- The historic correlation between Bitcoin and the U.S. greenback is ready for an additional cameo this bull run.

- Bitcoin is nearing truthful worth worth as long-term holders collected extra BTC.

Value motion patterns typically repeat themselves, which aids in predicting future costs of belongings like Bitcoin [BTC] and different cryptocurrencies.

Analyzing the BTC/USD and DXY charts alongside their correlation coefficient revealed a key sample — when BTC’s month-to-month correlation with DXY shifts from constructive, it alerts a serious transfer, however the path isn’t sure.

Traditionally, this has led Bitcoin to the ultimate leg of a bull run 75% of the time or a drop throughout a bear market 25% of the time.

Supply: TradingView

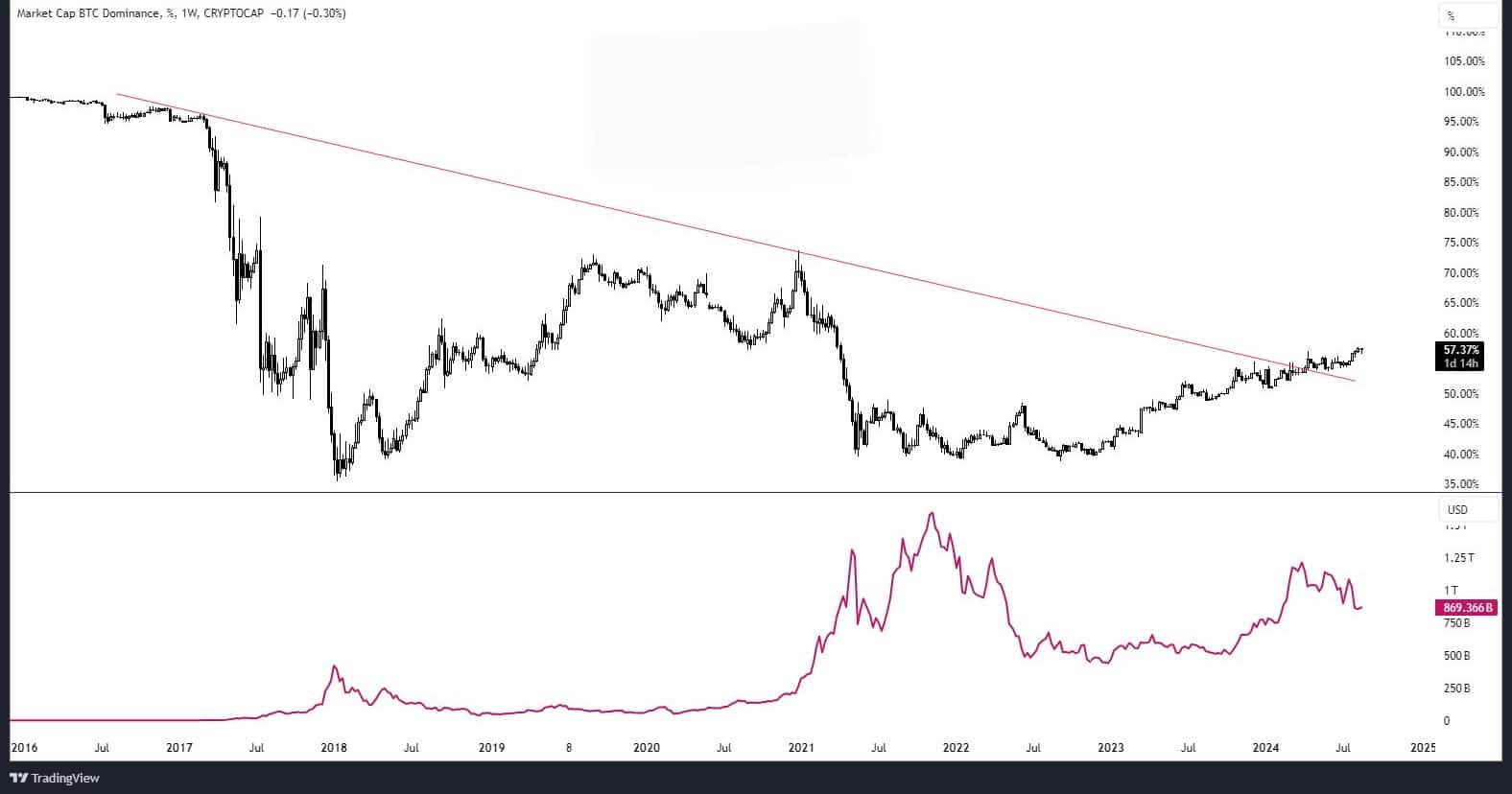

Many analysts are unsure about Bitcoin’s subsequent path, however AMBCrypto has the reply. First, Bitcoin’s weekly dominance chart has damaged out of a descending trendline, signaling potential energy.

Regardless of current worth declines, Bitcoin has reclaimed the $60K stage. In the meantime, altcoin market caps seem to have bottomed out and are actually beginning to pattern upward.

This indicated that Bitcoin and different cryptocurrencies could also be getting ready for a big upward motion.

Supply: TradingView

Nevertheless, the Spot-Perpetual Value Hole on Binance from CryptoQuant remained damaging, displaying ongoing promoting strain on Bitcoin.

This hole, pushed by aggressive liquidations and quick positions, advised that BTC worth was nearing its truthful worth. This signaled a possible alternative for buyers to purchase, indicating Bitcoin was probably heading upward.

Supply: CryptoQuant

Bitcoin’s historic danger ranges

The chart under highlights a danger stage for Bitcoin, serving to with long-term shopping for and promoting factors available in the market. AT press time, the danger stage was round 0.5, indicating low danger and a positive shopping for alternative.

Merchants and buyers can contemplate dynamic dollar-cost averaging on this area earlier than danger ranges rise, signaling the necessity to promote bigger parts.

