- Bitcoin skilled a major decline over the previous month.

- The declining short-term Sharpe ratio left analysts eyeing a rebound.

Bitcoin [BTC], the biggest cryptocurrency by market cap, has skilled a sustained decline over the previous 30 days. Nevertheless, the final 24 hours have seen the crypto make reasonable beneficial properties.

As of this writing, it was buying and selling at $58,820 after a 1.10% enhance over the previous day.

Previous to this, the king coin was in a declining development, dropping by 6.32% over the previous seven days. Equally, it has declined by 4.37% over the previous month.

Regardless of the latest beneficial properties on day by day charts, BTC remained 20% beneath its ATH of $73737 recorded earlier this 12 months.

Regardless of the latest poor efficiency, key stakeholders together with analysts remained optimistic concerning the crypto’s path.

For example, CryptoQuant analyst Kripto Mevsimi eyed a rebound from the recorded draw back, citing short-term Sharpe ratios.

Market sentiment

In his evaluation, Mevsimi cited the 2023 cycle, arguing that the present short-term Sharpe ratio mirrored the earlier 12 months’s cycle.

Supply: X

Through the earlier cycle, when the short-term Sharpe ratio declined, BTC costs surged from a low of $26675 to a excessive of $35137.

Primarily based on this historic efficiency, those that are bullish view it as a potential rebound sign.

Nevertheless, the analyst offered a opposite view for bearish buyers, positing {that a} bearish interpretation might point out a sustained volatility.

In totality, a declining short-term Sharpe ratio implied elevated volatility and not using a proportional enhance in funding returns, thus making investments much less enticing.

If the evaluation is solely primarily based on the historic cycle in relation to the short-term Sharpe ratio, BTC would possibly rebound.

Accordingly, this bullish evaluation is additional strengthened by Santiment’s evaluation, which posited that BTC was performing effectively with out counting on S&P 500, suggesting independence from equities.

Supply: Santiment

What BTC’s charts counsel

This evaluation offered a constructive outlook for future worth motion. Subsequently, it’s important to know what different indicators counsel.

