- Important purchase zones for Bitcoin are value proper now

- Bitcoin whales have gathered 358,000 BTC in July, marking an “unprecedented” switch of wealth

Bitcoin (BTC) has skilled appreciable worth fluctuations lately, dropping from round $67,000 to beneath $65,000 inside simply 24 hours. This volatility has caught the eye of merchants and analysts alike.

In actual fact, Zen, a preferred crypto dealer and analyst, famous on X that Bitcoin’s decline mirrored actions within the inventory market. He claimed,

“$BTC followed stock market and dumped. Nearest zone of interest 64.5-65k I mentioned before was skipped in one 1H candle – that is why I wrote that it is not good for blind limit orders and requires monitoring at lower timeframes.”

He emphasised the necessity for warning and shut monitoring of worth actions to keep away from untimely purchase orders.

Zen additional recognized crucial worth zones, stating that the primary stable purchase zone is round $61.4K to $61.8K, with a decrease zone doubtlessly protecting the CME hole round $58.5K to $60.5K.

Supply: X

Accumulation by Bitcoin whales

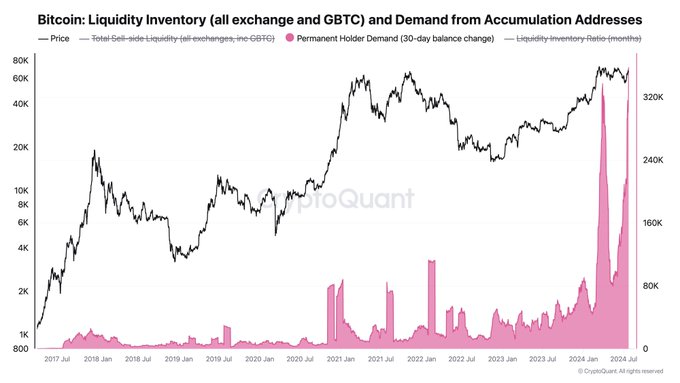

Moreover, on-chain analytics platform CryptoQuant additionally noticed a notable pattern of Bitcoin accumulation by large-volume traders, also called whales. CEO Ki-Younger Ju highlighted this in a current publish, describing the circulate of cash to those traders as “unprecedented.”

He acknowledged that over the previous month, 358,000 BTC has been moved to everlasting holder addresses. July alone noticed world spot ETF inflows of 53,000 BTC.

Regardless of not all BTC being in custody wallets, the buildup section is clear although, with a considerable switch of wealth throughout the crypto market.

Supply: CryptoQuant

Bitcoin was buying and selling at $64,222 at press time, with a 24-hour buying and selling quantity of $37,443,835,918. This underlined a 3.35% decline over the aforementioned interval.

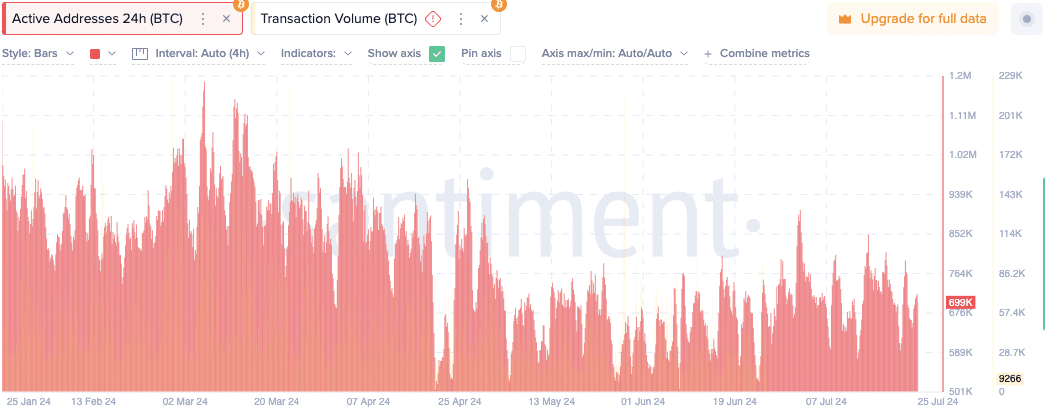

Furthermore, the variety of energetic Bitcoin addresses has proven some variability too, starting from roughly 500K to 1.2M.

On the time of writing, as an example, energetic addresses numbered 699K, with a transaction quantity of 9266 BTC – Marking a decline from earlier peaks seen in late February and early June.

Supply: Santiment

Moreover, the Complete Worth Locked (TVL) in Bitcoin stood at $701.92 million, reflecting ongoing engagement and funding within the cryptocurrency market.

The dynamics of energetic addresses and transaction volumes present beneficial insights into market exercise and investor conduct.

Impression of potential political developments

The upcoming Bitcoin 2024 convention has generated pleasure, notably as a result of involvement of 2024 presidential candidate Donald Trump.

Trump has been vocal about his help for Bitcoin, proposing the addition of BTC as a greenback reserve. This formidable plan goals to determine Bitcoin as digital gold. The potential affect of Trump’s presidency on Bitcoin’s worth is a subject of appreciable curiosity amongst crypto lovers.