- Whale exercise surged as Bitcoin fashioned a double-bottom sample, testing key resistance ranges

- Market sentiment strengthened on the again of rising lively addresses, declining alternate reserves, and the bullish purchase/promote ratio

Whale exercise on Binance has spiked considerably currently, with the whale ratio climbing by over 1.02%. This metric, which tracks the highest inflows in comparison with whole inflows, is used to evaluate giant actions by main Bitcoin holders.

Traditionally, such elevated whale exercise is commonly seen as a precursor to large-scale shopping for or promoting. Actually, this typically precedes main value actions on the charts too.

Evidently, its newest surge has raised questions on whether or not Bitcoin [BTC] is on the verge of a big market shift or only a non permanent rally.

Supply: CryptoQuant

Is Bitcoin prepared to check new highs?

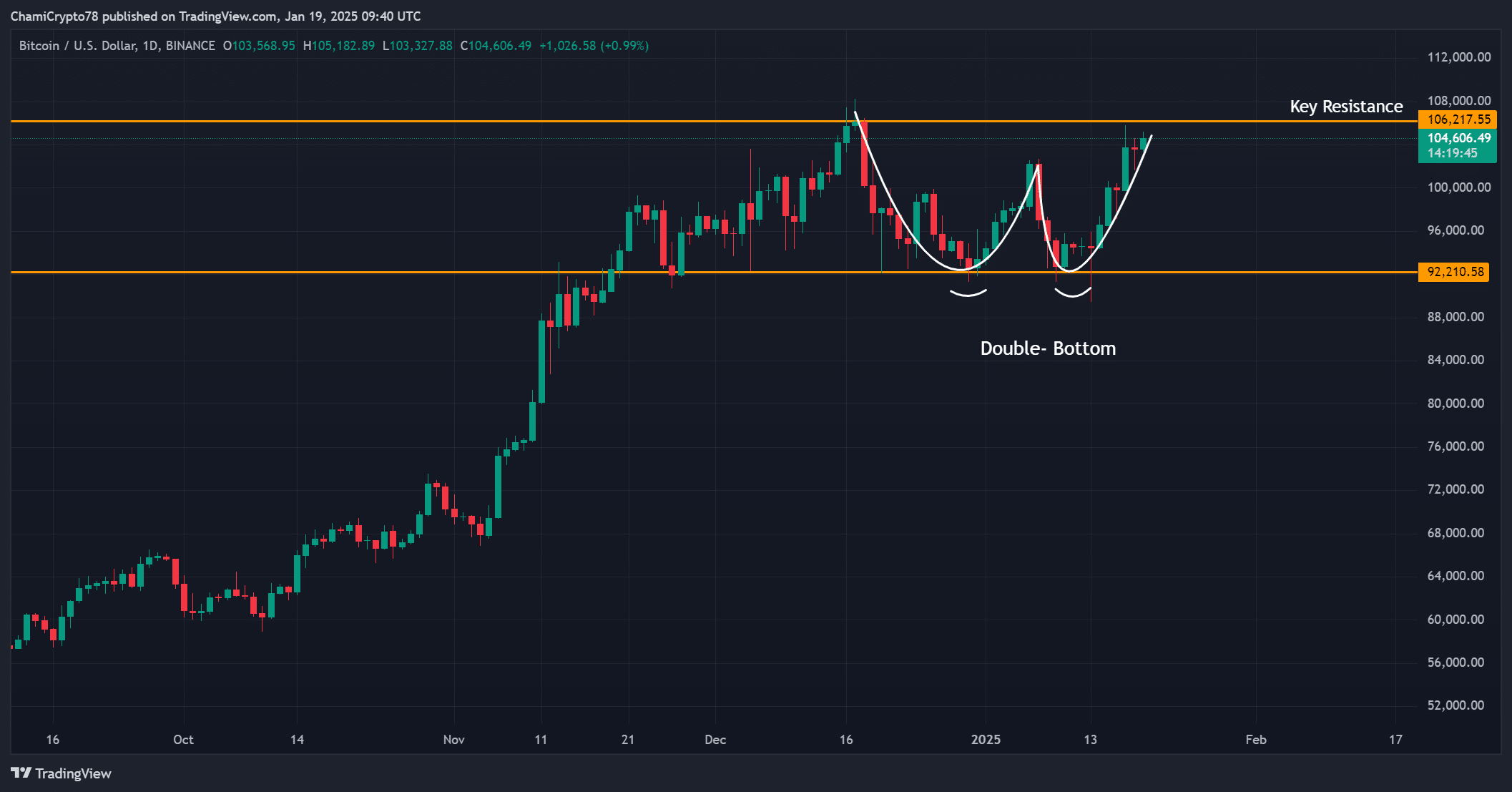

Bitcoin, on the time of writing, was buying and selling at $104,473.77, following a 1.39% hike within the final 24 hours. Its value motion on the charts revealed a double-bottom sample forming robust help close to $92,000, whereas the resistance at $106,200 remained a key hurdle.

