- As ETH/BTC reaches its lowest level since 2021, traders, notably from Korea and the U.S., start to build up.

- By-product merchants are additionally taking positions, putting lengthy bets on ETH.

Ethereum [ETH] has remained above the $3,000 mark for the previous month, with a 19.84% achieve. Nevertheless, over the previous week, ETH has seen a 2.15% drop.

Regardless of this, market sentiment seems to be shifting, as mirrored by a modest 0.19% uptick in current buying and selling.

AMBCrypto examines why traders are viewing this worth motion as a compelling shopping for alternative.

What the ETH/BTC pair alerts for Ethereum

The ETH/BTC pair, which displays the worth of 1 ETH when it comes to BTC, not too long ago dropped to its lowest stage since 2021, dipping beneath 0.03221, as reported by Degen Information.

Supply: X

This means that market contributors are receiving much less BTC for every ETH, as Bitcoin’s worth has surged to a lifetime excessive, now buying and selling above $97,000.

Two major interpretations might be drawn from this motion: First, Bitcoin’s rising dominance could result in liquidity flowing out of ETH and into BTC as investor confidence shifts.

Alternatively, some traders may view this as a chance to build up extra ETH, believing it’s at the moment undervalued.

Evaluation by AMBCrypto indicated that the latter situation was extra seemingly, with metrics displaying an uptick in shopping for exercise as traders benefit from ETH’s perceived worth dip.

Buyers proceed to build up

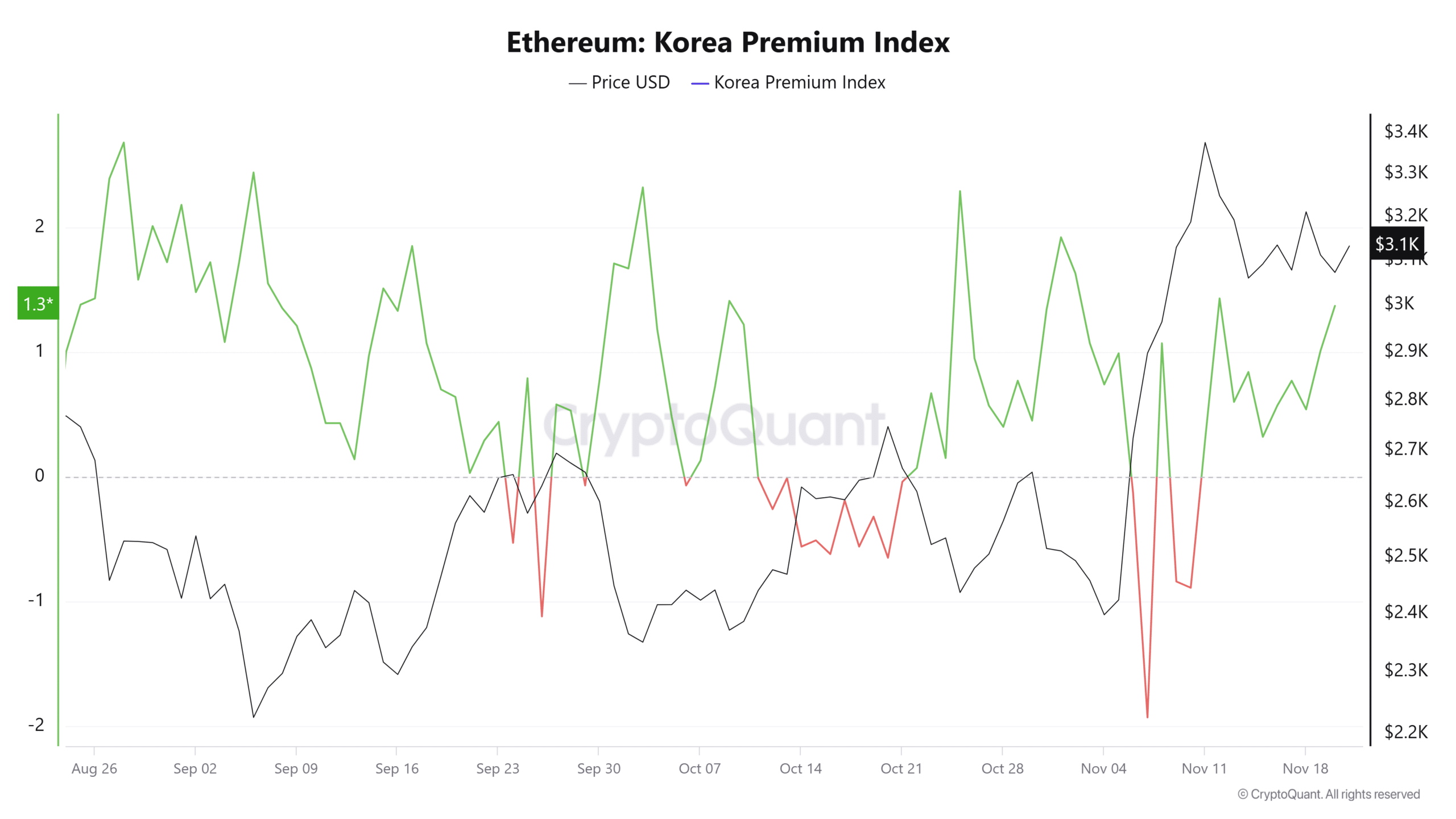

Regardless of the current drop within the ETH/BTC pair, AMBCrypto discovered that traders from each Korea and the U.S. have been actively accumulating ETH.

