- Bitcoin was buying and selling near the $59,000 vary at press time

- There gave the impression to be some miner capitulation, however massive miners nonetheless amassed

Bitcoin confronted important miner capitulation final week as its value dipped, resulting in heightened outflows from miners. This occurred alongside a spike in mining issue, with the identical reaching its highest stage in years and placing extra strain on miners. Nonetheless, current metrics point out that this capitulation could also be nearing its finish as Bitcoin confirmed indicators of stabilizing considerably.

Bitcoin sees miner capitulation

CryptoQuant‘s information revealed that Bitcoin noticed important miner capitulation final week as its value dropped to the $49,000-range. On 5 August, day by day miner outflows surged to 19,000 BTC, the best stage since 18 March.

This sell-off occurred as miners confronted more and more slim revenue margins. The margin fell to 25%, the bottom since 22 January.

Supply: CryptoQuant

The evaluation additional indicated that some miners bought parts of their reserves, realizing a lack of $22 million – Marking the biggest day by day loss since 29 Could. A pointy hike in hashrate and community issue drove this wave of capitulation.

The metrics reached new all-time highs over the previous week, placing extra pressure on miners’ operations. These difficult situations pressured miners to liquidate holdings to cowl prices, highlighting the strain they confronted throughout this era.

Present state of miners’ holdings

That’s not all. The holdings of smaller miners reached a low level as a result of current capitulation within the Bitcoin market.

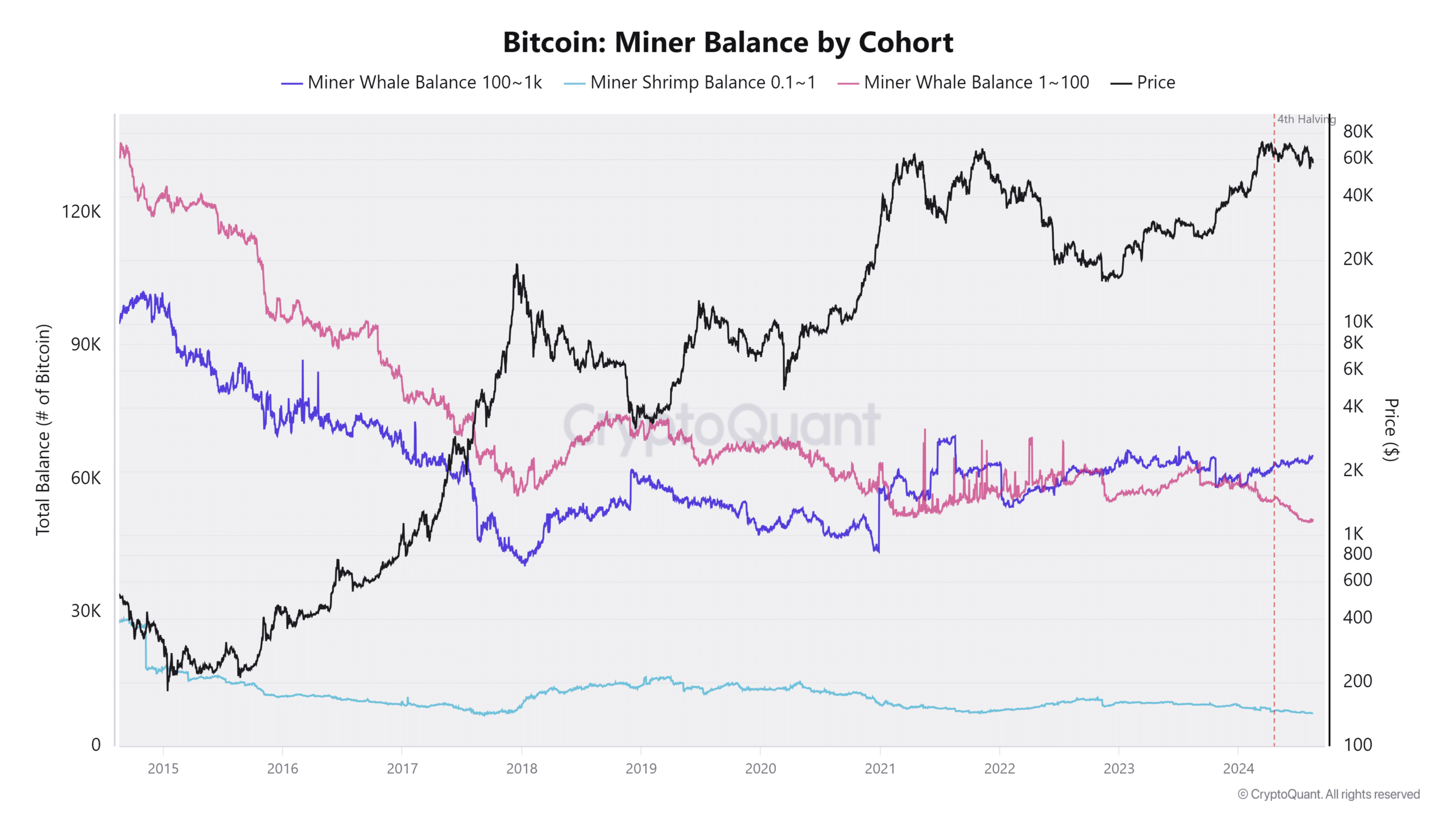

Knowledge from the Miner Stability by Cohort revealed that even earlier than this newest capitulation, smaller miners (pink line) had been experiencing a gentle decline of their Bitcoin holdings – A pattern that intensified following the halving occasion in Q2.

