- Bitcoin bulls defied bearish odds, triggering a short-squeeze.

- Nevertheless, the surge lacked momentum, leaving room for the following “dip” to spark renewed hope.

Bitcoin [BTC] kicked off the second week of September with bullish momentum, defying bearish expectations and shutting above $57K. Nevertheless, the rally was short-lived, with BTC buying and selling at $56,407 on the time of writing.

Surprisingly, the drop adopted a surge in lengthy positions, elevating hypothesis of a short-squeeze-driven hype.

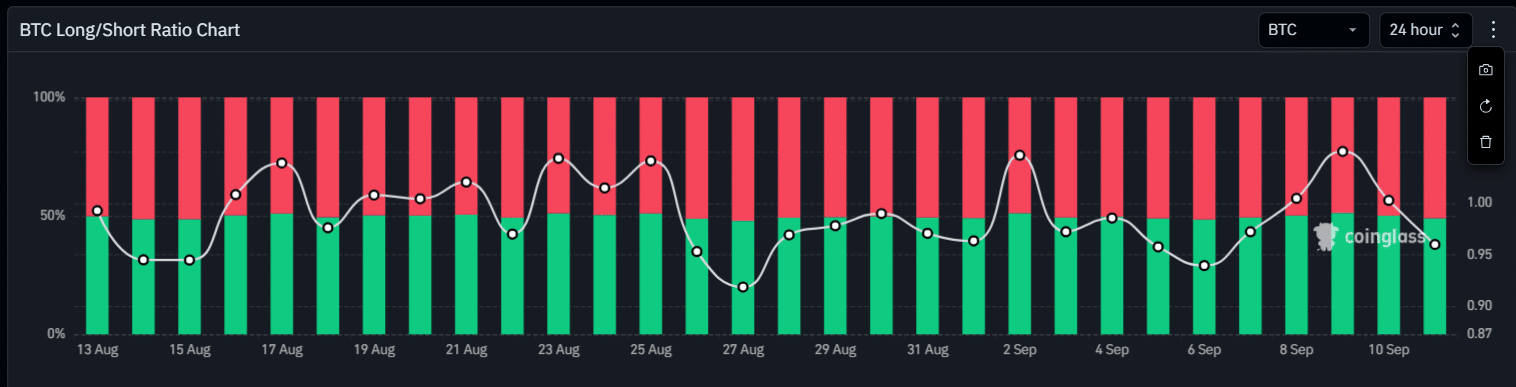

Supply: Coinglass

As anticipated, longs outperformed shorts, remaining assured in an impending reversal.

Moreover, a surge in Futures merchants going lengthy has aligned with the worth rise. As an example, throughout the mid-August rally to $64K, longs constantly prevailed, retaining shorts at bay.

Nevertheless, since then, the ratio has change into extra erratic, retaining the worth consolidated beneath $60K. The $56K help is now essential. If market shorting intensifies, the probabilities of a rebound might falter.

