- Bitcoin value set to surge as international liquidity rises.

- Assessing subsequent liquidity clusters for Bitcoin.

Bitcoin [BTC] continues to indicate power, pushed by rising international liquidity and favorable macroeconomic circumstances.

With international liquidity growing by 0.92% to $132.8 trillion, the best since early 2022, Bitcoin is predicted to profit from this pattern.

Improved collateral values and actions by China’s central financial institution have contributed to this rise. Although the Federal Reserve has not but carried out a stimulus, markets are optimistic about future fee cuts.

These elements recommend that Bitcoin might see larger costs, making the ultimate quarter of the 12 months notably bullish for the broader crypto market.

Supply: Alpha Extract

Bitcoin’s value motion and key ranges

Bitcoin’s value lately bounced off the essential 0.786 Fibonacci retracement degree, presently buying and selling at $66,000. This degree has constantly acted as a key indicator for each upward and downward actions this 12 months.

The sample of respecting this degree reveals that Bitcoin stays aligned with international liquidity traits. As liquidity continues to rise, it’s anticipated to maneuver larger, with the following main goal being new highs above $66,700.

The worldwide liquidity enhance will possible profit Bitcoin because it stays a main hedge towards financial inflation, alongside gold.

Supply: TradingView

Affect of September’s bullish shut

This month closed with a 7.35% enhance, making it the best-performing September in BTC’s historical past. This bullish sentiment is supported by Bitcoin’s means to resist current corrections and preserve upward momentum.

Regardless of market expectations of a decline, AI fashions from Spot On Chain precisely predicted a bullish month, noting,

“There’s a 69% chance of a new all-time high this month and a 54% chance of Bitcoin reaching $100K by year-end.”

The broader crypto market can also be anticipated to profit from favorable macroeconomic elements, notably potential fee cuts from the Federal Reserve and the European Central Financial institution.

The Fed has shifted its focus from inflation to employment, with a 42% likelihood of a 50 foundation level fee lower in November.

If upcoming U.S. unemployment information is available in decrease than anticipated, this likelihood might enhance additional. Price cuts usually sign a extra favorable setting for threat property like Bitcoin, pushing its value larger.

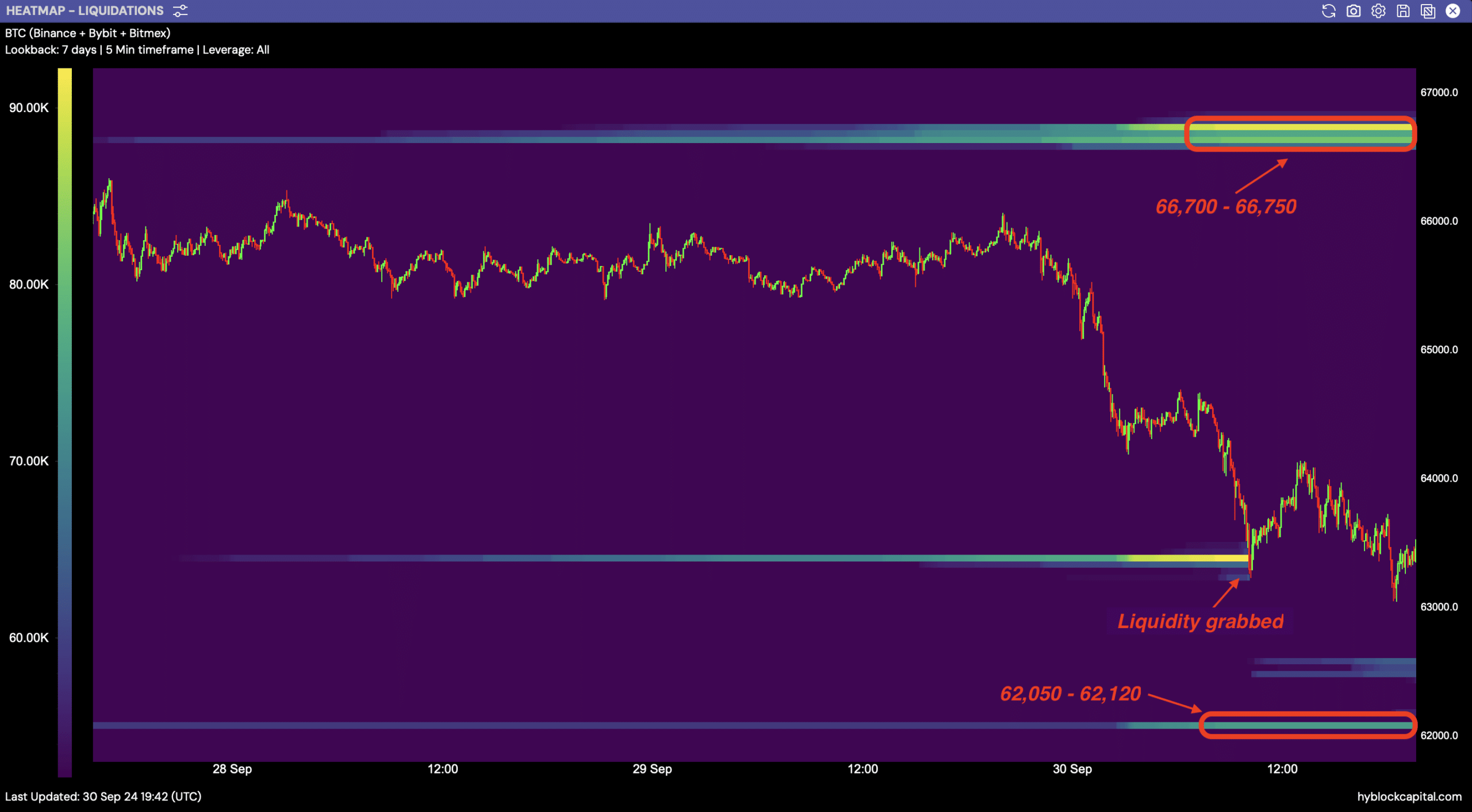

Liquidity clusters to look at

Key liquidity clusters for Bitcoin are rising as the value climbs. Latest retraces in direction of $63,225 allowed Bitcoin to seize liquidity, setting the stage for the following transfer.

The following high-liquidity clusters sit between $66,700 and $66,750, whereas decrease clusters round $62,050 to $62,120 present assist.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

These ranges will likely be vital to watch as Bitcoin continues its upward pattern, doubtlessly resulting in a breakout to larger costs.

Supply: Coinglass

Rising international liquidity, bullish technical patterns, and constructive macroeconomic alerts place Bitcoin for larger costs quickly.