- Bitcoin has registered a powerful uptrend these days, with analysts eyeing a parabolic rally to $276,400

- Final 24 hours noticed BTC hike by 2.08% on the charts

After weeks of sideways motion and even consolidation on the value charts, the legislation few days lastly noticed Bitcoin [BTC] unfold its wings. Actually, the cryptocurrency’s bullish rally pushed the cryptocurrency to as excessive as $105k for the primary time in 2025.

On the time of writing, nonetheless, BTC had retraced considerably, with the cryptocurrency down to only over $103k.

Even so, its price declaring that its newest worth pump allowed Bitcoin to interrupt out of a cup and deal with sample – Highlighting potential for sturdy upside. For sure, with one other breakout probably rising, analysts are actually left eyeing extra positive factors.

Supply: Ali on X

Actually, crypto analysts like Ali Martinez are hypothesising {that a} rally to $276,400 could also be so as in 2025.

Merely put, though the market has seen pessimism after a chronic consolidation, this sudden upswing is an indication that rallies can emerge even when some individuals flip bearish.

How bear zones construct sturdy Bitcoin rallies

In response to CryptoQuant, sturdy Bitcoin rallies can emerge from bear zones if market individuals are affected person sufficient. This was seen over the previous week too, at a time when BTC dropped under $90k on the charts.

Supply: Cryptoquant

As per this evaluation, after we take a look at Bitcoin’s pullbacks, an enchanting sample emerges. When the market dips into the bear zones, and buyers lose hope, the market sees a rebound.

Thus, persistence is a powerful alternative for buyers. Traditionally, after quiet durations, Bitcoin tends to register a powerful upswing on the charts. Due to this fact, after each main pullback, the market pauses, takes a breath, after which enters a stronger uptrend.

Whereas purple zones would possibly initially discourage buyers, historic patterns revealed that the rebounds from these ranges are sometimes much more spectacular.

What do BTC’s charts say?

Whereas the evaluation supplied above presents us a promising outlook, it’s important to find out what different market indicators counsel too.

In response to AMBCrypto’s evaluation, Bitcoin is at present in a bullish part with bulls having market management.

