- Bitcoin buying and selling at $67K, above the Spot ETFs common value.

- BTC’s Open Curiosity was at its highest since 2020.

Bitcoin [BTC] has as soon as once more surged above $67K, drawing the eye of merchants and establishments to key help ranges that might play a vital function within the ongoing bull rally.

One such stage is the typical value of Bitcoin Spot ETFs, excluding Grayscale’s (GBTC). All through 2024, this value stage has emerged as a major help, offering stability throughout unstable intervals.

Regardless of minor dips, Bitcoin has constantly rebounded, underscoring the resilience of Spot ETF buyers who’ve maintained their positions even throughout market corrections.

The $57K stage, representing the typical value of Bitcoin Spot ETFs, has confirmed to be a vital help all year long.

Supply: CryptoQuant

It has solely been examined twice—throughout the sell-off on the fifth of August and the sharp correction on the sixth of September. Nevertheless, as an alternative of panic promoting, Spot ETF buyers held their floor, with solely minor outflows.

This demonstrated a powerful perception in Bitcoin’s long-term potential, as buyers confirmed no indicators of capitulating regardless of short-term unrealized losses.

BTC Spot ETFs inflows and OI

This resilience has helped solidify the $57K stage as a basis for the continued bull rally, with the rise of Bitcoin Spot ETFs offering a regulated entry level for institutional buyers, boosting confidence available in the market.

This integration of conventional monetary merchandise with Bitcoin has opened the door to wider adoption.

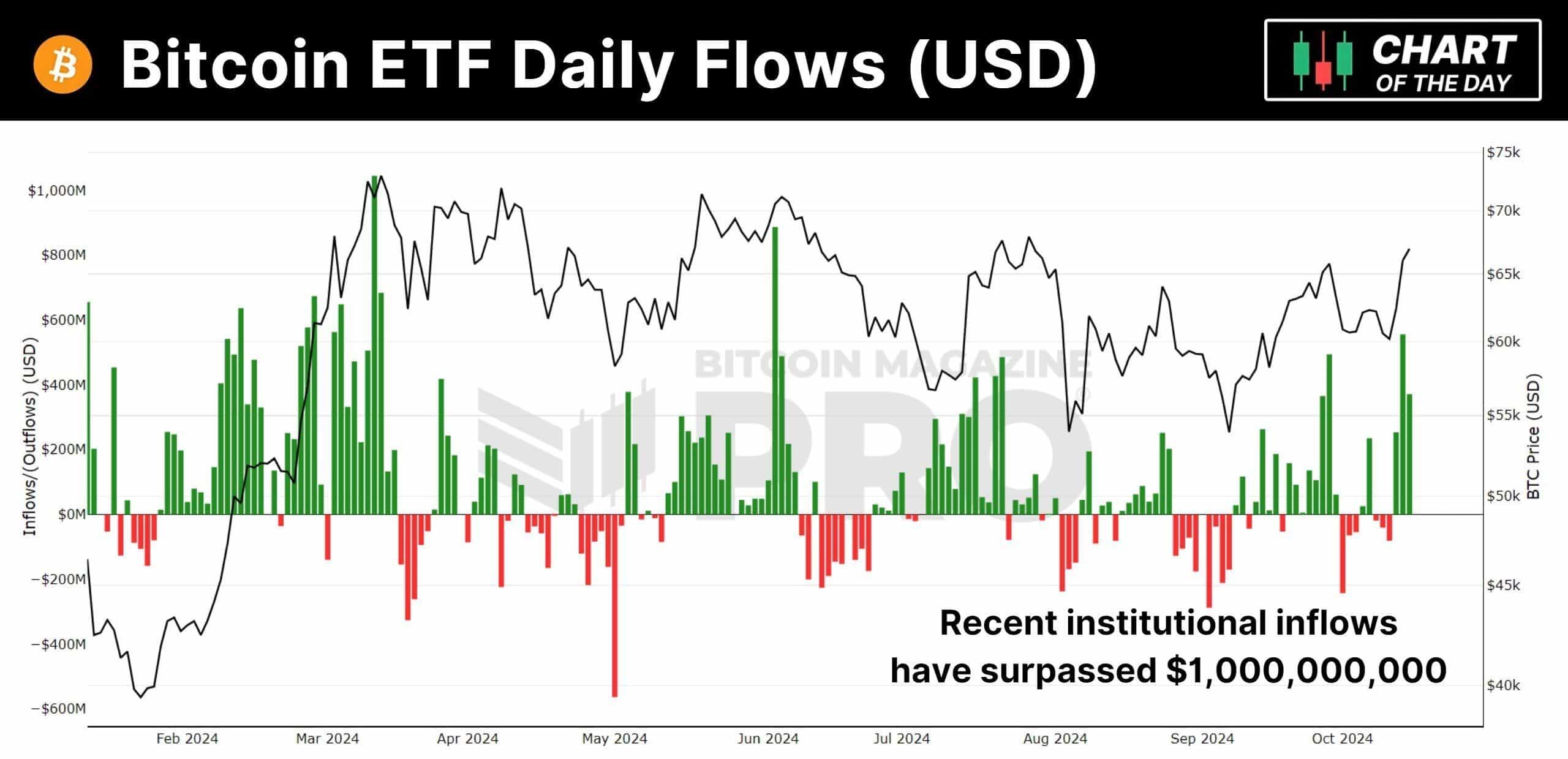

Within the final three buying and selling days alone, Bitcoin ETFs have seen inflows exceeding $1 billion, indicating that institutional buyers are accumulating BTC at an unprecedented fee.

