- The German authorities has as soon as once more transferred a notable 1,000 BTC value $55.8 million to crypto exchanges and unmarked wallets.

- Bitcoin was bearish at press time, shifting under the 200-day EMA, with a excessive risk of hitting the $52,800 degree.

The cryptocurrency market as soon as once more turned bearish, with main property together with Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] experiencing a value drop of over 2.5%, 2.7%, and 4.5%, respectively.

Amid this ongoing market downturn, the German authorities has as soon as once more transferred a notable 1,000 BTC value $55.8 million, based on knowledge from blockchain intelligence agency Arkham.

German authorities dumps one other 1,000 BTC

In response to Arkham, out of the 1,000 BTC transferred by the German Authorities, a major 500 BTC was despatched to cryptocurrency exchanges together with Bitstamp and Coinbase, value $27.9 million.

In the meantime, one other 500 BTC value $27.9 million was transferred to an unmarked pockets handle “139PoP.”

Because the nineteenth of June, the federal government has transferred vital BTC to totally different exchanges and the identical pockets handle.

So, this unmarked pockets handle “139PoP” may belong to an establishment or an OTC companies supplier’s handle.

Impression of the dump

This steady switch of BTC by the federal government of Germany has badly impacted the cryptocurrency market.

Because the nineteenth of June, BTC has fallen by greater than 15%, dropping from the $65,200 degree to the $55,700 degree. Throughout this era BTC reached a low of $53,269 based on TradingView.

Taking a look at this steady dumping, on the 4th of July, Tron [TRX] founder Justin Solar provided to purchase all BTC holdings value $2.3 billion off-market from the German Authorities to attenuate the affect available on the market.

Nonetheless, it seems that the federal government has ignored Solar’s supply.

Based mostly on the historic knowledge, if this BTC switch continues out there, there’s a excessive risk that BTC will fall additional.

Bitcoin technical evaluation and key ranges

On-chain, Bitcoin was trying bearish because it gave a powerful breakdown of main help ranges of $58,000, retested that degree, and fashioned a powerful bearish candle under it.

Moreover this breakdown, BTC was shifting under the 200 Exponential Transferring Common (EMA) on a day by day timeframe, which signaled bearishness.

Supply: TradingView

There may be thus a excessive risk that BTC will attain the $52,800 degree, which serves as its subsequent help.

Regardless of the bearish alerts within the chart, the Relative Power Index (RSI) was in oversold territory, suggesting potential for a restoration.

Brief liquidation turns larger

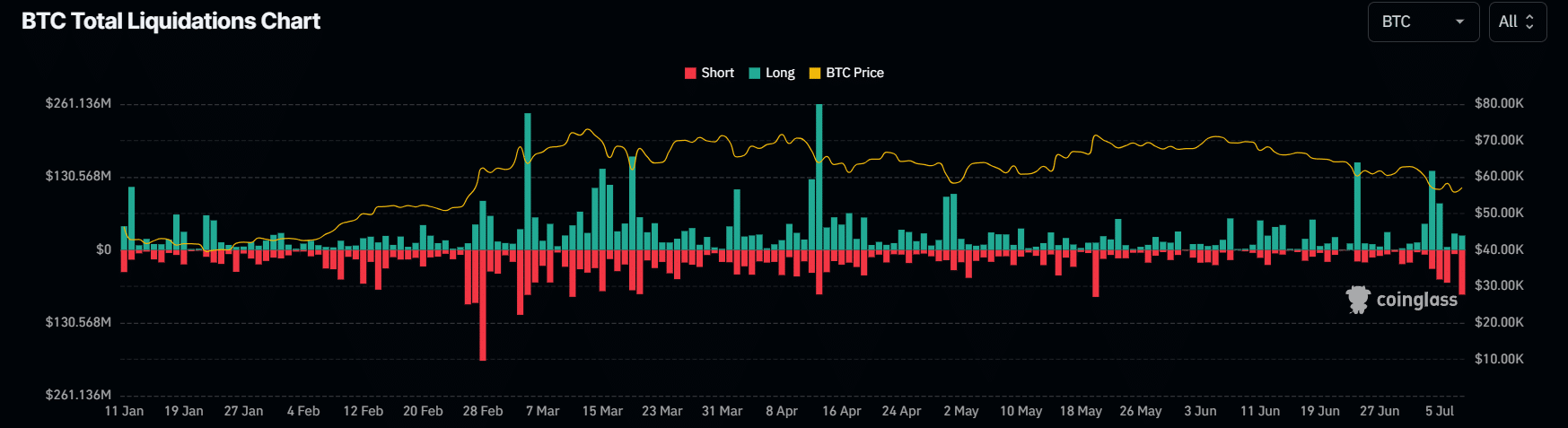

Regardless of this fall, bulls have liquidated solely $46.97 million of lengthy positions whereas quick sellers have liquidated over $86 million of quick positions, based on on-chain analytic agency Coinglass.

This larger variety of quick liquidations indicated that bulls have been nonetheless there out there. Whereas, the Open Curiosity (OI) dropped by 4.3%, signaling concern amongst market contributors.

Supply: Coinglass

Practical or not, right here’s TRX market cap in BTC’s phrases

As of this writing, BTC was buying and selling close to the $56,000 degree, having skilled a value drop of over 2.5% within the final 24 hours. Throughout this era, it additionally reached a low of $54,400 degree.

Taking a look at BTC’s efficiency over an extended interval, it has dropped by 10% within the final seven days. During the last 30 days, BTC has misplaced over 18% of its worth.