Picture supply: Getty Photos

The time to purchase shares is once they commerce at low cost costs. And with US tariffs shaking shares on each side of the Atlantic, I believe there are some nice-looking alternatives for buyers for the time being.

I’ve received a watch on two shares specifically. The underlying companies are very totally different however they’ve one essential factor in widespread – the shares appear like good worth to me.

WH Smith

I believed I’d missed my likelihood on WH Smith (LSE:SMWH). I used to be trying on the inventory with curiosity initially of the 12 months, however the share worth jumped 14% on the finish of January.

Since then although, the shares have fallen again and I’ve seized the chance so as to add the inventory to my portfolio at what I believe is a cut price worth.

The factor with WH Smith is it’s truly two companies – a excessive avenue division and a journey division. The primary isn’t notably enticing, however the second is.

WH Smith has introduced plans to give attention to its journey enterprise. That is dangerous, because it’s way more weak to a recession weighing on discretionary spending – like holidays.

However I believe the choice is the precise one. The journey ops generated £189m in earnings final 12 months and will alone be well worth the present £1.4bn market cap.

If I’m proper, buyers would possibly effectively have a margin of security constructed into the present share worth. And something the corporate can get for its excessive avenue shops is a pleasant bonus.

Celebrus

Celebrus Applied sciences (LSE:CLBS) is far much less of a family identify. And it’s a really totally different kind of funding – this one is about constant development going ahead.

The inventory is definitely larger than it was initially of February. However zoom out a bit and the share worth is down 18% because the begin of the 12 months, so it’s buying and selling at a reduction to that degree.

Celebrus is a software program agency with a product that permits companies to see what clients are doing on their web site or app in real-time. And it has been rising very impressively.

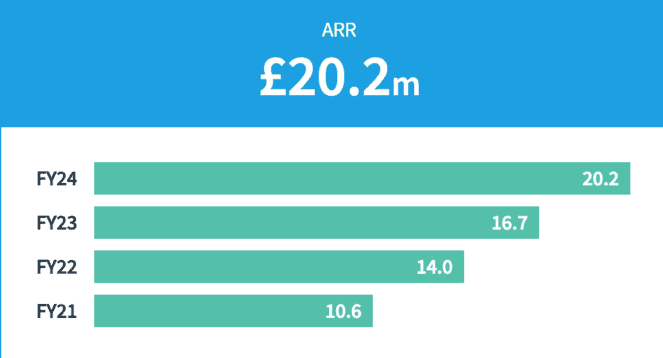

The corporate operates on a subscription mannequin and since 2021, annualised recurring revenues have been rising by at the very least 20% per 12 months. I believe that’s spectacular, however there are dangers.

Celebrus has some vital competitors and it offers away rather a lot when it comes to dimension towards a few of its rivals. That’s one thing buyers ought to be mindful.

I believe, nevertheless, that is mirrored in a price-to-sales (P/S) ratio of under 3. In comparison with CoStar Group (11), Guidewire Software program (16), or Tyler Applied sciences (13), the a number of is extremely low.

Similar… however totally different

Each WH Smith and Celebrus shares commerce at a price-to-earnings (P/E) ratio of 23. However that’s the place the similarities finish, from my perspective.

WH Smith is a well known enterprise, however I believe there’s extra to the inventory than meets the attention. And Celebrus doesn’t get a lot consideration, however I’ve been shopping for it for my portfolio.

Noise from the US and its tariff threats have created uncertainty within the inventory market. In consequence, I believe it is a nice time to be searching for potential alternatives.