Supply: CryptoQuant

Quite the opposite, bigger miners have been growing their holdings. In accordance with the aforementioned evaluation, bigger miners (violet line) have continued to build up Bitcoin, with their complete holdings now amounting to 66,000 BTC.

This accumulation by bigger miners has contributed to a decline in total Bitcoin capitulation. Particularly as the value of BTC notes a slight restoration.

Resistance at $60,000 regardless of current positive aspects

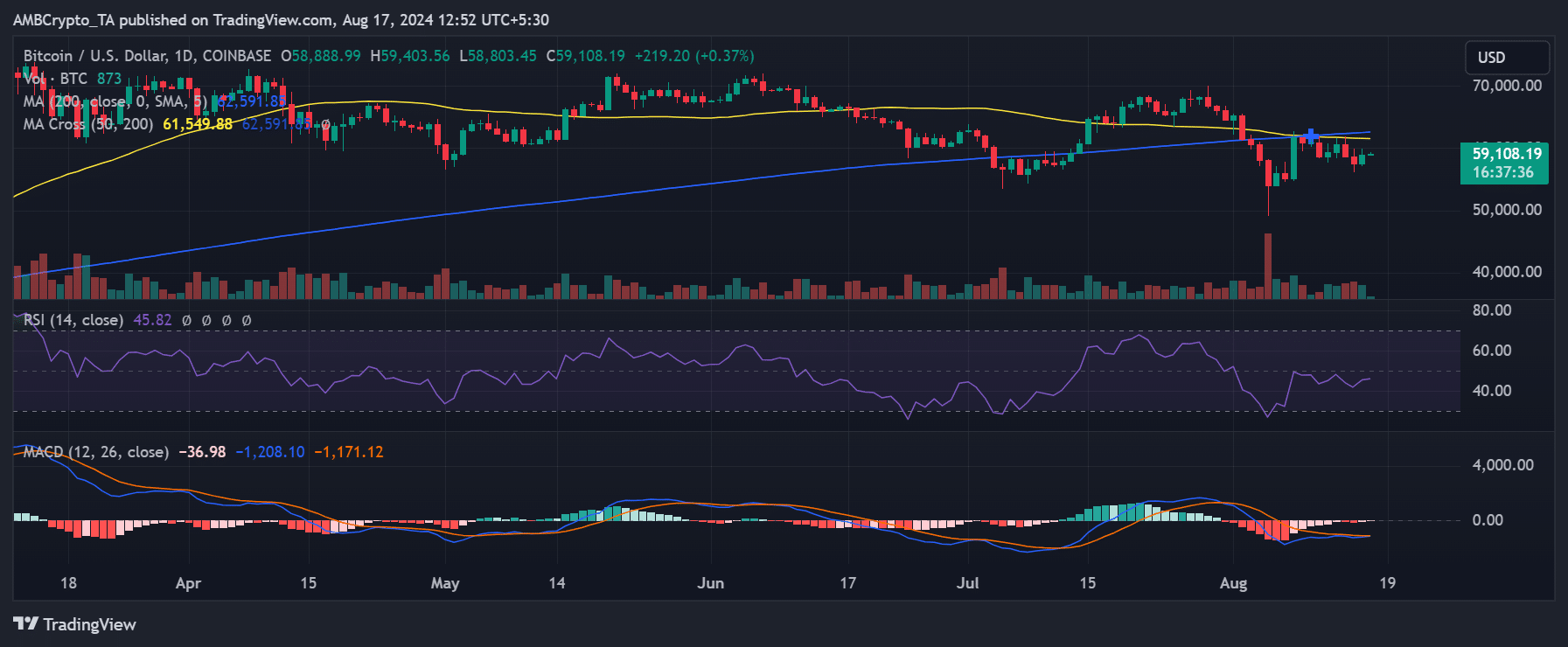

Since Bitcoin fell under its brief and long-term transferring common (yellow and blue strains), the $60,000 value vary has constantly served as a major resistance stage. Evaluation of Bitcoin’s day by day timeframe chart indicated that the yellow line supplies resistance round $61,000, whereas the blue line marks one other resistance level at roughly $62,000.

On the time of writing, Bitcoin noticed an over 2% hike over the past buying and selling session, closing above $58,000.

Whereas this restoration shouldn’t be but a return to earlier highs, it marks a constructive transfer upwards from the current dip to $49,000, which triggered miner capitulation.

Supply: TradingView

– Learn Bitcoin (BTC) Value Prediction 2024-25

Although nonetheless shy of breaking previous the crucial $60,000-resistance, this uptick would possibly precipitate a gradual restoration.

Nonetheless, Bitcoin should overcome these key resistance ranges to regain stronger bullish momentum and transfer nearer to its earlier highs.