- BTC has skilled elevated volatility over the previous month.

- Regardless of the decline, new whales proceed to enter the market as previous ones maintain their place.

Bitcoin [BTC] has seen some of the dramatic Septembers to this point. Traditionally, September is related to a bearish market. Nevertheless, during the last week, BTC has tried to defy this historic sample.

Actually, the crypto has recorded a neighborhood excessive of $60670 from a low of $52546. At press time, Bitcoin was buying and selling at $58819. This marked a 3.19% enhance on weekly charts.

Regardless of this try to interrupt out, the final three days, have seen BTC lose all of the latest features to hit a neighborhood low of $57488.

Such market habits signifies bulls are trying to take over the market, however they don’t seem to be sturdy sufficient to displace the bears.

This battle is effectively evidenced by the present whale’s exercise as they try to regain market confidence.

This phenomenon was noticed by CryptoQuant evaluation, as they recommended previous whales have continued to carry whereas new ones enter the market.

Whales proceed to carry

In keeping with CryptoQuant, new whales have been actively shopping for regardless of the decline, whereas previous ones continued to carry.

Supply: CryptoQuant

These merchants are accumulating at a base price of $62,038 which was down by 3.28%. This reveals their confidence within the long-term worth of BTC.

Alternatively, Outdated Whales (above 155 days) continued to carry their positions. Holding habits recommended they anticipate costs will spike within the close to future.

The truth that they don’t seem to be prepared to shut their positions to keep away from additional losses, reveals sturdy confidence.

These previous whales are holding their positions from a base price of $27,843 which was up by an enormous 115.54%.

Though they’re ready of main realized earnings, previous whales proceed to carry, as they anticipate additional worth will increase. That is one other traditional bullish sign.

Apart from whales, miners and Binance merchants proceed to carry. Though miners at a Base price of $43179 are 38.19% in revenue, there are not any indicators of mass promoting suggesting they could maintain are promoting in phases.

Typically, new whales and Binance merchants are actively out there shopping for whereas previous whales proceed to carry their positions.

This mix signifies a possible for additional worth will increase and an indication of total market maturity.

What BTC charts point out

Undoubtedly, though BTC is experiencing a bearish market sentiment, the prevailing situations may set the crypto for large features.