Supply: Cryptoquant

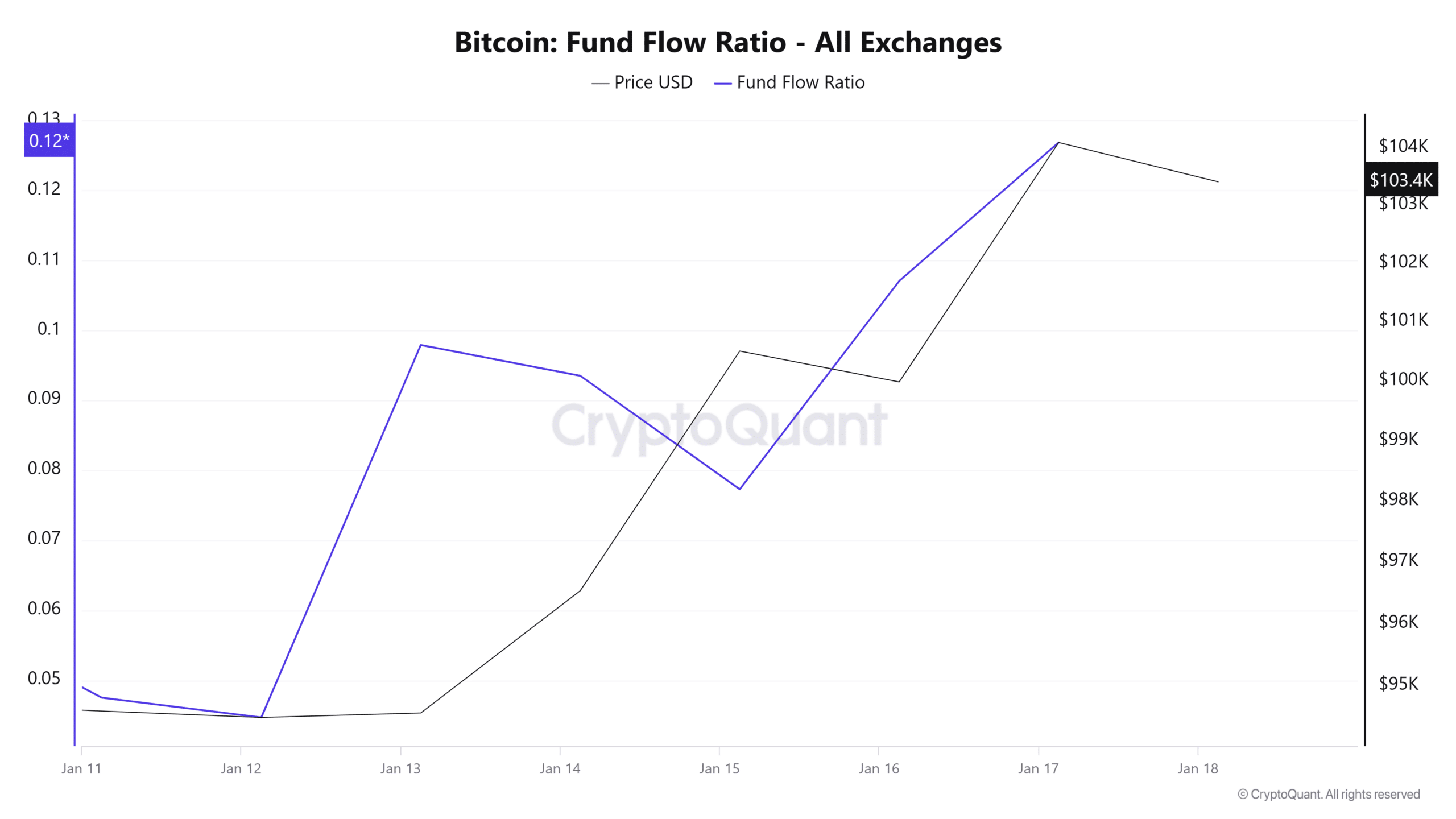

For instance, Bitcoin’s fund circulate ratio spiked over the previous week to 0.12.

When this rises, it indicators a surge in capital inflows into BTC as buyers purchase extra tokens. This may be seen as an indication of higher shopping for stress and accumulation traits.

Supply: CryptoqQuant

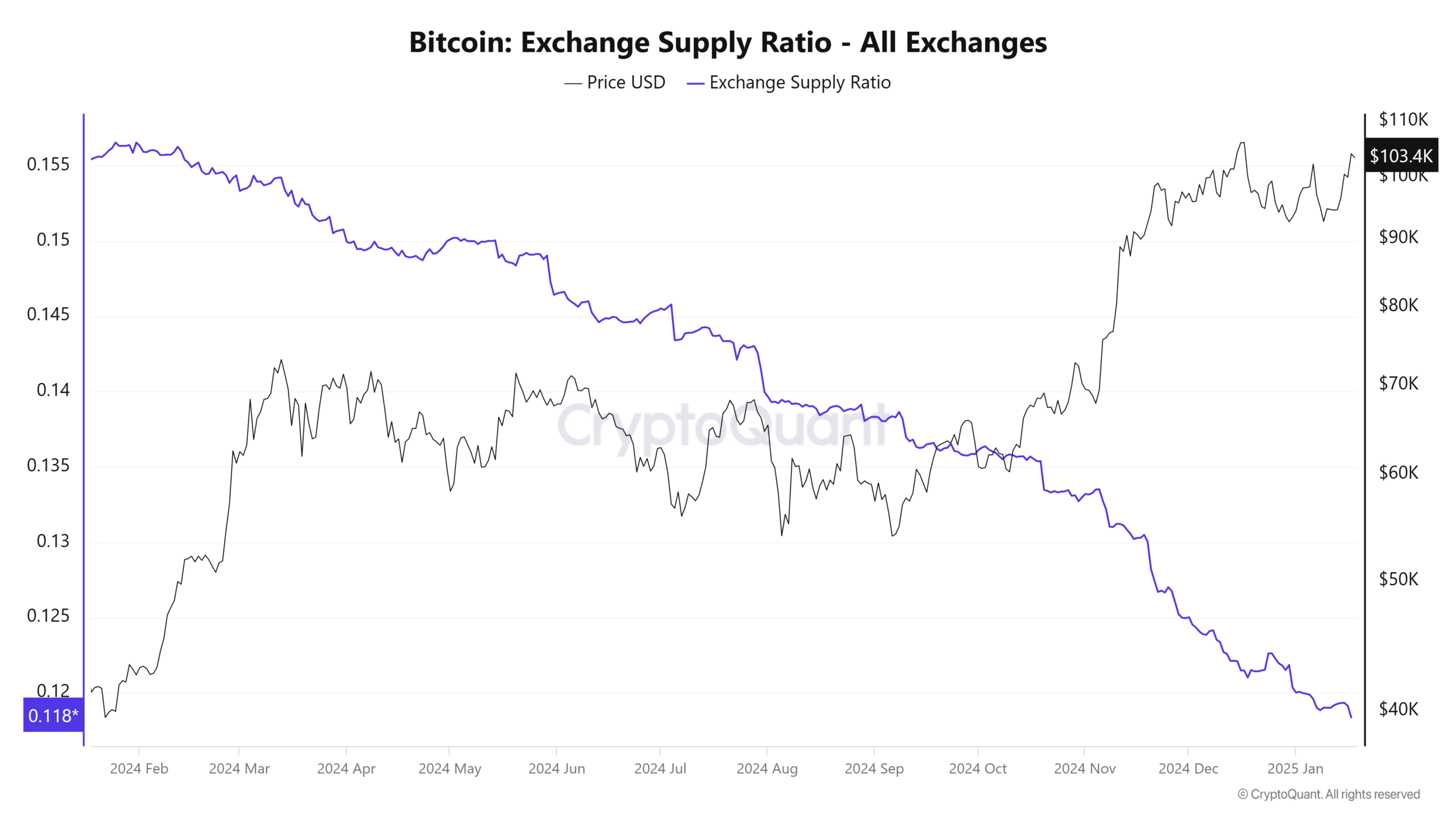

Moreover, Bitcoin’s Trade provide ratio has declined to hit a yearly low – An indication that buyers are preserving their BTC off exchanges.

