- Bitcoin may hit $64,000 if BTC’s 4-hour candle closes strongly above the $60,700 degree.

- Lengthy positions are comparably larger than brief positions, signaling upcoming bullishness.

The general sentiment within the cryptocurrency market shifted after Germany fully offered off its Bitcoin [BTC] holdings. These adjustments has not solely turned general crypto property inexperienced but in addition assist BTC to breach the $60,000 degree.

Bitcoin breaches main resistance degree of $60,000

Since third July, 2024, BTC has tried a number of occasions to breach the $60,000 degree however failed. As a result of a number of rejections, this degree was weakened and simply broke this time.

If it closes with a powerful every day candle above the $60,700 mark, there’s a excessive risk that we may even see BTC on the $64,000 degree within the coming days.

Other than the German authorities’s BTC sell-off, one other potential cause that turned market sentiment barely bullish is the continual influx into spot Bitcoin Change Traded Funds (ETFs).

In the course of the interval, when the general market was bleeding, ETF merchants confirmed robust confidence and curiosity in BTC by shopping for the dip, in accordance with the info from an on-chain analytic agency spotonchain.

Technical evaluation of BTC and key ranges

Based on professional technical evaluation, BTC is trying bullish as it’s buying and selling above its 200 Exponential Shifting Common (EMA) on a every day timeframe. A value above 200 EMA alerts bullishness within the chart.

Moreover this larger timeframe bullishness, it additionally fashioned a bullish ascending triangle value motion sample in a 4-hour timeframe. If it offers a powerful candle closing above $60,700 then there’s a excessive probability we may even see a bullish transfer as much as $64,000.

Supply: TradingView

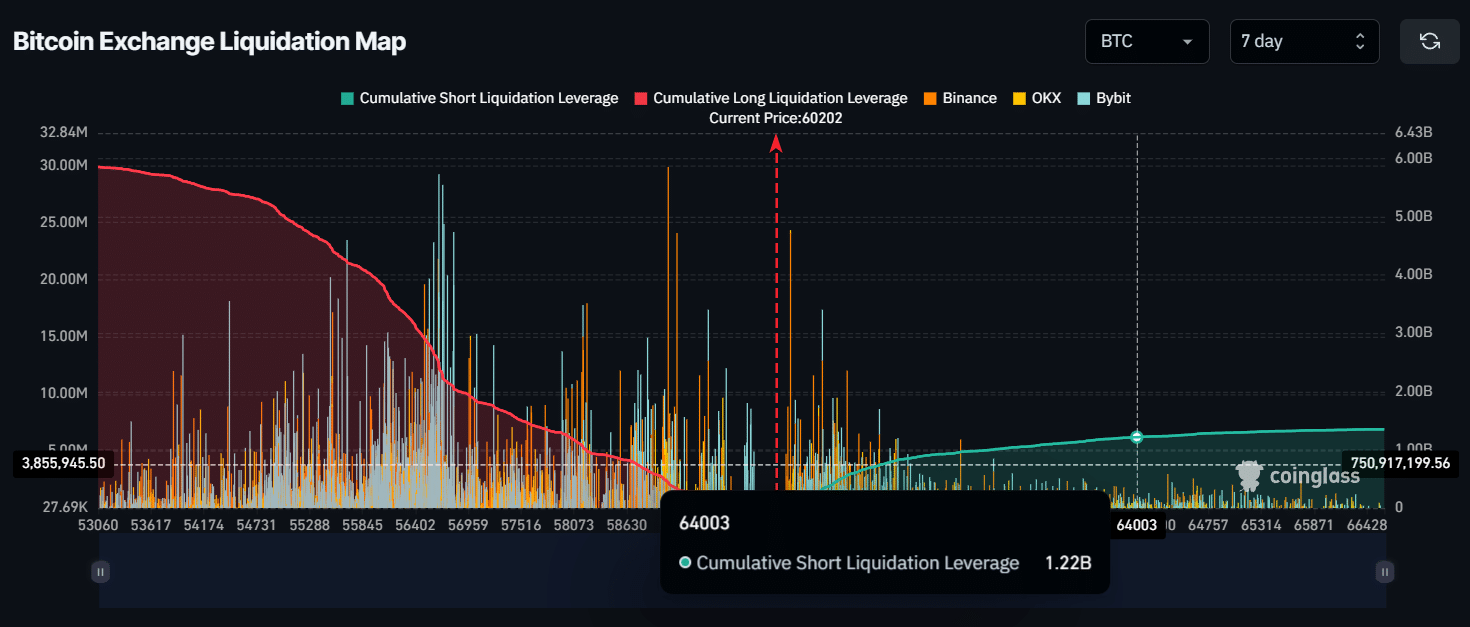

Nonetheless, if BTC reaches the $64,000 degree, practically $1.22 billion of brief positions might be liquidated.

Moreover, knowledge from an on-chain analytic agency CoinGlass signifies that bulls’ lengthy positions have been comparably larger than short-sellers’ during the last seven days.

Supply: CoinGlass

On the time of writing, BTC was buying and selling close to $60,140 and it skilled 3.5% upside strikes within the final 24 hours.

In the meantime, open curiosity (OI) has surged by 5.3% exhibiting robust confidence and curiosity amongst traders and merchants. Based on coinmarketcap knowledge, BTC has gained a value surge of over 4.6% within the final 7 days.

Altcoins together with Ethereum (ETH), Solana (SOL), Cardano (ADA), and XRP (XRP) have additionally undergone comparable upside strikes.