LTH confidence alone might not suffice

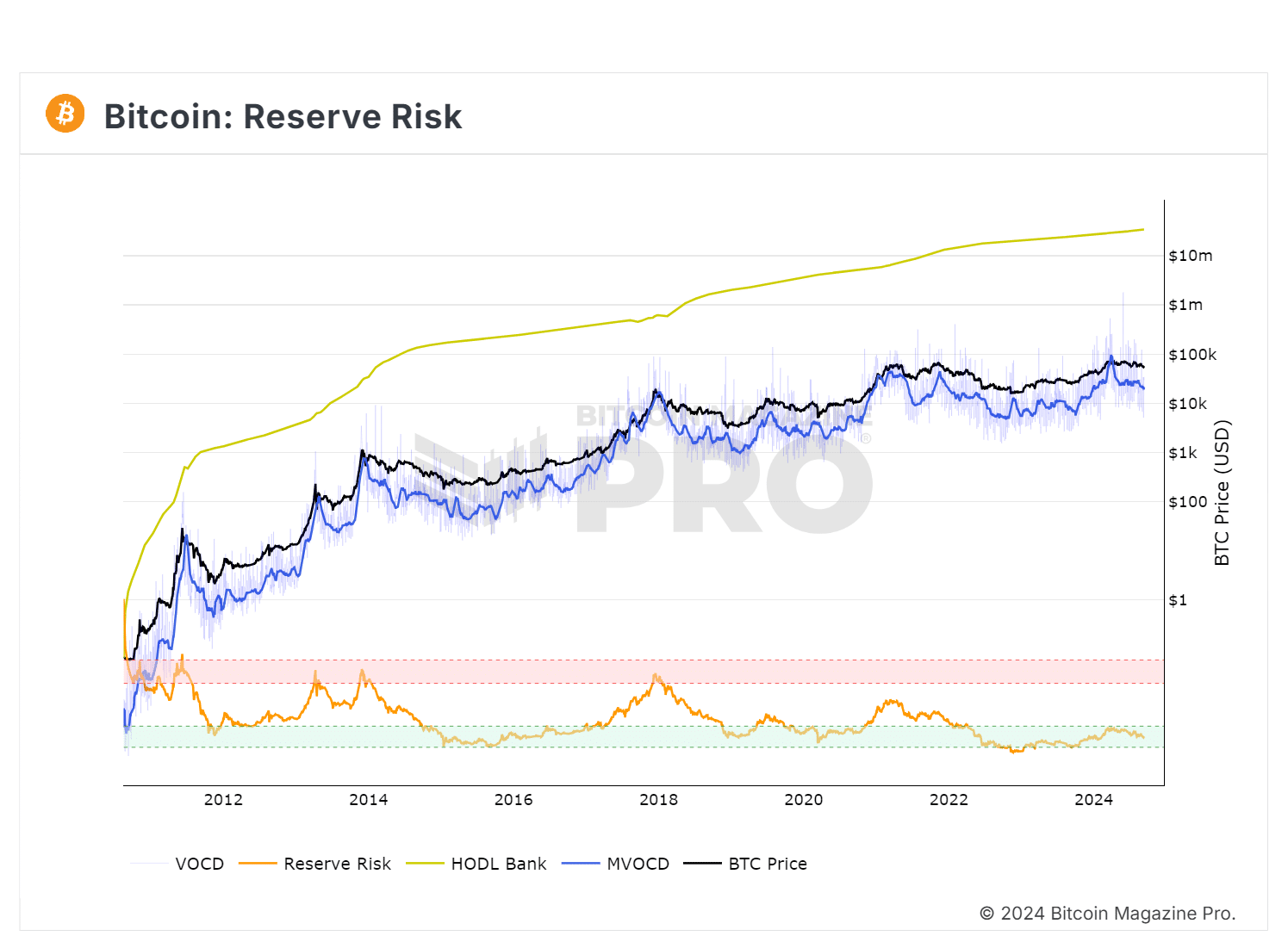

Reserve threat indicated long-term holders are assured relative to Bitcoin’s value. Investing throughout inexperienced zone intervals has traditionally yielded outsized returns.

Supply: Bitcoin Journal Professional

Furthermore, when confidence is excessive and value is low, then there may be a horny threat/reward to spend money on Bitcoin at the moment.

Put merely, traders monitor LTH exercise to gauge market sentiment. If this sentiment exhibits optimism, it could entice extra merchants.

Nevertheless, regardless of this, short-term holder’s insecurity, evidenced by the $850 million BTC sell-off, reinforces AMBCrypto’s short-squeeze analogy.

Briefly, with the market slipping into excessive worry, the place is the worth more likely to settle?

Figuring out BTC’s value backside

As talked about earlier, holding the $56K vary is essential. Monitoring this stage carefully will point out BTC’s subsequent path.