Supply: Into The Cryptoverse

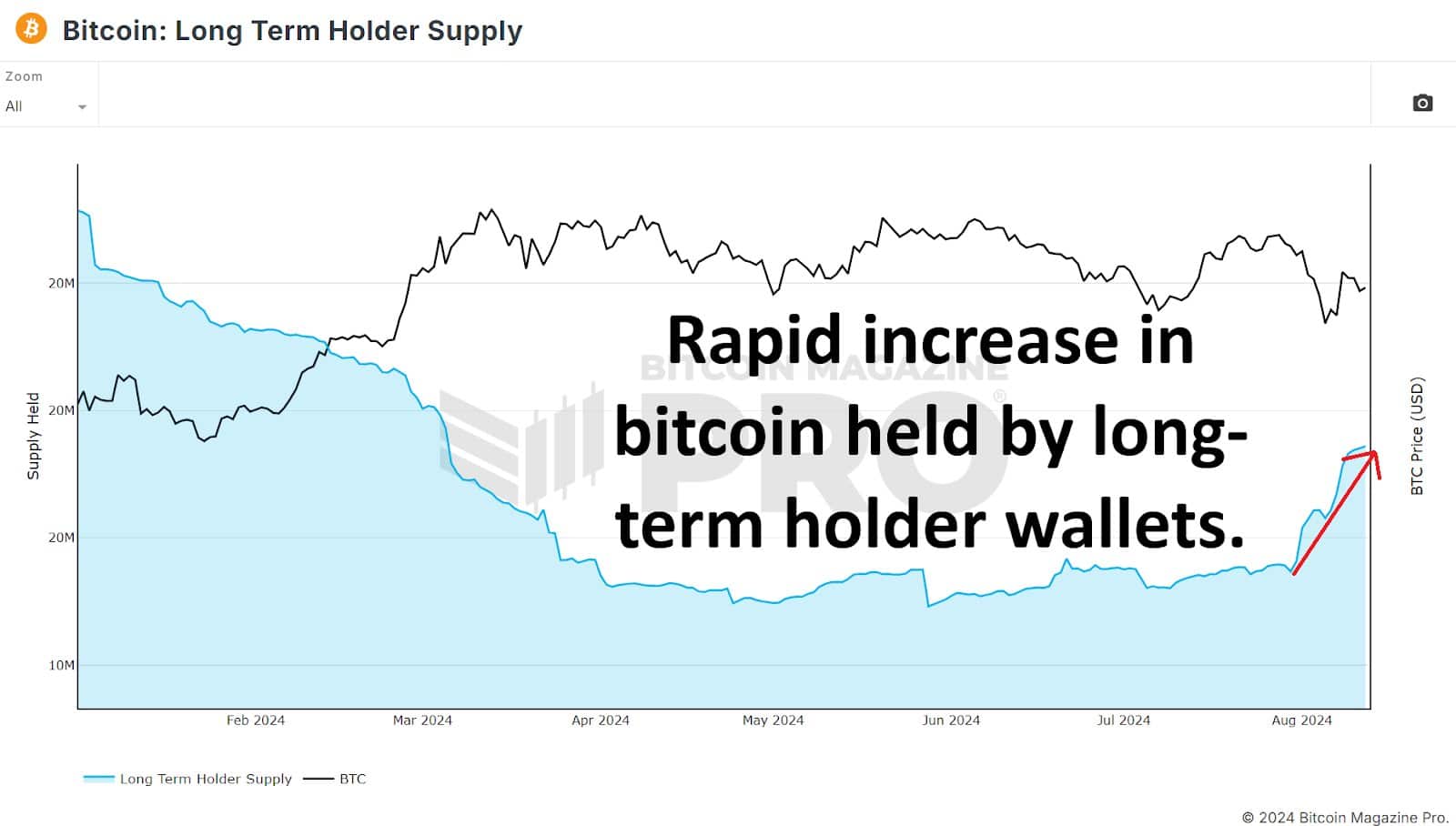

Additionally, for the reason that thirtieth of July, over 500,000 BTC have been added to long-term holder wallets, signaling a bullish pattern for Bitcoin.

This surge indicated that whales and establishments had been actively accumulating Bitcoin, reflecting rising confidence in its future worth.

Supply: Bitcoin Journal PRO

