- BTC alternate reserves have dropped to the bottom degree this yr.

- Bitcoin, leaving exchanges’ reserves, stood at 2.6 million BTC.

Bitcoin [BTC] has as soon as once more damaged by a key resistance degree, rising above $65K, a degree it had struggled to surpass for over eight months.

This latest surge has triggered bullish momentum, which means BTC is gaining power.

A major signal of this constructive outlook is the drop in Bitcoin alternate reserves, which have hit their lowest ranges of the yr.

The reserves stood at roughly 2.6 million BTC. This decline means that each short-term and long-term holders are more and more unwilling to promote. It has fueled expectations of additional worth positive aspects.

Traditionally, decrease alternate reserves are related to bullish market sentiment, as they point out a decreased chance of promoting strain within the close to time period.

Supply: CryptoQuant

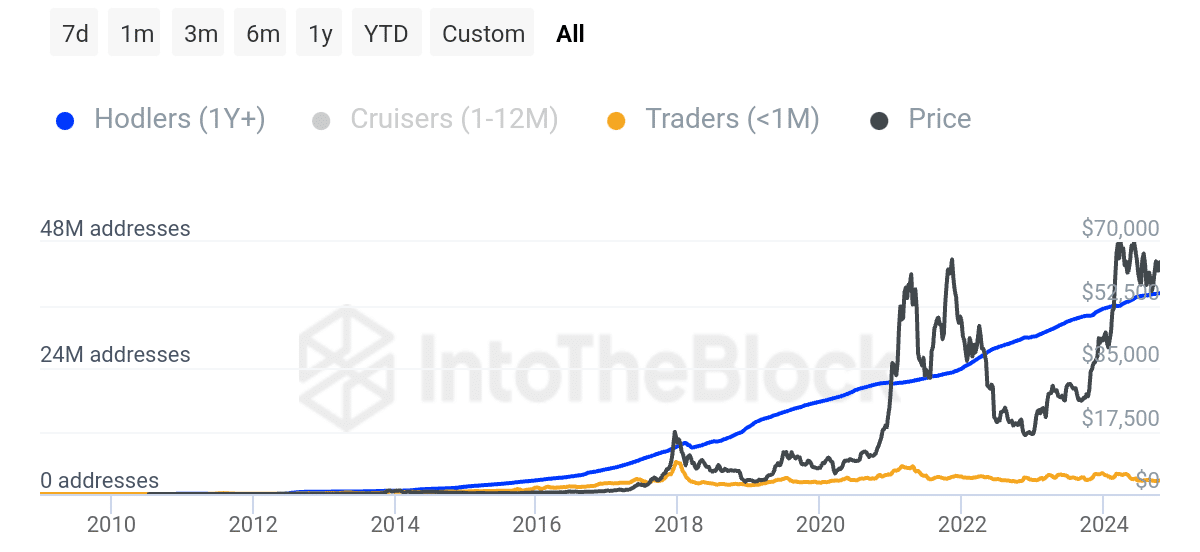

Bitcoin’s accumulation development amongst long-term holders has been steadily rising since 2014, and the variety of addresses holding BTC for over a yr is now at an all-time excessive.

This robust accumulation by long-term traders helps a better worth trajectory for Bitcoin.

In accordance with information from IntoTheBlock, the variety of addresses holding BTC for greater than a yr has elevated by 0.35% over the previous month.

Presently, over 38 million addresses have retained Bitcoin for greater than a yr, whereas 13 million addresses have been held for one to 12 months.

Supply: IntoTheBlock

Solely 2 million addresses have held BTC for lower than a month, underscoring the dominance of long-term holders.

This long-term accumulation development is a bullish sign. This indicated that extra traders are assured in Bitcoin’s future progress and are holding onto their positions for potential positive aspects.