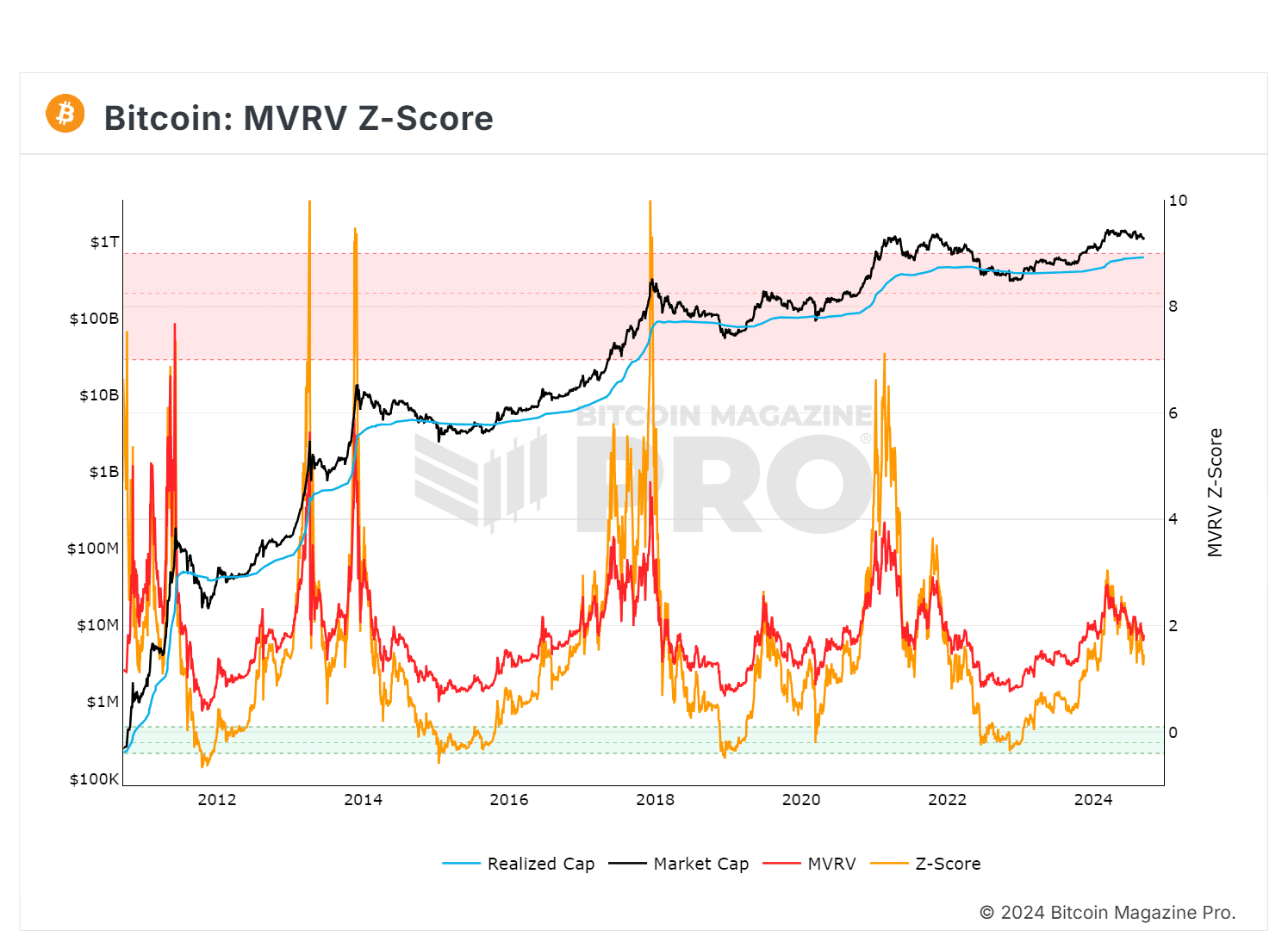

Supply: BM Professional

An MVRV ratio of 1.8 exhibits Bitcoin’s market worth is 1.8x its realized worth, indicating common holder revenue. If realized, this might create promoting stress.

Therefore, a market prime is unlikely until a Fed fee minimize weakens the Greenback index, prompting an outright bull momentum.

Nevertheless, a value backside, occurring when market worth falls beneath realized worth, might sign capitulation and arrange the following cycle.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In keeping with AMBCrypto, BTC is more likely to dip to round $40K earlier than a possible reversal, with a bearish pullback wanted for a rebound.

With out this, consolidation might proceed.