If BTC can breach this resistance, it could pave the best way for a serious breakout. Nevertheless, failure to keep up upward momentum may set off a retest of decrease ranges, presenting a important juncture for merchants to watch intently.

Supply: TradingView

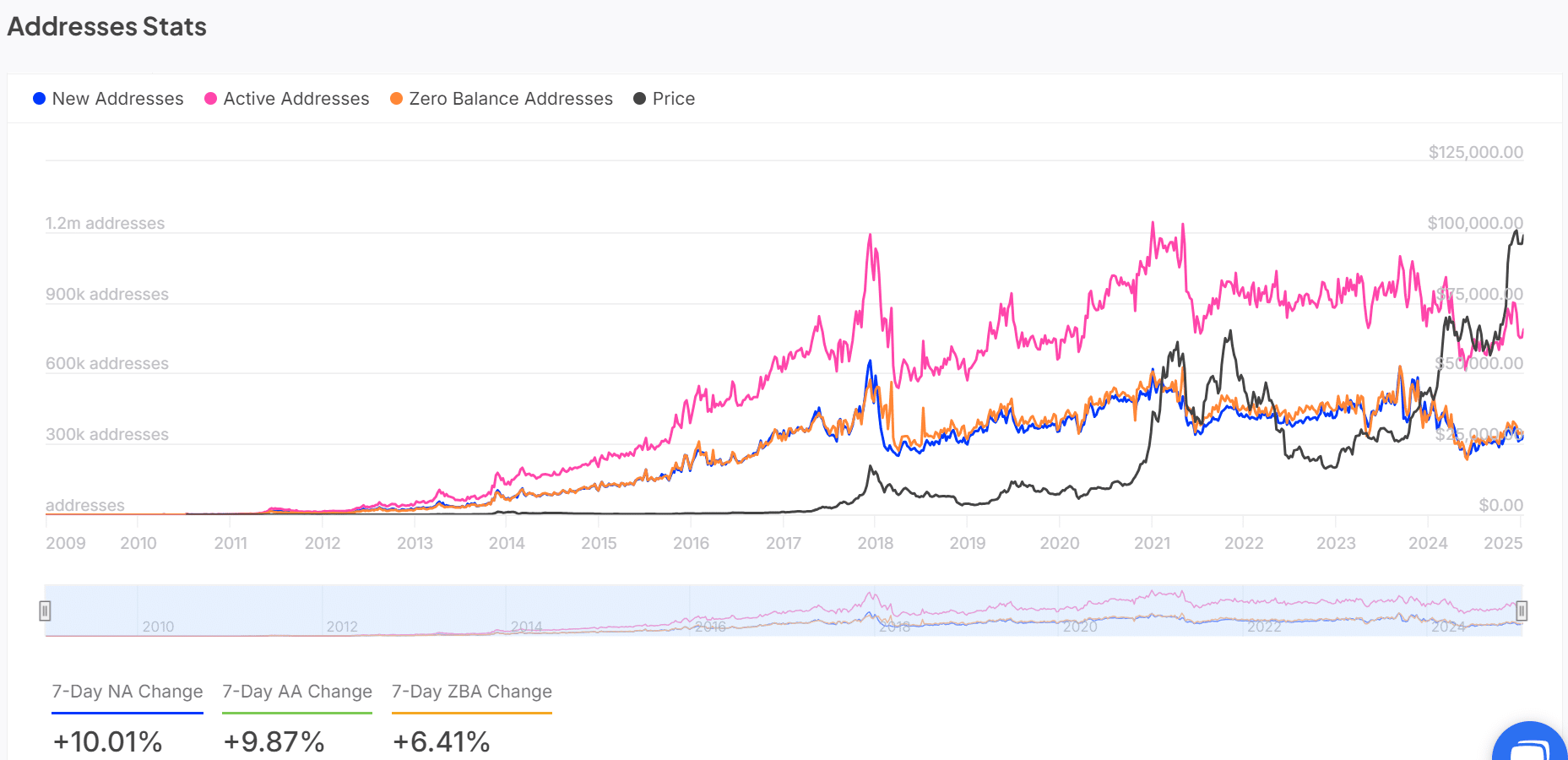

How can lively addresses form the market?

Bitcoin’s lively addresses surged by 9.87% over the past 7 days, reflecting rising curiosity within the crypto-asset. Such a hike is a vital indicator of market exercise, hinting at heightened transactional demand from each retail and institutional traders.