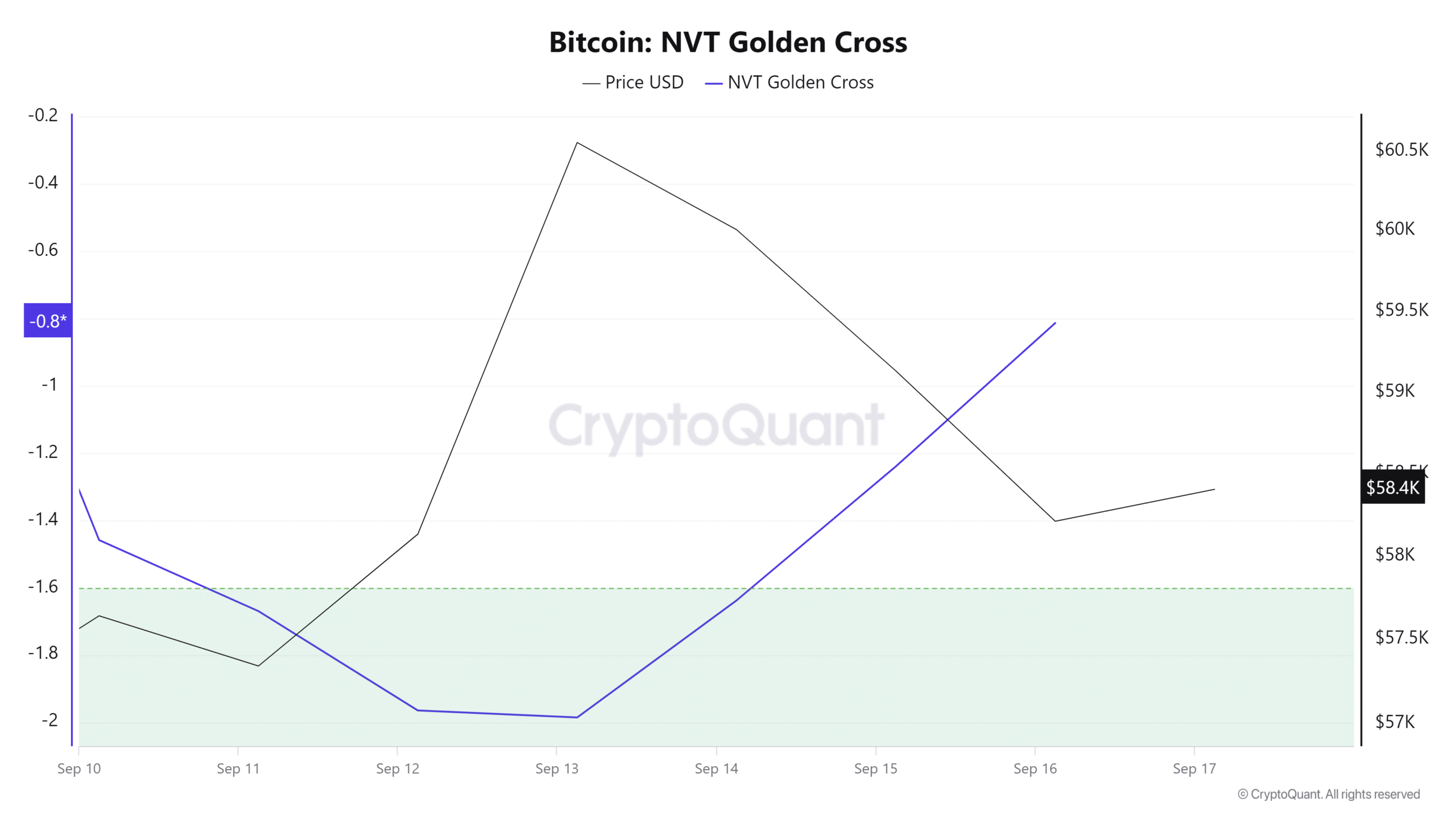

Supply: CryptoQuant

For starters, the NVT Golden Cross has skilled a powerful upswing over the previous week. An NVT golden cross indicated that the 50-day transferring common of NVT has crossed above lengthy long-term (200-day MA).

This was an indication that costs have been more likely to enter a bullish part because the market cap rises in relation to the community’s transaction quantity.

Thus, traders gave the impression to be anticipating additional worth appreciation based mostly on community fundamentals and market sentiment.

