- Analysts venture a potential BTC rise after a document uptick in US cash provide.

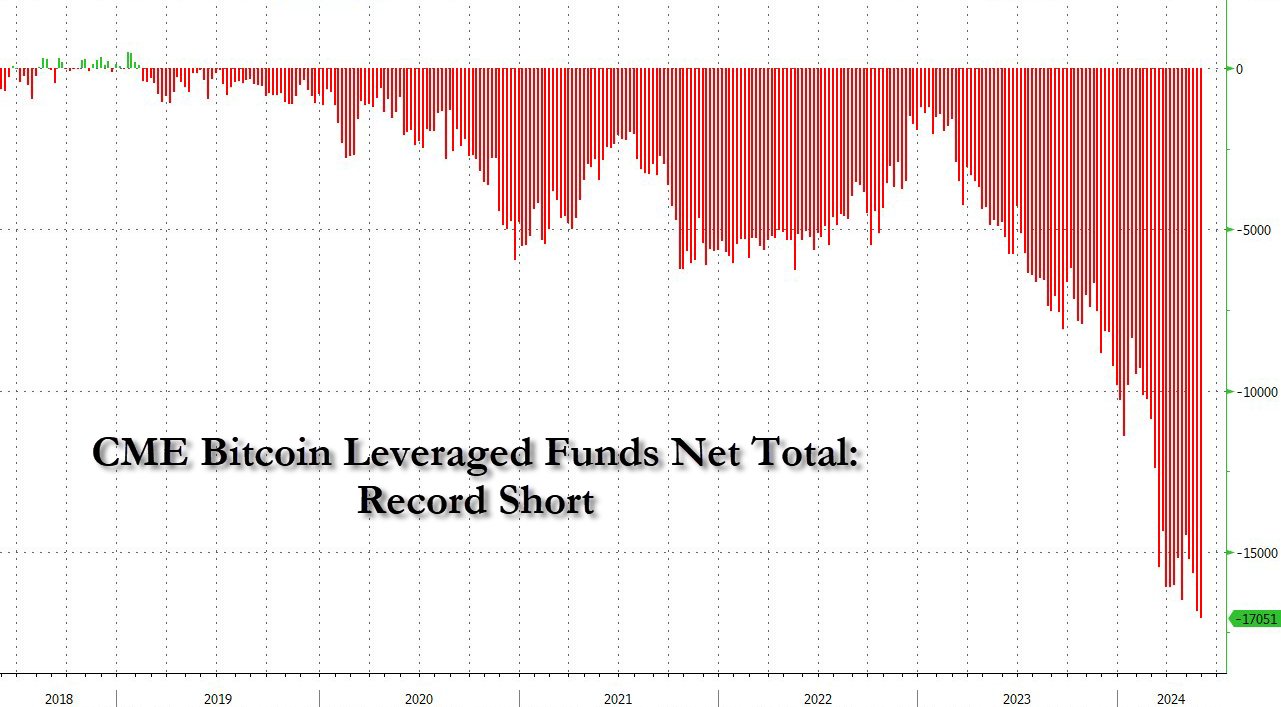

- Nonetheless, quick positions towards BTC have spiked, elevating fears of a value correction.

Bitcoin [BTC] has been in a value consolidation vary between $60K and $70K for weeks, a boring set-up for speculators who thrive on volatility.

This sideways motion prolonged after the April halving occasion and the seemingly ‘stagnant’ demand from US spot BTC ETFs.

However there’s a brand new growing narrative for the King coin—an uptick within the US cash provide.

Bitcoin’s path ahead

In keeping with X person (previously Twitter) TechDev_52, an entrepreneur and crypto analyst, BTC might be tipped for a ‘blowoff’ after BTC vs. M1 liquidity hit a document excessive.

‘$BTC had no business setting new highs in 2021. M1 soared to record heights, but #bitcoin couldn’t set one towards it. Now that it’s damaged above its 2M supertrend, we’re probably in for that blowoff transfer it’s at all times signaled.’

Supply: X/TechDev_52

The analyst blamed the ‘COVID panic M1 liquidity’ for the dearth of ‘blowoff’ in 2021 when BTC printed the same breakout towards the cash provide.

For the unfamiliar, M1 liquidity tracks probably the most liquid chunk of the cash provide. It consists of forex and any property that may swiftly be transformed to money. For M2, the scope goes additional to some ‘not so liquid parts’ of the cash provide, like financial savings deposits.

Apparently, M2 has additionally expanded by 0.7%, per one other analyst, Willy Woo. In earlier cycles, the surge within the cash provide led to an uptick in BTC’s worth in USD phrases.