Additionally, an uptick within the variety of lively addresses is commonly seen as a measure of market confidence. If this development continues, it may present the transactional help wanted to push BTC to increased value ranges.

Supply: IntoTheBlock

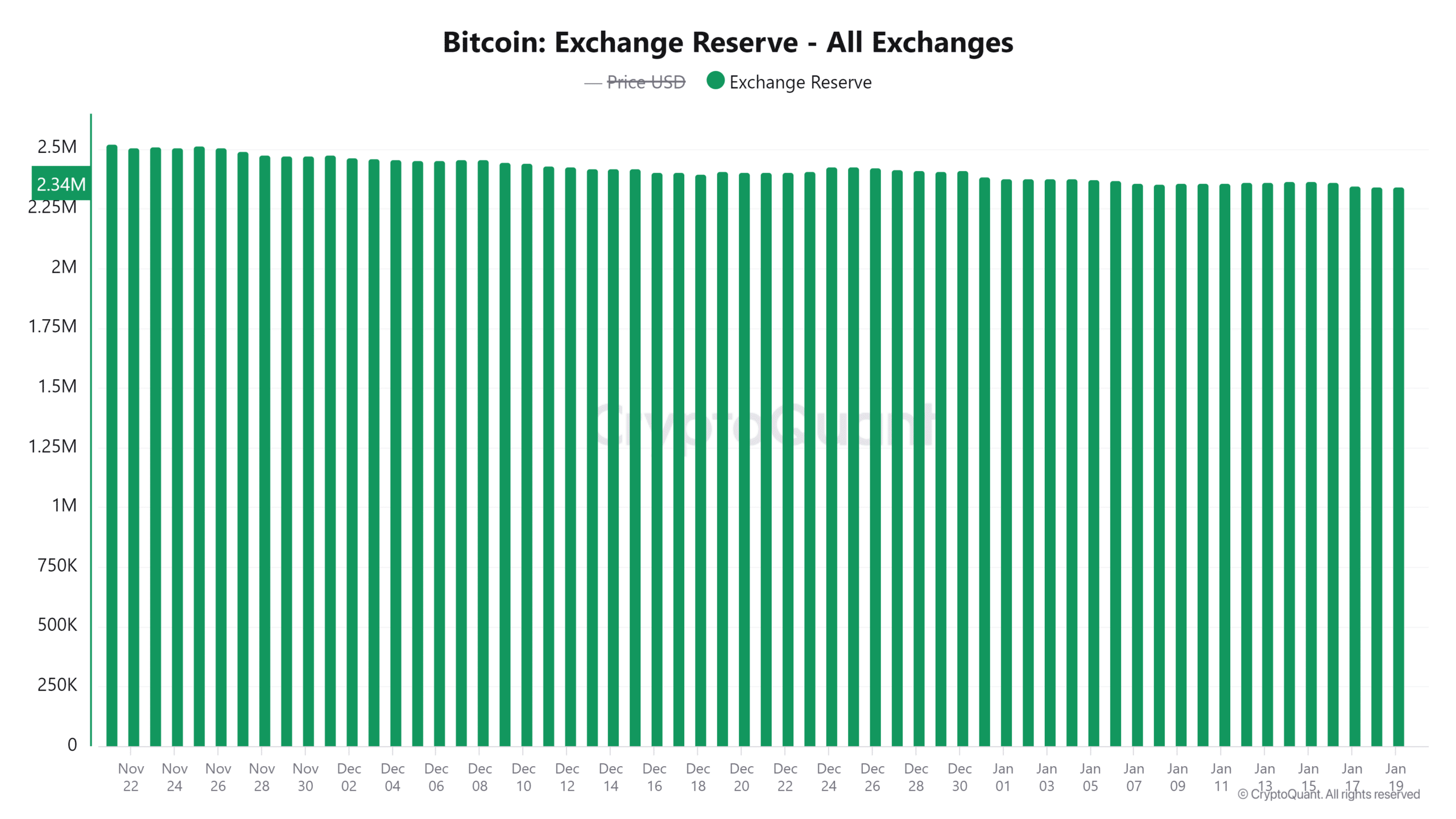

Alternate reserves sign lowered promoting strain

Over the past 96 hours, greater than 20,000 BTC, price over $2 billion, have been withdrawn from exchanges. On the time of writing, alternate reserves sat at 2.344 million BTC, reflecting a sustained decline.

This development indicated that traders have been transferring their holdings to non-public wallets – An indication of long-term bullish sentiment.

Right here, it’s price noting that lowered alternate reserves sometimes correlate with a fall in promoting strain, a discovering that will additional help a possible BTC rally.