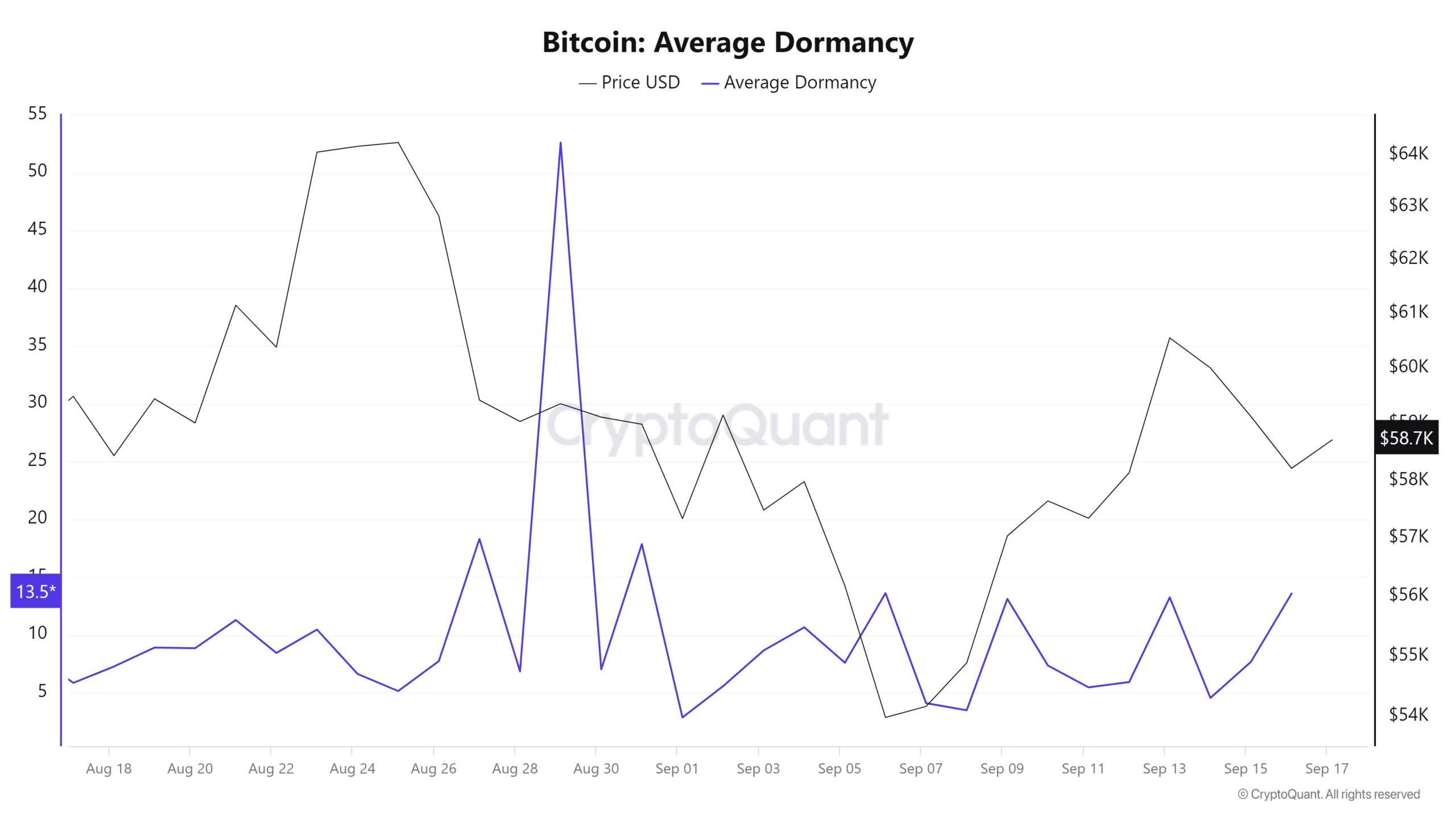

Supply: CryptoQuant

Moreover, Bitcoin’s Common Dormancy has been declining for the reason that twenty ninth of August, from 52.89 to 13.5 at press time.

A decline in common dormancy recommended that long-term holders are usually not promoting their property, though time period holders are promoting.

This confirmed that the market was within the accumulation part as short-term holders offered to long-term, holders as they anticipated costs to understand sooner or later.

This was one other bullish sign, as long-term holder’s accumulation recommended confidence within the asset’s future worth.

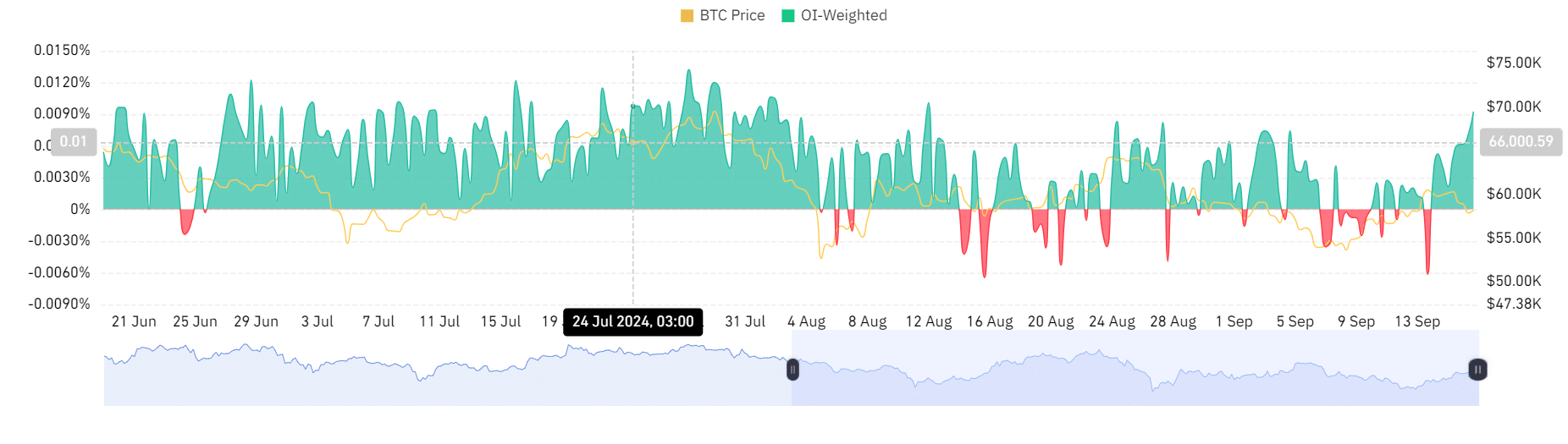

Supply: Coinglass

This demand for BTC’s lengthy positions was additional supported by a optimistic OI-weighted funding price.

A optimistic Open Curiosity Weighted Funding Charge indicated that the market had a better demand for lengthy positions than shorts.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Due to this fact, as famous by CryptoQuant analysts, Bitcoin was having fun with elevated market favorability amongst long-term holders.

This was a optimistic market sentiment as they anticipated additional worth features. Thus, if this optimistic sentiment is maintained, BTC will get away of the $61182 resistance degree that has confirmed cussed.