It stays to be seen whether or not the BTC’s breakout towards the M1 liquidity and M2 enlargement will push it above the vary.

Nonetheless, current information confirmed that leveraged funds hit document BTC quick positions. This might be a hedge towards any potential drop in BTC or bets on value correction.

Supply: X/ZeroHedge

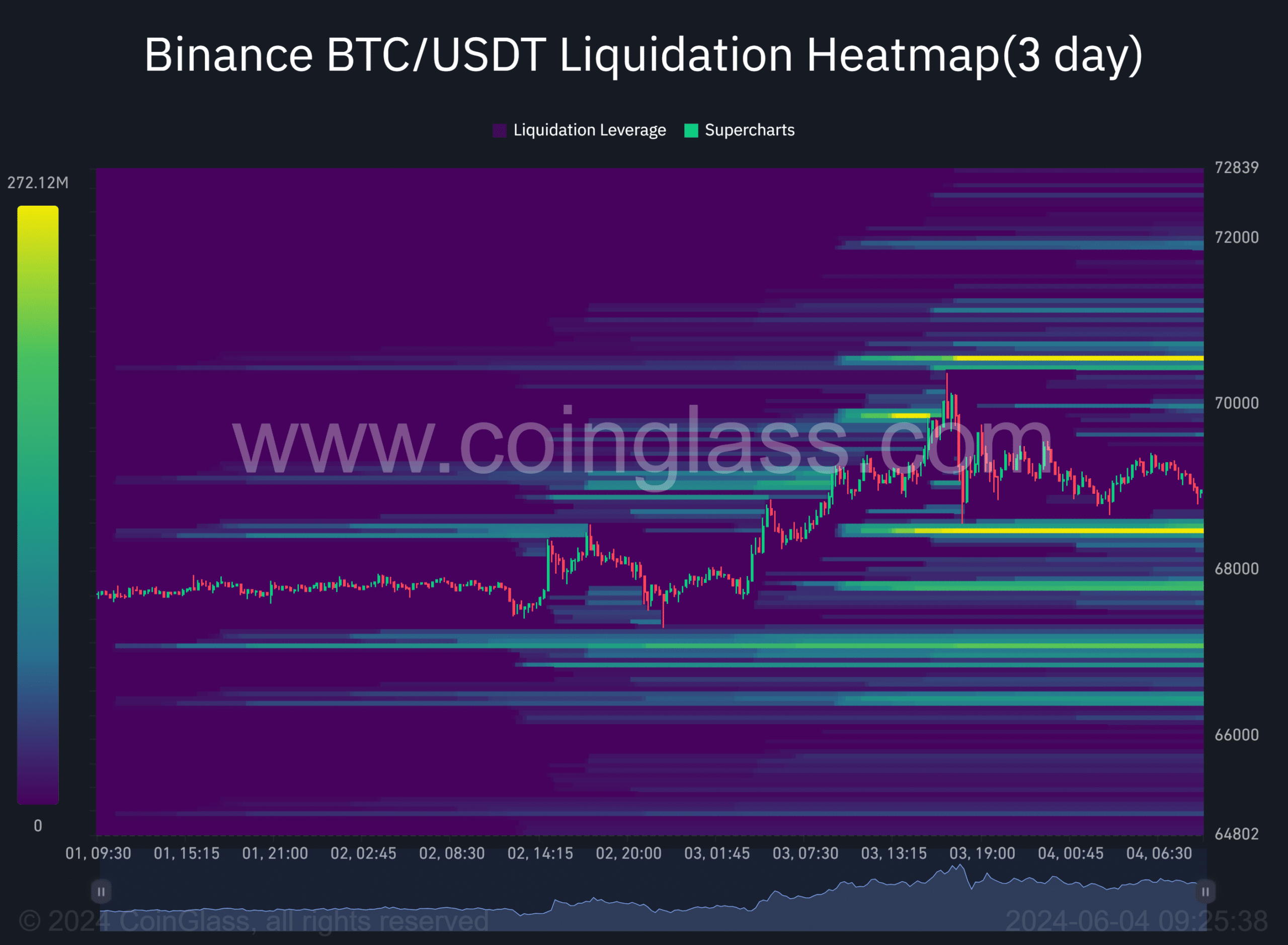

Within the meantime, a short-term transfer in direction of $70.5K was extra probably after sweeping the liquidity at $68.4K.

In keeping with Coinglass information, each ranges, marked orange, had been key liquidity cluster factors that might act as magnets for value motion.

Supply: Coinglass