Supply: CryptoQuant

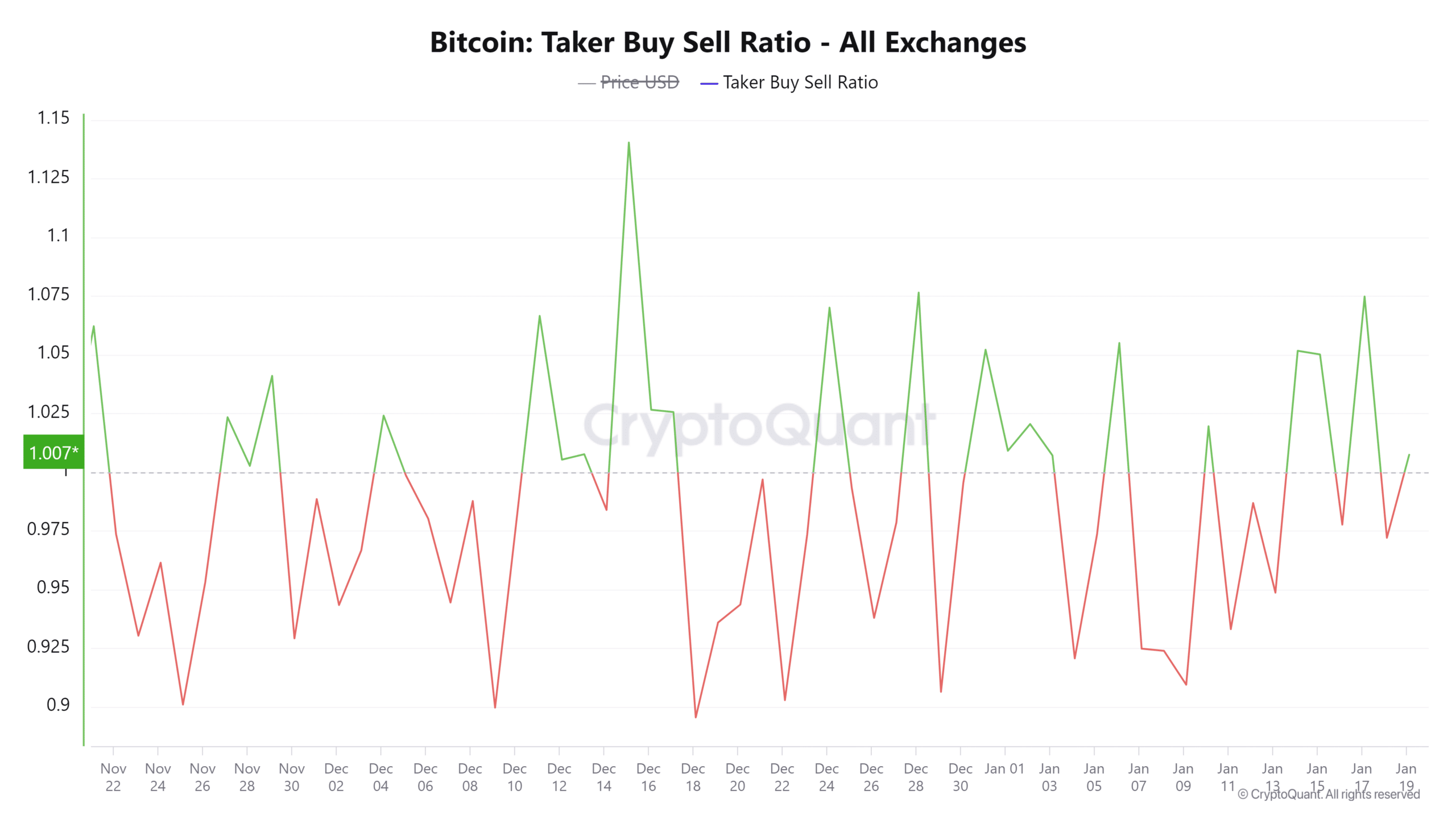

Taker purchase/promote ratio signifies bullish momentum

At press time, the taker purchase/promote ratio had a studying of 1.01, with a 0.99% hike in purchaser dominance. This metric highlighted that market contributors have been actively buying Bitcoin at increased costs – An indication of rising demand.

Moreover, this bullish sentiment complemented the broader narrative of accelerating curiosity in BTC, additional solidifying the potential of upward momentum within the brief time period.

Supply: CryptoQuant

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Given the surge in whale exercise, growing lively addresses, declining alternate reserves, and bullish taker purchase/promote ratios, Bitcoin seems primed for a breakout.

Whereas dangers of a pullback stay, information strongly supported a bullish case for the cryptocurrency.