The Korean Premium Index and Coinbase Premium Index, which observe the value variations between Korean exchanges, Coinbase, and different platforms, present that each metrics are at the moment above 1 and 0, respectively.

This means robust shopping for stress from these investor teams.

Supply: CryptoQuant

As of writing, the Korean Premium Index is at 1.37, and the Coinbase Premium Index is at 0.0073, suggesting that these traders are rising their ETH holdings. If this development continues, it may drive the token to new highs.

Ought to the shopping for exercise persist amongst these cohorts, ETH’s modest positive factors over the previous 24 hours may see a big increase.

By-product merchants align with shopping for development

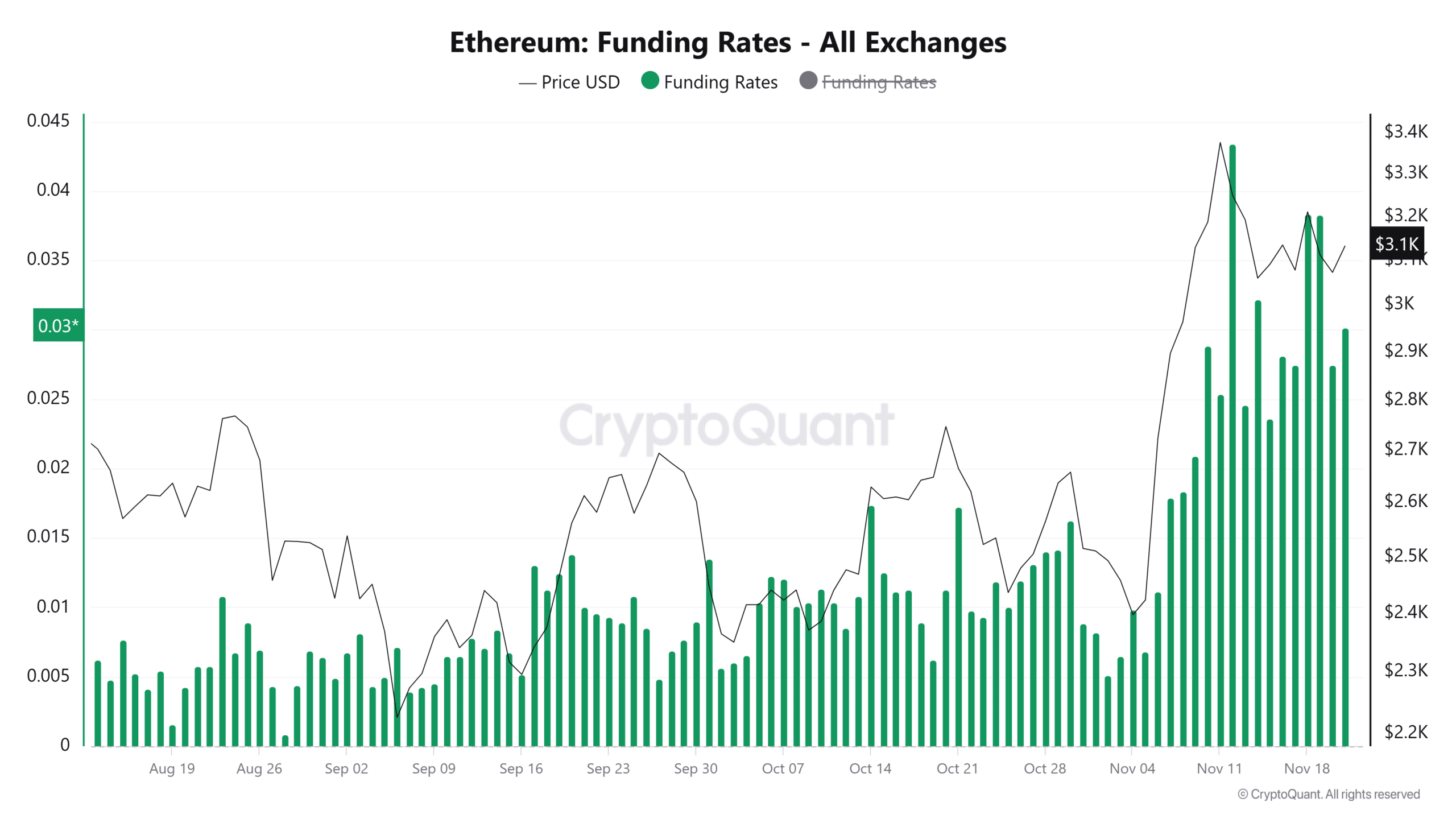

Current knowledge by CryptoQuant on spinoff merchants within the ETH market revealed shopping for traits, notably with the Funding Fee and Taker Purchase/Promote Ratio.

The Funding Fee, which displays the steadiness between lengthy and brief positions in Futures markets, favored lengthy positions at press time.

This urged a bullish outlook, with merchants anticipating ETH to rise from its present worth stage.

Supply: CryptoQuant

As well as, the Taker Purchase/Promote Ratio—measuring the amount of purchase orders versus promote orders amongst market takers—has surpassed 1 and reached its highest stage in November, exceeding the earlier peak of 1.0486.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

This indicated robust shopping for exercise and a market skewed towards upward momentum.

If these traits persist, they might drive ETH to increased ranges, additional reinforcing the bullish sentiment out there.