Supply: CryptoQuant

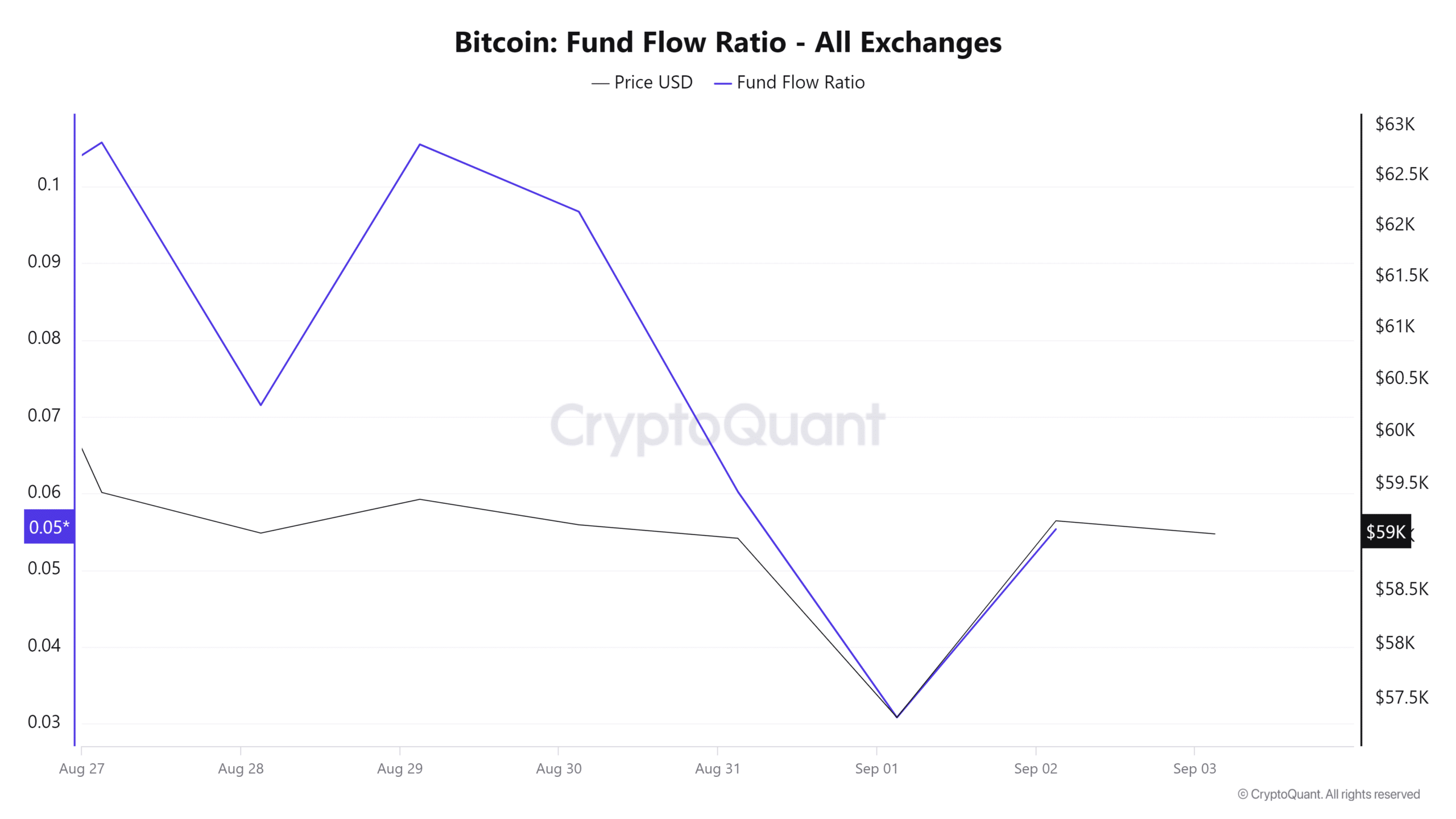

For starters, Bitcoin’s Fund Circulation Ratio declined over the previous seven days. A decline within the fund movement ratio implied that buyers had been selecting to HODL their property quite than promote.

This signaled long-term confidence, with buyers preserving their funds in chilly storage quite than exchanges. Such market habits ends in accumulation in anticipation of the long run worth enhance.

Supply: Coinglass

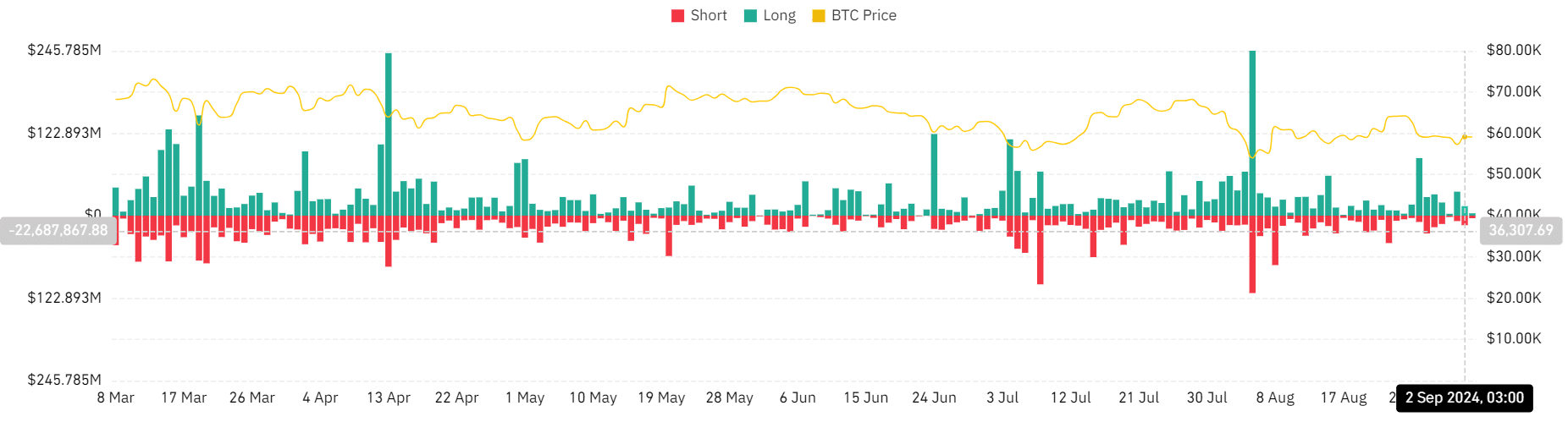

Moreover, BTC’s liquidation has decreased over the previous three days. Lengthy place has declined from $35.7 million to $3.4 million at press time.

