- Bitcoin long-term holders notice a major 92.7 million in earnings.

- Metrics and indicators level to potential short-term worth corrections.

Bitcoin [BTC] was buying and selling at round $58,185 at press time. The king of crypto was testing a key assist degree at $56,427 at press time. This extraordinarily necessary degree corresponds to a major trendline that has traditionally acted as a powerful assist prior to now.

Supply: Tradingview

Whales money in, warning forward?

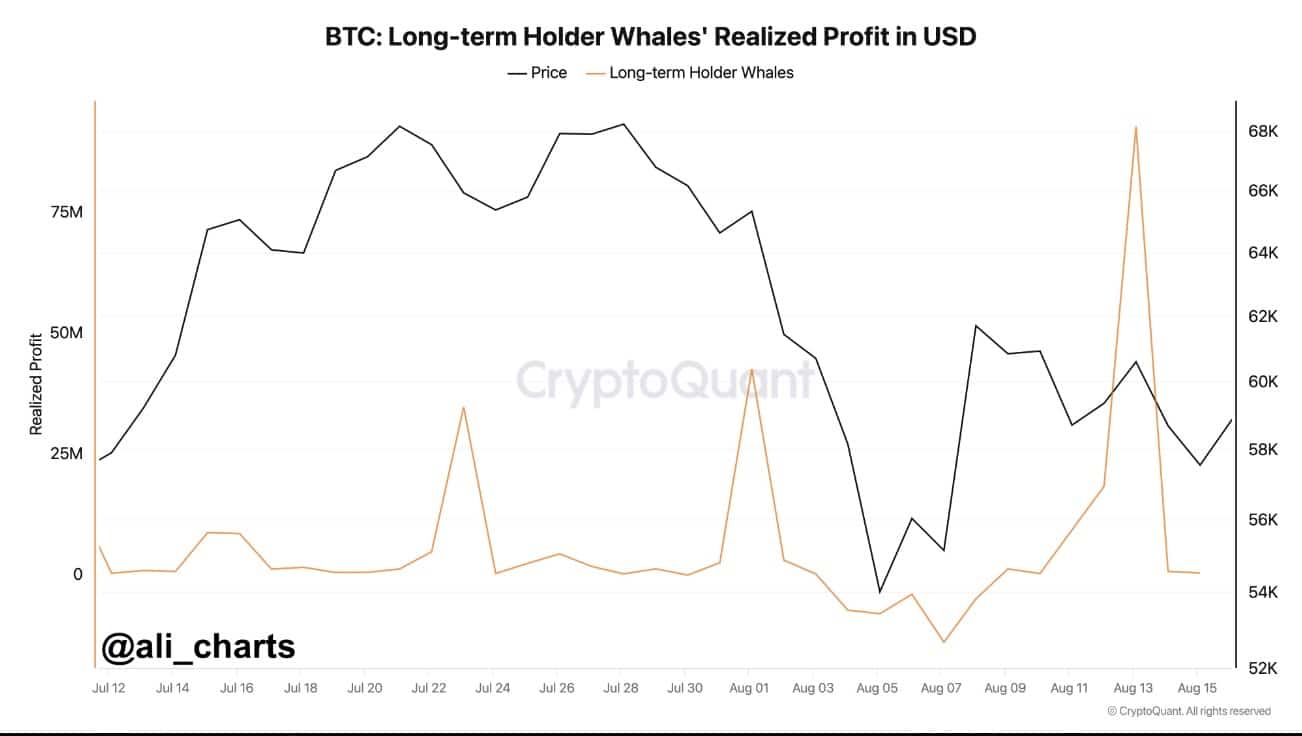

In response to whale realized revenue information, long-term whales revamped $92.7 million in earnings not so way back. Such big profit-taking signifies cautious indicators amongst these gamers and will portend a bearish development forward.

Traditionally, when the massive market gamers begin taking their money dwelling, there will be some short-term promoting stress. This resultant elevated stress could in flip create market uncertainty on Bitcoin.

