- Binance’s stablecoin dominance dropped from over 16% to ~13%, reflecting a redistribution of dealer capital.

- BTC liquidity circumstances might shift if stablecoin inflows to Binance don’t rebound within the coming days.

As market contributors hunt for indicators of Bitcoin’s [BTC] subsequent large transfer, a delicate however important shift is going on beneath the floor: Binance’s stablecoin dominance is declining.

Given Binance’s huge function in world crypto liquidity, the implications might stretch far past the trade itself.

Let’s break down what the info says.

Binance stablecoin reserves decline

Based on CryptoQuant’s 100% stacked chart of stablecoin reserves by trade, Binance’s maintain over the full reserve pie has visibly shrunk since January 2025.

At its peak, Binance accounted for over 60% of stablecoin reserves throughout centralized exchanges. Nonetheless, that determine has now dipped nearer to the 50% mark.

Supply: CryptoQuant

This decline is going on whilst BTC trades within the $85K–$95K vary, and different exchanges, most notably Coinbase and Kraken, have seen a relative improve of their share of reserves.

In principle, a falling Binance reserve dominance might indicate both a redistribution of dealer capital to different platforms or decreased stablecoin inflows to Binance itself.

Such a development might cut back the trade’s short-term liquidity depth, weakening its potential to soak up purchase/promote strain, particularly if BTC volatility spikes.

Lack of dominance momentum

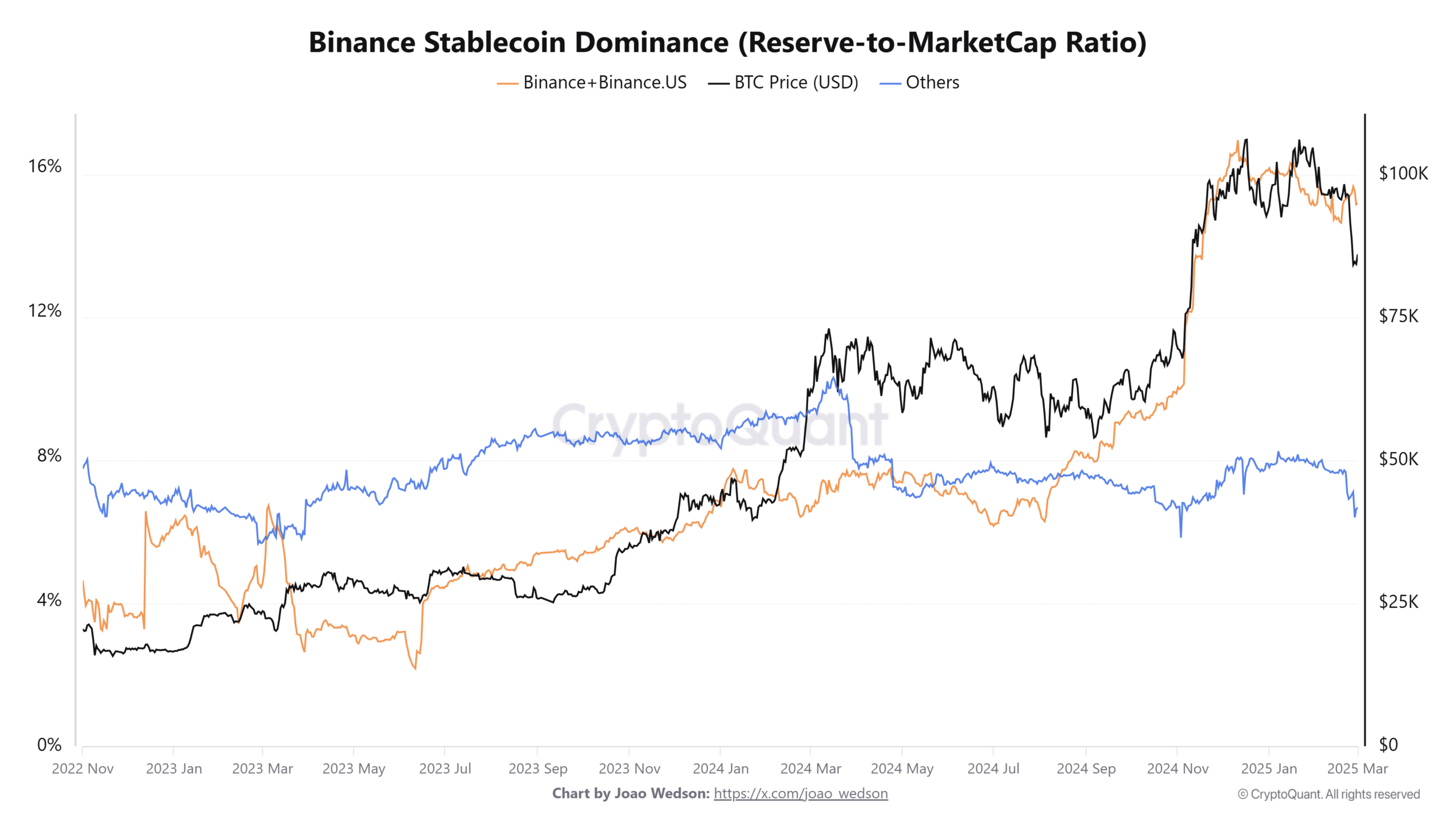

Binance’s stablecoin dominance relative to total market cap reveals even sharper developments. At first of 2024, the reserve-to-market cap ratio for Binance and Binance.US was round 8%.

This metric steadily climbed to over 16% by late 2024 however has since slipped again to round 13%.

Supply: CryptoQuant

The chart additionally reveals a transparent inverse correlation between Binance dominance and the broader participation of different exchanges. As Binance’s dominance fell not too long ago, the “Others” class confirmed a gentle upward development.

This could possibly be interpreted as capital diversifying into a number of venues reasonably than concentrating on one trade.

Traditionally, a excessive reserve-to-market cap ratio at Binance tends to precede or accompany sturdy BTC rallies as customers put together to deploy stablecoins into the market.

Conversely, a decline might sign warning, suggesting that customers are holding again or distributing capital elsewhere.

What this implies for BTC value motion

Binance’s declining dominance doesn’t assure a market downturn however hints at a key behavioral shift.

With fewer stablecoins parked on the most important trade, the market might see decrease buy-side strain from retail and whales alike.

For BTC to interrupt previous its $95K ceiling convincingly, renewed inflows throughout exchanges, particularly Binance, will probably be required. Till then, cautious optimism could be the theme of the week.