- Bitcoin’s worth was about to achieve an important assist degree.

- Most metrics hinted at a worth enhance quickly.

Bitcoin [BTC] witnessed a worth correction within the final 24 hours. A serious cause behind this could possibly be the rise in liquidation.

Nonetheless, BTC was approaching an important assist degree from which it may make a development reversal within the coming days or even weeks.

Why Bitcoin is down

CoinMarketCap’s information revealed that BTC was down by greater than 3% within the final 24 hours. On the time of writing, BTC was buying and selling at $60,862.71 with a market capitalization of over $1.2 trillion.

Ali, a preferred crypto analyst, just lately posted a tweet revealing a potential cause behind this downtrend. As per the tweet, BTC’s liquidation rose sharply close to the $61,490 mark.

Every time liquidation rises, it will increase the probabilities of a worth correction. Subsequently, traders may need chosen to exit their positions after hitting that degree.

This latest worth decline has pushed BTC down in the direction of a essential assist degree.

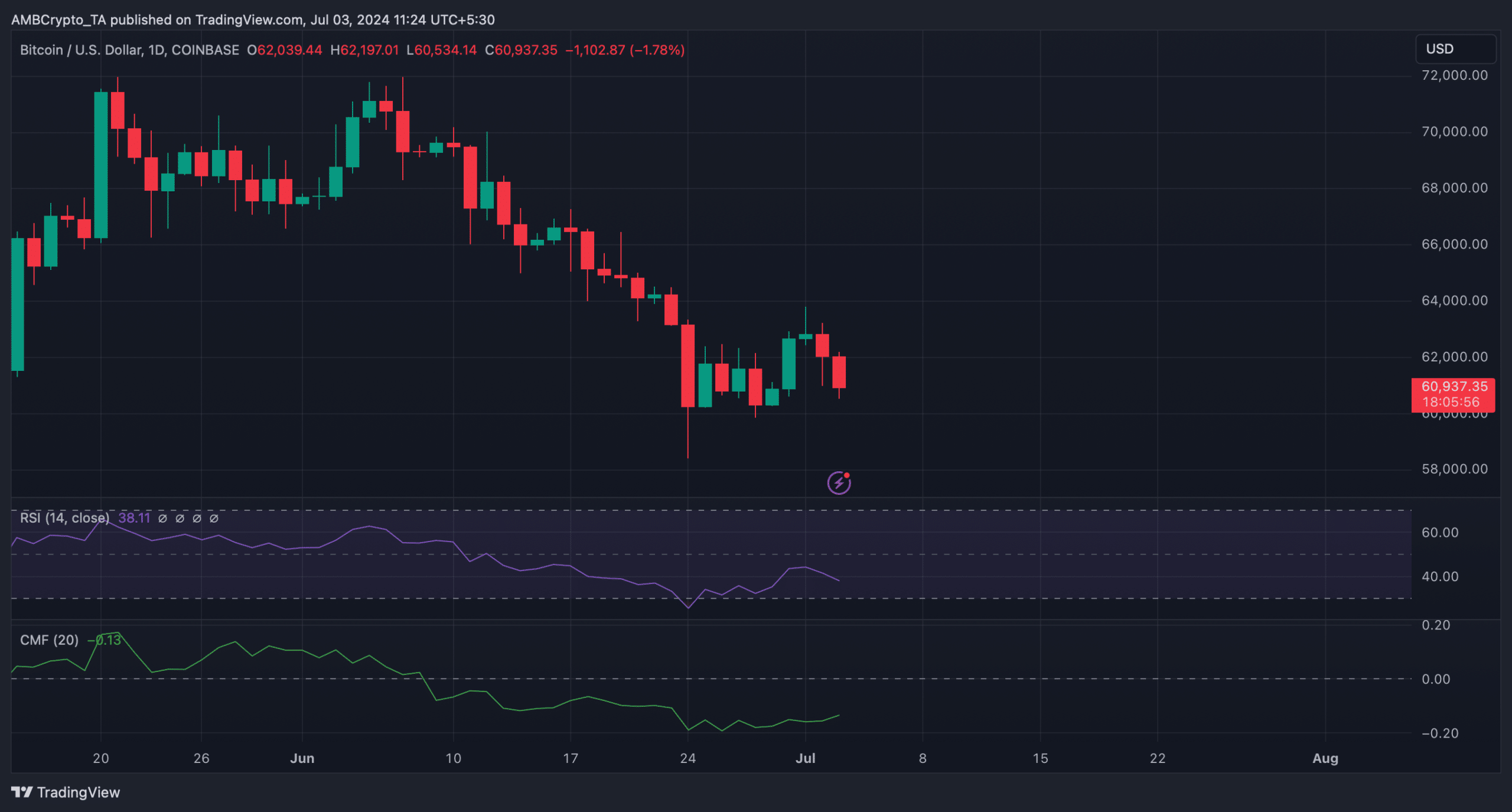

AMBCrypto’s evaluation of the coin’s day by day chart revealed a widening, falling wedge sample. If the downturn continues, then traders would possibly witness BTC dropping to $60,078.

At that time, BTC would have an opportunity to rebound. If that occurs, then the king of cryptos’ worth would possibly achieve bullish momentum and attain $71k within the coming weeks or months.

