- BTC remained above the short-term realized worth ($86.5K) regardless of a $359M lengthy squeeze.

- Worth restoration recommended spot market power, however momentum must construct for additional upside.

Bitcoin [BTC] is proving resilient regardless of a pointy liquidation occasion that worn out $359.7 million in lengthy positions.

As volatility continues to grip the market, short-term ranges are actually extra vital than ever to gauge what lies forward for the king coin.

Huge lengthy liquidation however no breakdown

In accordance with CryptoQuant knowledge, the market just lately witnessed a large-scale lengthy squeeze, with almost $360 million in lengthy positions flushed out in a single hour.

Curiously, this was not accompanied by a pointy downward worth spiral. As an alternative, BTC bounced again shortly and traded at round $86,000, indicating robust purchaser assist and an absence of panic promoting.

Supply: CryptoQuant

This restoration signifies that, regardless of over-leveraged merchants dealing with losses, spot market individuals stay steadfast.

The liquidation occasion seems to have corrected overheated derivatives positions, doubtlessly paving the way in which for extra sustainable upward actions.

Bitcoin worth holds above short-term realized worth

One other encouraging sign comes from the Realized Worth – UTXO Age Bands chart.

On the time of writing, BTC was above the short-term realized worth for the 1-day to 1-week cohort at $86,000 and the 1-week to 1-month cohort at $84,000. These ranges usually act as assist zones for short-term holders.

Supply: CryptoQuant

So long as BTC maintains its place above these worth bands, it implies that robust fingers are stepping in, validating purchaser conviction.

Nevertheless, a breakdown under these ranges may sign a shift in sentiment and set off a wave of short-term profit-taking.

Bitcoin momentum stays intact regardless of slight cooling

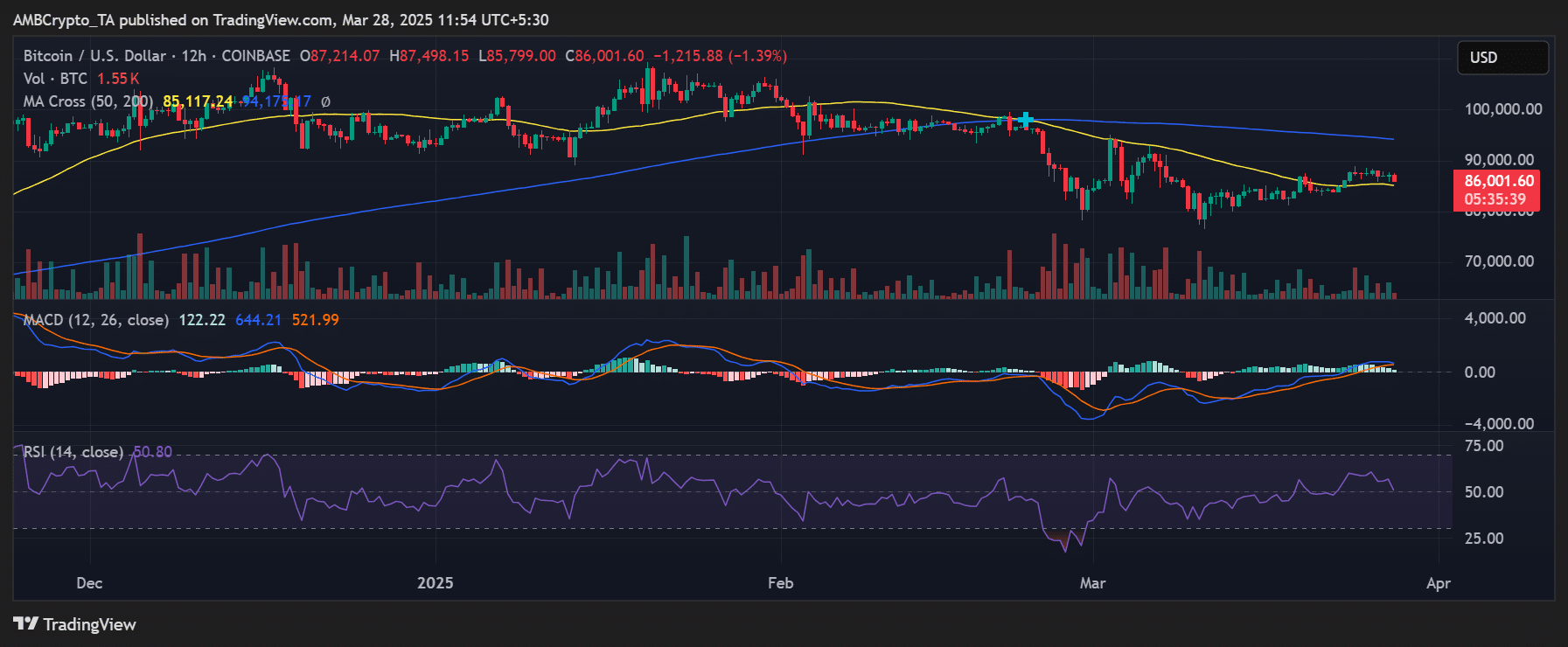

From a technical evaluation perspective, Bitcoin’s 50-day Transferring Common ($85,250) stays an vital pivot.

The worth has just lately bounced off this degree and is trending above it, with the Relative Energy Index (RSI) sitting at round 50, indicating a closeness to oversold situations.

Supply: TradingView

Furthermore, the MACD line remained above the sign line, albeit with narrowing divergence, a potential signal of consolidation earlier than the following leg up.

A retest of the $90,000 psychological degree seems probably if momentum picks up once more.

What subsequent?

Bitcoin’s resilience after liquidation and its skill to stay above key realized worth ranges spotlight robust demand.

Nevertheless, cautious optimism is critical, as BTC requires sustained momentum and better quantity to interrupt out of its vary. If patrons efficiently shield short-term assist zones, the following bullish motion may already be unfolding.