Supply: CryptoQuant

Trade outflow factors to bullish sentiment

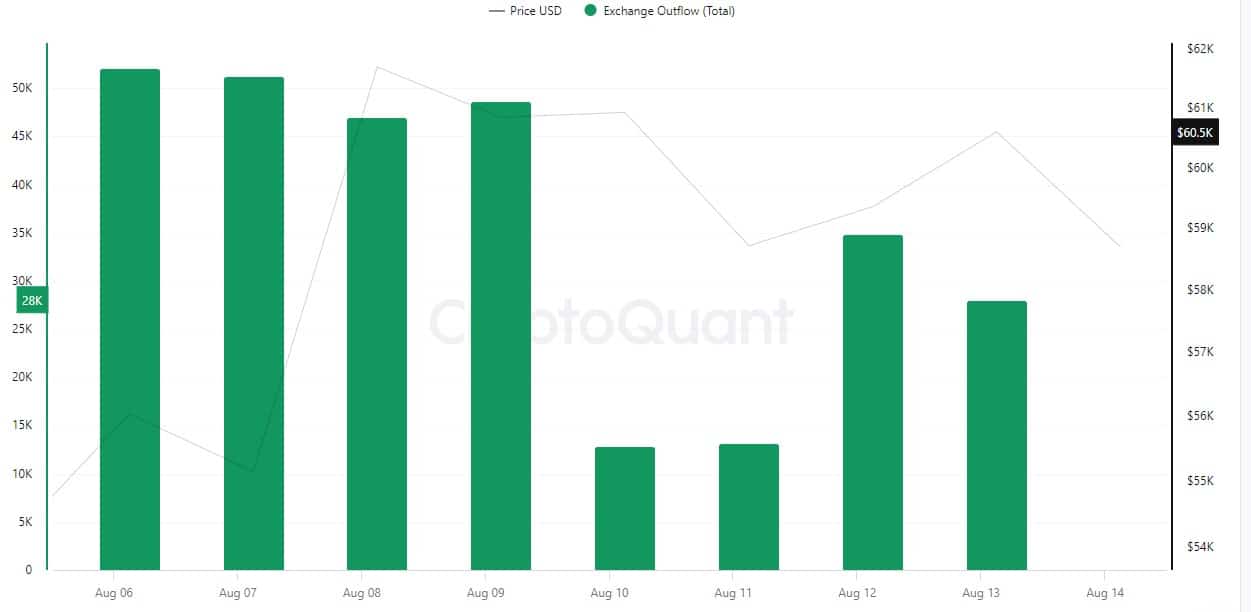

In distinction, trade outflow information signifies that substantial portions of Bitcoin moved off exchanges, with a peak round August 9 hitting over 50K BTC.

By giant, that is taken positively because it means traders are transferring cash into chilly storage, thus much less likelihood of instant gross sales occurring.

Usually, decreased BTC’s on numerous exchanges translate into decreased promoting stress, which might maintain costs and even provoke a rally.

Supply: Cryptoquant

Bitcoin liquidation dangers loom giant

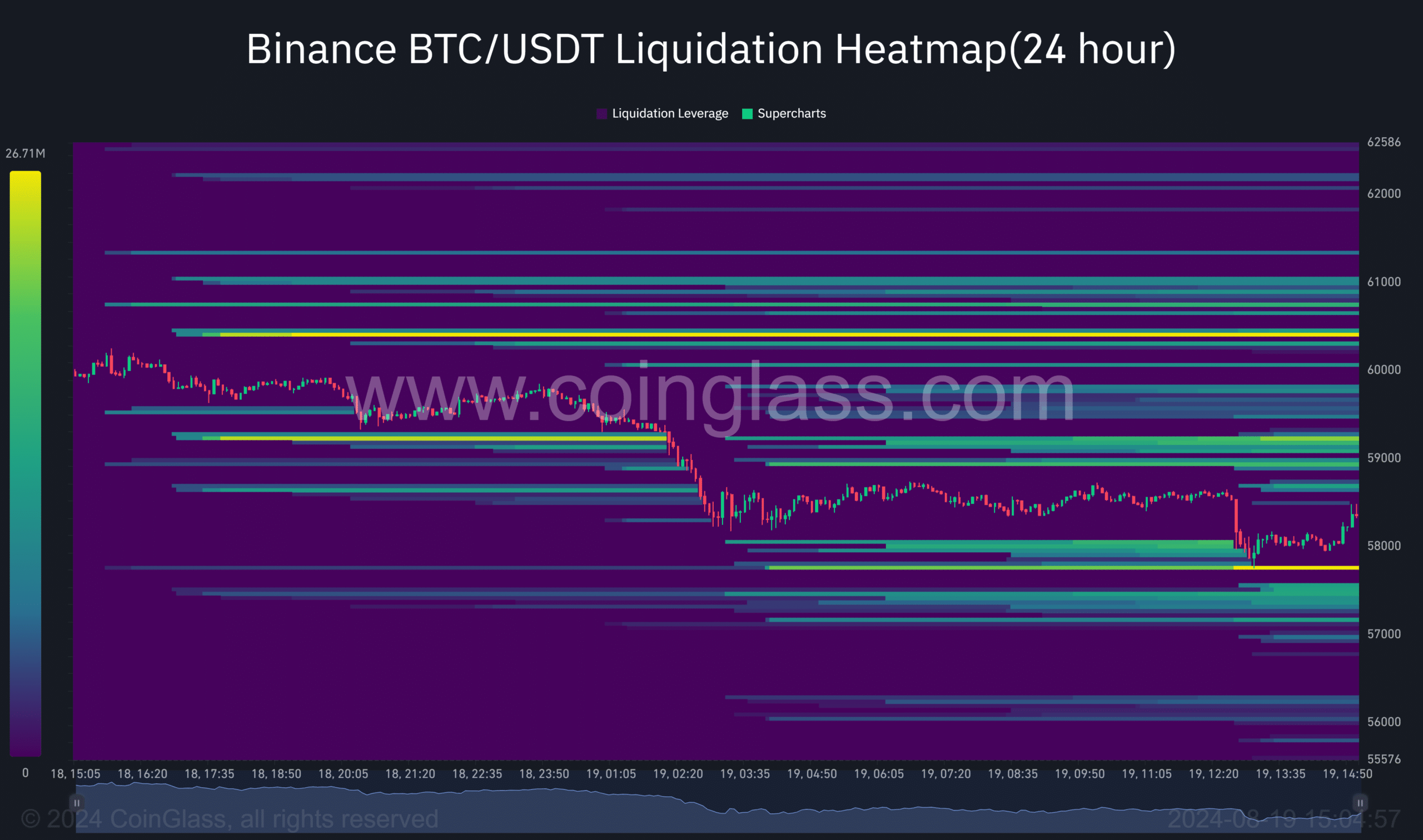

But there’s a severe threat on the horizon. If worth crosses above $60k, then the liquidation heatmap reveals greater than 100 million {dollars}’ price of BTC shall be bought off very quickly in any respect.

Thus, any upward motion will result in large liquidations, inflicting sharp fluctuations in costs.

Supply: Coinglass

Volatility forward for Bitcoin

Lastly, Bitcoin’s latest worth motion implies that the market could expertise elevated volatility.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

The $56,427 assist degree nonetheless stays vital; nonetheless, the $60k spot ought to be on watch as there’s appreciable liquidation stress at this level.

On the whole, whale habits, trade outflows, and a few technical points level to an attentive market standing.