Supply: Bitcoin Journal PRO

Along with the rising affect of Spot ETFs, Open Curiosity (OI) in Bitcoin Futures is reaching new heights, significantly on Binance, the place OI has surged to $40 billion.

This mirrored continued bullish sentiment amongst merchants, who remained keen to purchase regardless of the value enhance. This surge in demand may scale back the obtainable provide, fueling BTC costs to go larger.

Futures OI on different exchanges, corresponding to Bybit and OKX, has additionally reached peak ranges, additional supporting the concept Bitcoin is prone to maintain above the $57K stage throughout this bull run.

Supply: IntoTheCryptoverse

Whale transactions

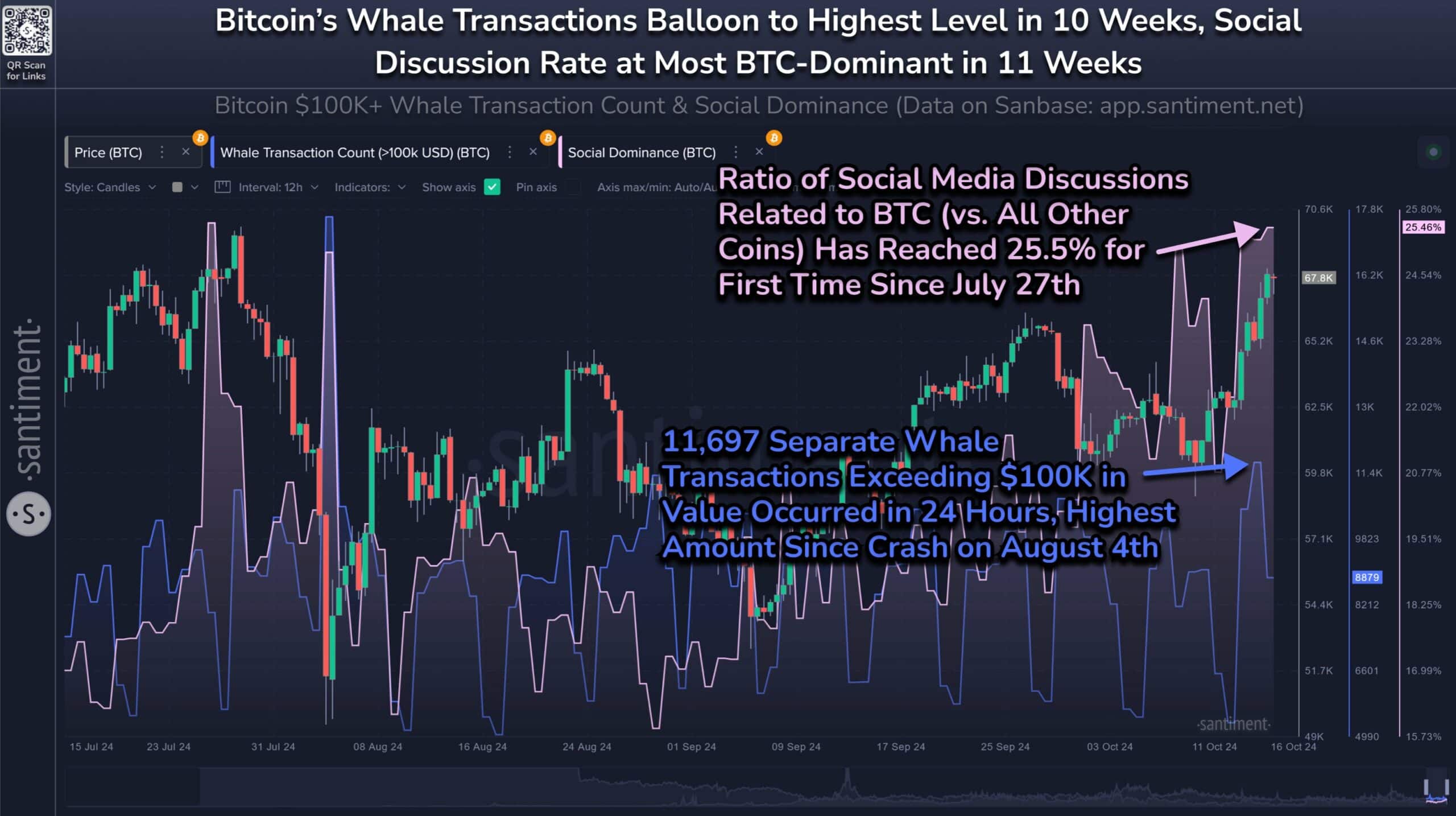

One other key issue supporting the $57K help stage is the current spike in whale transactions. Over the previous 10 weeks, whale transfers of $100K or extra have surged, with 11,697 such transactions recorded.

This heightened exercise suggests that enormous buyers are actively accumulating Bitcoin, including extra confidence to the market’s upward trajectory.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Furthermore, Bitcoin has dominated social media discussions, accounting for over 1 / 4 of all crypto-related conversations.

Supply: Santiment

Whereas the value may even see short-term corrections, mid- and long-term metrics stay bullish, reinforcing the probability that BTC will keep its place above the $57K help stage within the present rally.