Picture supply: Getty Photos

There’s no such factor as a assured dividend earnings. As we noticed in the course of the pandemic, even probably the most dependable of dividend shares can cut back, postpone, or cancel shareholder payouts when crises come alongside.

Nevertheless, there are steps we as traders can take to cut back the chance of dividend disappointments. Such ways could also be particularly necessary right this moment as contemporary knowledge reveals British dividends falling once more.

Right here, I’ll present you ways I can shield myself, and talk about a prime dividend inventory I’d purchase if I had money readily available to take a position.

Q3 dividends lowest since 2020

Earlier than I do, let’s take a look at that gloomy UK dividend knowledge from the third quarter. In accordance with Computershare, payouts from British firms slumped 8.1% on a headline foundation to £25.6bn. Excluding particular dividends, the entire was down 3.5% at fixed currencies.

As a consequence, the July-August interval was the worst third quarter for dividends since 2020, when firms scrambled to save lots of money following the Covid-19 outbreak.

Computershare mentioned: “The decline reflected steep cuts in the mining sector in particular” whereas “a stronger pound; unusually low, one-off special dividends; and large share buyback programmes” additionally hampered investor payout at headline stage.

Taking precautions

Traders can’t completely shield themselves in opposition to falling dividends. Hardly anybody predicted that Shell — which hadn’t minimize dividends since World Warfare Two — would cut back payouts earlier than the pandemic, to quote a well-known instance.

However we are able to increase our probabilities of receiving a powerful (and hopefully rising) passive earnings by selecting firms which have:

- Market-leading positions in mature industries

- Numerous income streams, as an illustration via totally different geographies and product classes

- Aggressive benefits (corresponding to highly effective manufacturers and low value bases)

- Strong stability sheets, with low debt and reliable money flows

- Experience in defensive, recession-proof industries (corresponding to utilities and healthcare)

The excellent news is that UK traders can discover many shares that meet all or most of those standards. Defence contractor BAE Techniques (LSE:BA.) is one I’d purchase for my very own portfolio.

A prime FTSE inventory

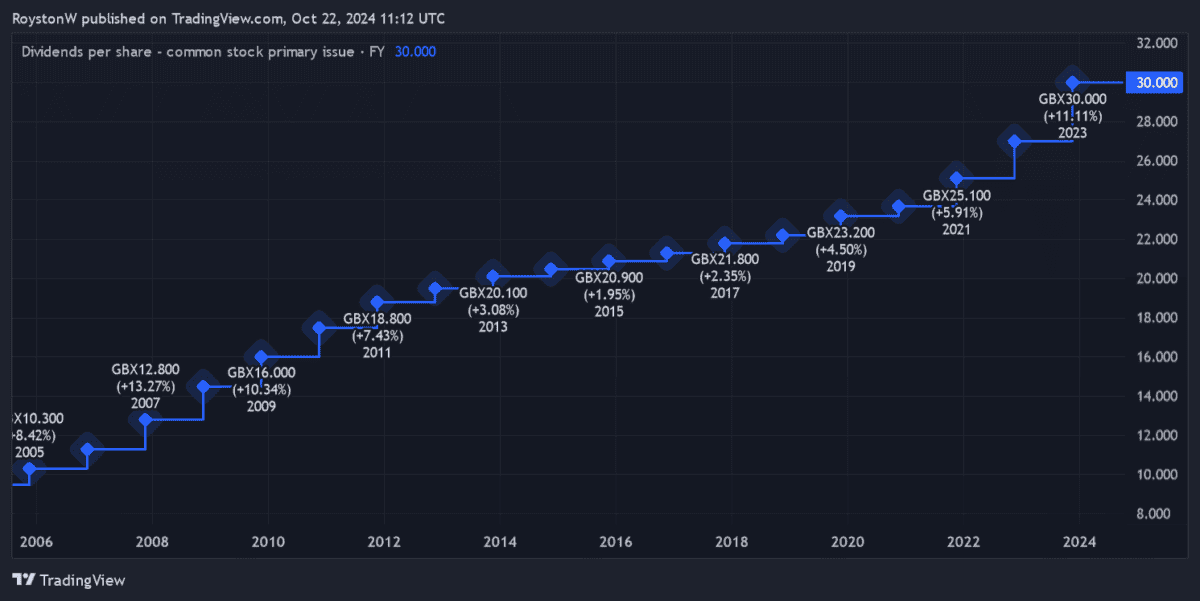

As you’ll be able to see, the FTSE 100 firm has an extended historical past of dividend progress relationship again a long time. That is due to a wide range of elements. Firstly, Western defence spending stays secure no matter financial situations. And as a crucial provider to the US and UK militaries, BAE Techniques enjoys particularly strong earnings visibility.

The enterprise additionally manufactures a wide range of applied sciences for land, air and sea. So long-term revenues proceed to develop at the same time as the character of warfare evolves over time.

Lastly, main defence contractors like this take pleasure in formidable obstacles to entry, due to points like safety and experience. This, in flip, reduces the aggressive risks they face.

BAE Techniques isn’t with out threat. Provide chain disruption, as an illustration, is affecting the complete aerospace trade.

But Metropolis analysts don’t suppose this can derail the agency’s progressive payout coverage, as proven within the desk under:

| Yr | Dividend per share | Dividend progress | Dividend yield |

|---|---|---|---|

| 2024 | 32.3p | 8% | 2.4% |

| 2025 | 35.4p | 10% | 2.6% |

| 2026 | 38.8p | 10% | 2.9% |

As international defence spending spikes, BAE Techniques could also be among the best dividend progress shares to think about right this moment.