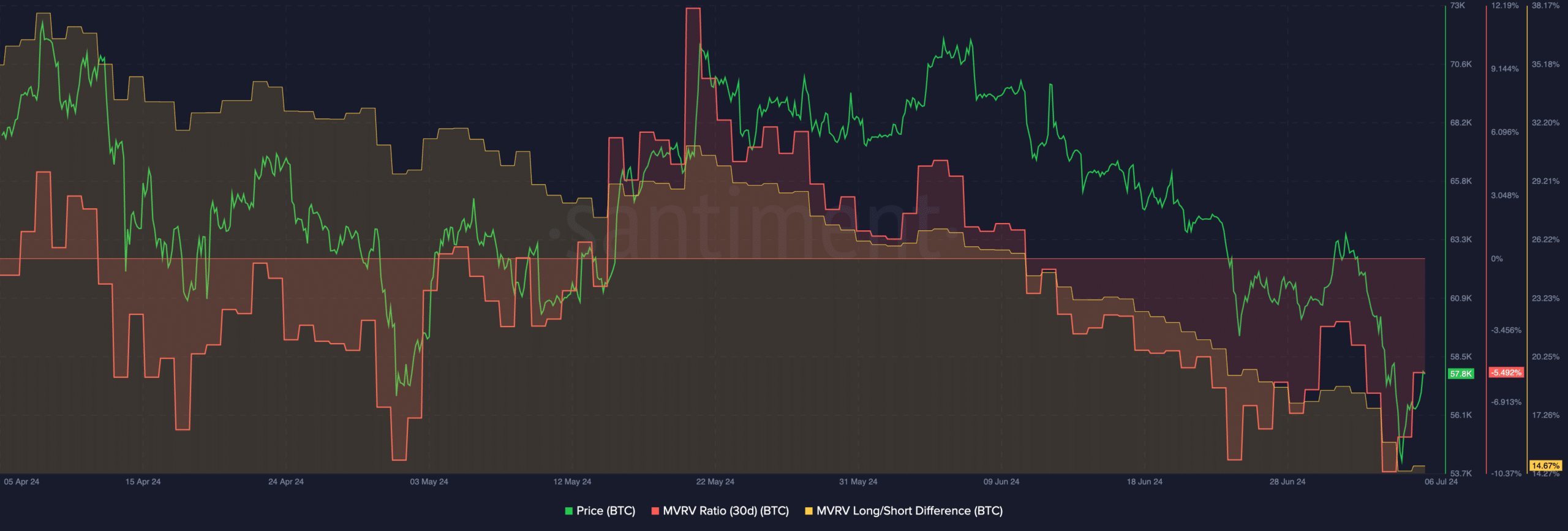

At press time, BTC was buying and selling at $57,149.91 and its worth had declined by 0.75% within the final 24 hours. As a result of declining worth, the MVRV ratio for BTC fell.

This indicated that the variety of worthwhile addresses holding BTC had declined considerably. This might scale back the inducement for these holders to promote their holdings sooner or later.

Supply: Santiment