Picture supply: Getty Photographs

AstraZeneca (LSE:AZN) isn’t your typical development inventory. It’s the most important firm listed on the FTSE 100 however it’s additionally a agency that has grand plans to virtually double gross sales over the following 5 years.

Nonetheless, the inventory fell on Thursday 25 July after the corporate launched its H1 outcomes, regardless of the science-led biopharma big elevating its steering.

Let’s discover why.

Sturdy outcomes, fearful market

Whereas traders in biotech and pharma have been very eager on fat-fighting medicine lately, AstraZeneca is constant to generate very spectacular development from its oncology-focused portfolio.

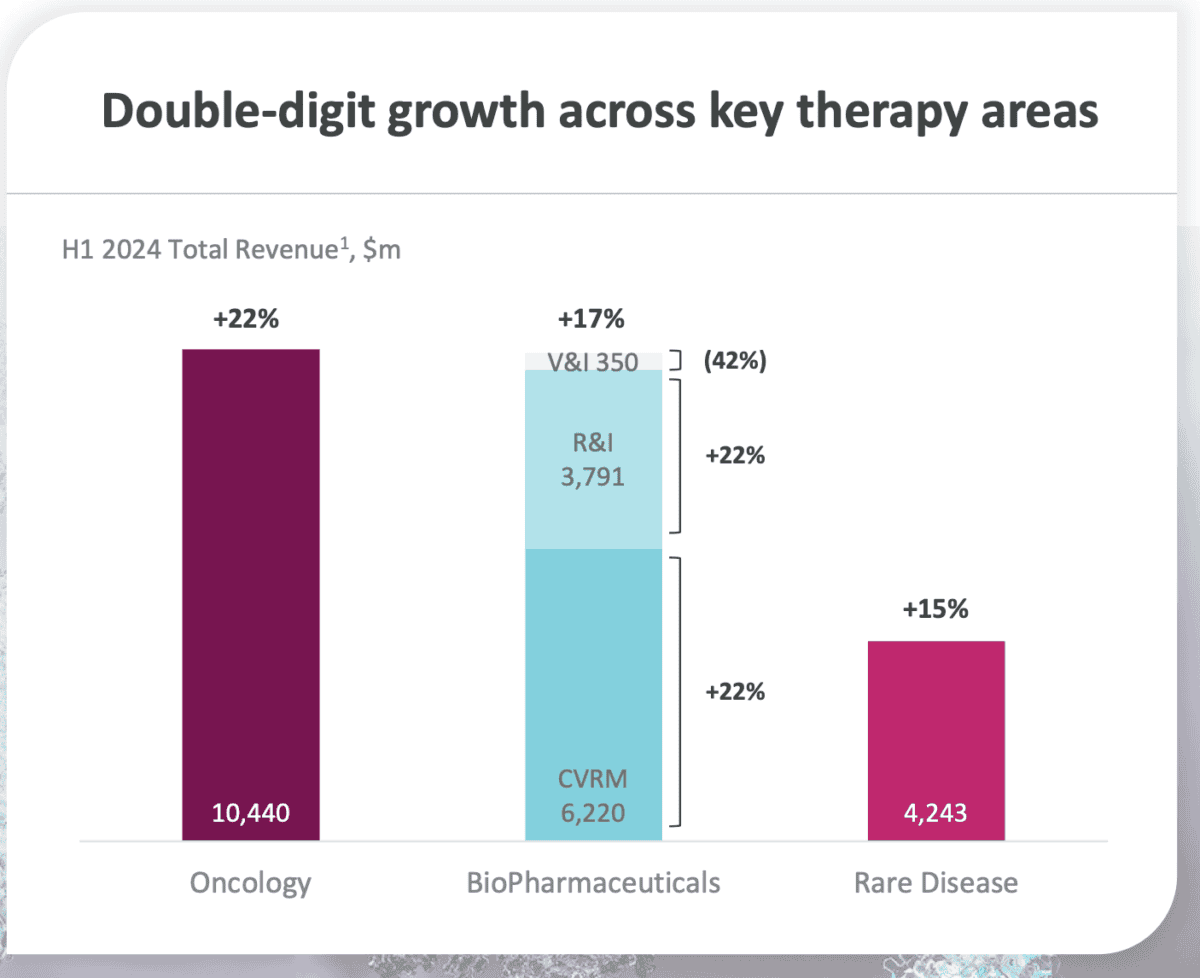

In H1, the corporate’s income rose to $24.6bn, with $12.9bn within the second quarter, pushed by a 22% rise in oncology.

Biopharma, which incorporates CVRM (Cardiovascular, Renal and Metabolism) and R&I (Respiratory & Immunology), noticed revenues enhance by 17%, and gross sales from its uncommon illness unit rose 15%.

Regardless of the optimistic income development, AstraZeneca’s shares fell practically 4% on the day of the announcement.

This decline could be partially attributed to higher-than-expected prices, which led to decrease web earnings margins that fell to 17.2% from 19% in Q1.

The market’s response most likely additionally displays the present bearish sentiment within the equities market as a complete, the place even sturdy earnings studies are scrutinised for any indicators of weak point.

Nonetheless, AstraZeneca has upgraded its full-year steering. It’s now anticipating each complete income and core earnings per share (EPS) to extend by a mid-teens share at fixed alternate charges.

Critical development plans

Within the H1 report, the corporate pointed to a few of its pipeline and new commercialisation developments which can be set to push income greater within the years to the top of the last decade.

In Might, the corporate set out its plan to attain $80bn in income by 2030, a major leap from the $45.8bn reported in 2023.

This shall be pushed by 20 new medicines. CEO Pascal Soriot believes every of those new medicine or new molecular entities can ship greater than $5bn yearly in peak-year revenues.

What does all this imply?

AstraZeneca is among the many costliest corporations on the FTSE 100. It at the moment trades round 28.4 instances ahead earnings, placing it at a major premium to the index common — round 12 instances.

Nonetheless, we pay a premium for development. And the corporate’s price-to-earnings (P/E) ratio falls to 23.3 instances in 2025 and 20.4 instances in 2026. Bear in mind, that is based mostly on the present worth of the inventory.

If AstraZeneca is ready to ship on its income era targets, then this degree of earnings development is more likely to proceed. Briefly, we may very well be one of many quickest rising shares on the index when it comes to earnings.

Buyers, nevertheless, must determine whether or not they’re keen to pay a premium for that development. And with the inventory getting cheaper, that call might have turn into barely simpler.

I already maintain AstraZeneca shares in my pension, however I’m actually contemplating shopping for extra.