Supply: Cryptoquant

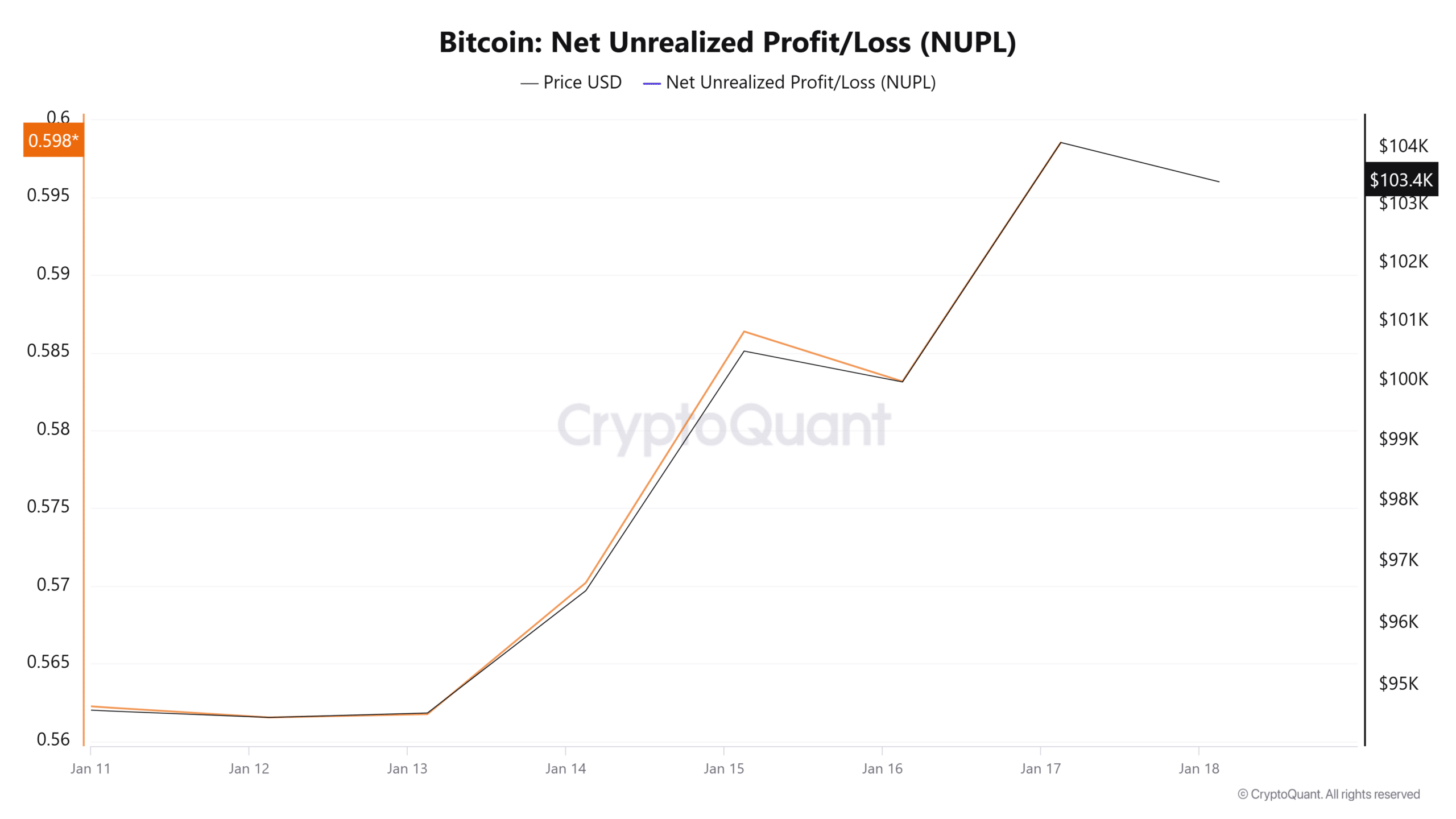

Lastly, Bitcoin’s NUPL has spiked over the previous week to hit 0.59.

Traditionally, NUPL values between 0.5 and 0.6 are seen in the course of the center phases of bull markets, proper earlier than a parabolic worth rally.

How far can Bitcoin go?

Merely put, the dip witnessed earlier this week has strengthened BTC for a possible parabolic rally as buyers purchased the dip. Accompanied by optimistic sentiment and optimism, Bitcoin could also be well-positioned for extra positive factors now.

Due to this fact, if these market circumstances proceed to carry, Bitcoin will reclaim $108k and hit a brand new ATH within the close to time period. Due to this fact, a rally previous $200k, as predicted by Martinez, could also be far-fetched within the quick time period. Nonetheless, it’s possible in the long run.