This confirmed investor confidence in long-term worth will increase, as they had been keen to pay a premium to carry these positions.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

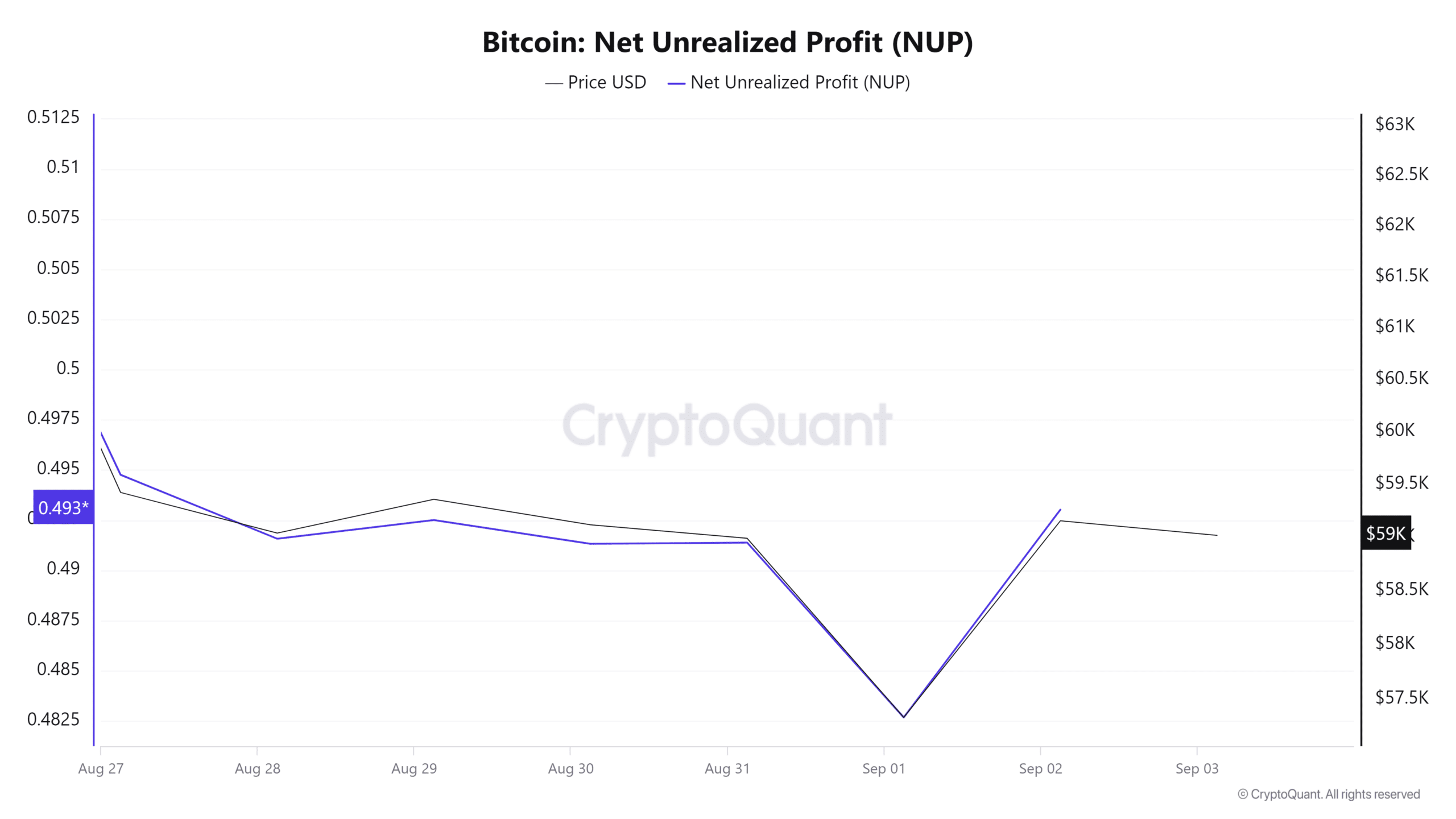

Lastly, BTC’s internet unrealized revenue was at 0.49, indicating that the prevailing market sentiment was optimistic. At this fee, though there was some profit-taking, it was unlikely to lead to a significant correction.

Subsequently, if the prevailing market sentiment holds, BTC is effectively positioned to interrupt out of the cussed resistance degree round $60k and problem the $64,752 resistance degree.