Supply: TradingView

Will BTC rebound quickly?

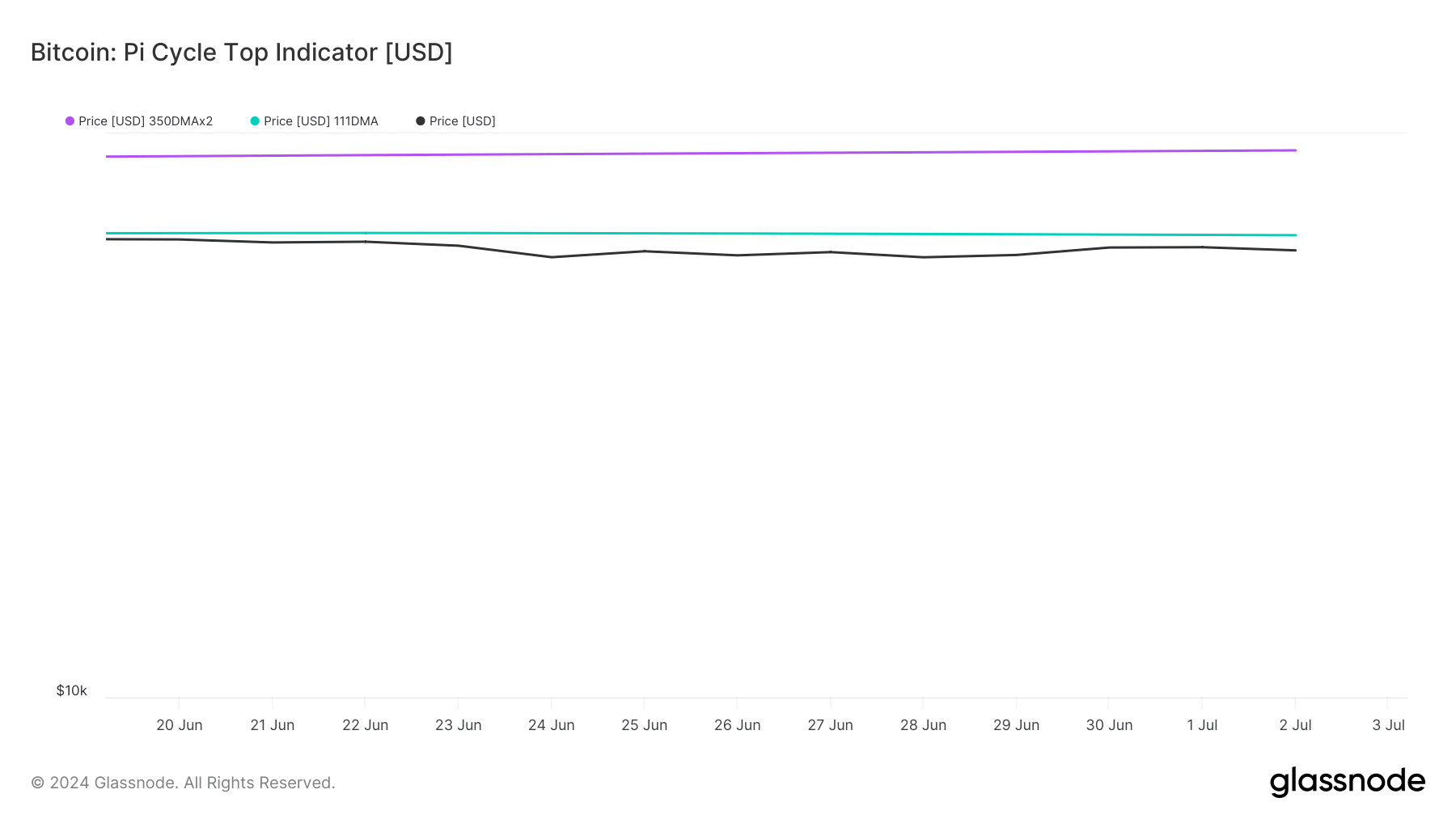

AMBCrypto then deliberate to check out the king coin’s on-chain information to see whether or not the coin was prepared for a rebound. Our evaluation of Glassnode’s information revealed a bullish metric.

Notably, BTC’s Pi Cycle High indicators identified that BTC’s worth was buying and selling under its potential market backside. If that’s true, then BTC would possibly flip bullish quickly.

For the uninitiated, the Pi Cycle indicator consists of the 111-day transferring common (111SMA) and a 2-times a number of of the 350-day transferring common (350 SMA x 2) of Bitcoin’s worth.

Supply: Glassnode

The truth is, as per CryptoQuant’s information, BTC’s web deposit on exchanges was low in comparison with the final seven days’ common. This clearly meant that promoting strain on BTC was low, which often leads to worth upticks.

BTC’s Binary CDD was additionally within the inexperienced, which means that long-term holders’ actions within the final seven days have been decrease than common. They’ve a motive to carry their cash.

Issues within the derivatives market additionally regarded good, as BTC’s Funding Price was rising.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The Chaikin Cash Circulate (CMF) additionally registered a slight uptick, which steered that the probabilities of a worth enhance have been excessive.

Nevertheless, the Relative Power Index (RSI) supported the bears because it plummeted sharply at press time.

Supply: TradingView