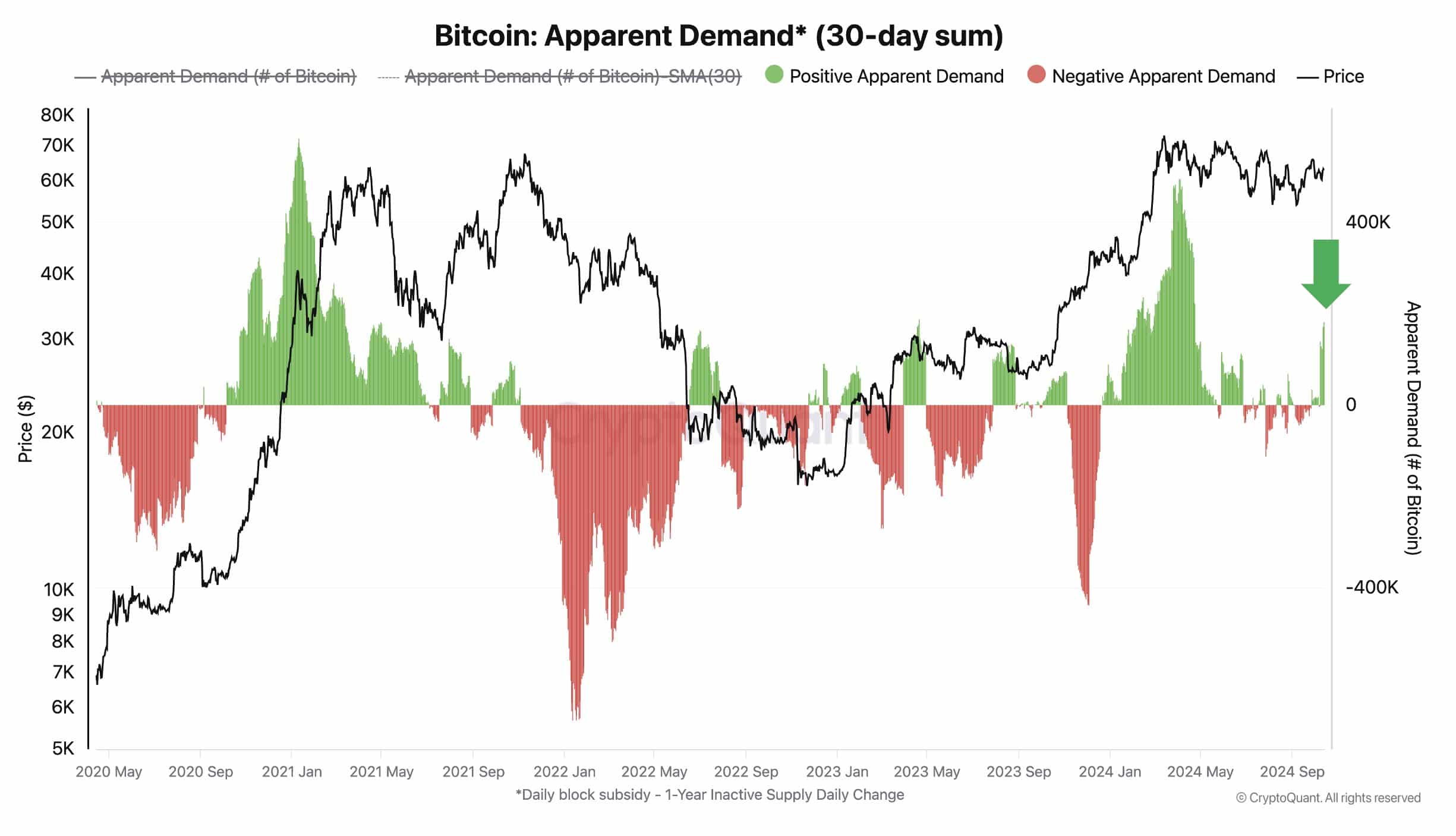

BTC’s obvious demand

One other constructive indicator for Bitcoin’s worth is the obvious demand, which measures the distinction between manufacturing and adjustments in stock.

Within the context of Bitcoin, manufacturing refers back to the issuance of recent BTC by mining, whereas stock refers back to the provide of Bitcoin that has been inactive for over a yr.

When the stock discount outpaces new manufacturing, it indicators growing demand for Bitcoin.

Supply: CryptoQuant

This elevated demand, mixed with a restricted provide, sometimes drives costs greater.

Given the latest traits, the demand for Bitcoin seems to be on the rise, additional supporting the case for continued worth will increase.