Is your portfolio inexperienced? Try the BTC Revenue Calculator

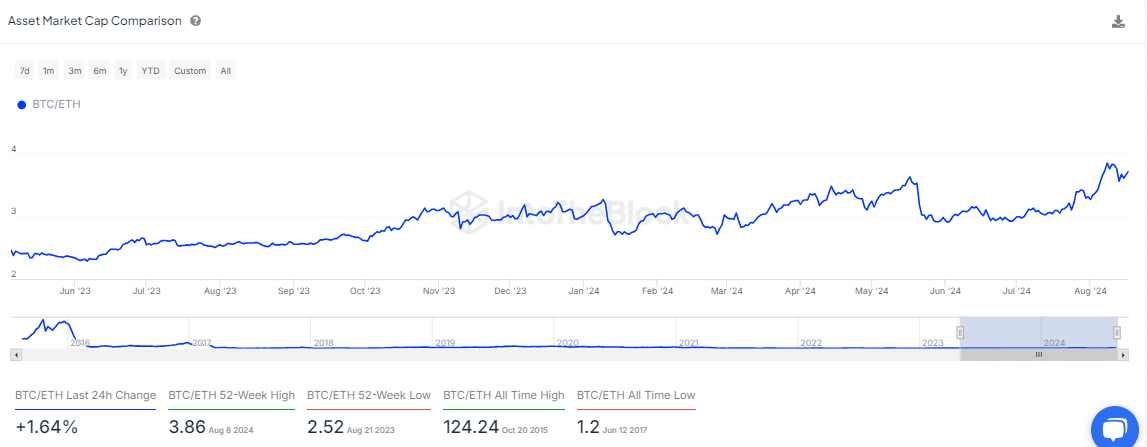

Lastly, Bitcoin gained momentum over Ethereum at press time. The BTC/ETH market cap ratio has steadily elevated in August, indicating stronger accumulation of the king coin.

This pattern advised that Bitcoin was poised for additional upward motion.

Supply: IntoTheBlock