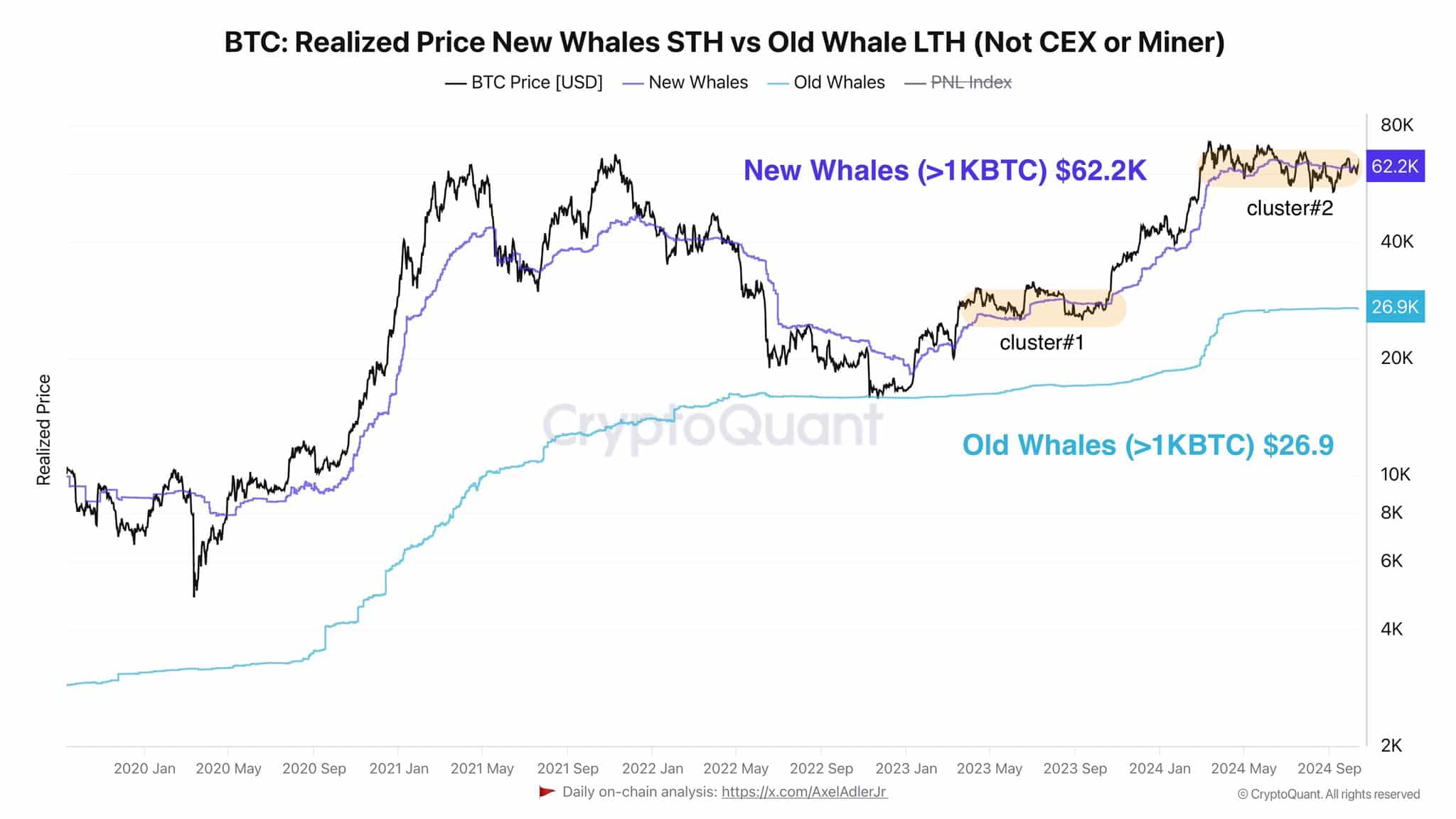

Realized worth of recent vs. outdated whales

The typical buy worth of recent whale traders is presently round $62.2K, whereas extra skilled whales have a mean buy worth of $26.9K.

With Bitcoin now buying and selling above these key worth ranges, it turns into much less probably that whales will promote their holdings till the market cycle peaks.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This consolidation of whale purchases across the present ranges reinforces the assumption that Bitcoin’s worth is poised to maneuver greater.

Giant traders sometimes maintain onto their positions throughout an uptrend, including additional stability and confidence to the market.