- Bitcoin miners offloaded vital BTC after a light surge, cashing in on positive aspects.

- If the market high slips, miner capitulation may rise.

Bitcoin [BTC] miners have not too long ago offered a major chunk of their holdings, simply as mining issue hit an all-time excessive.

It is a crucial second—if miners don’t present confidence in a rebound, it may sign a looming bearish run.

Bitcoin miners are at a vital juncture

The mining neighborhood holds about 9% of Bitcoin’s whole provide and is increasing capability amid record-high mining issue.

Traditionally, miner capitulation—when Bitcoin miners exit as a result of low earnings—usually alerts native worth bottoms throughout bull markets.

The final time this occurred was on the fifth of July, when BTC fell to $56K after testing the $71K ceiling. Miners exited as a result of squeezed revenue margins, contributing to the worth backside.

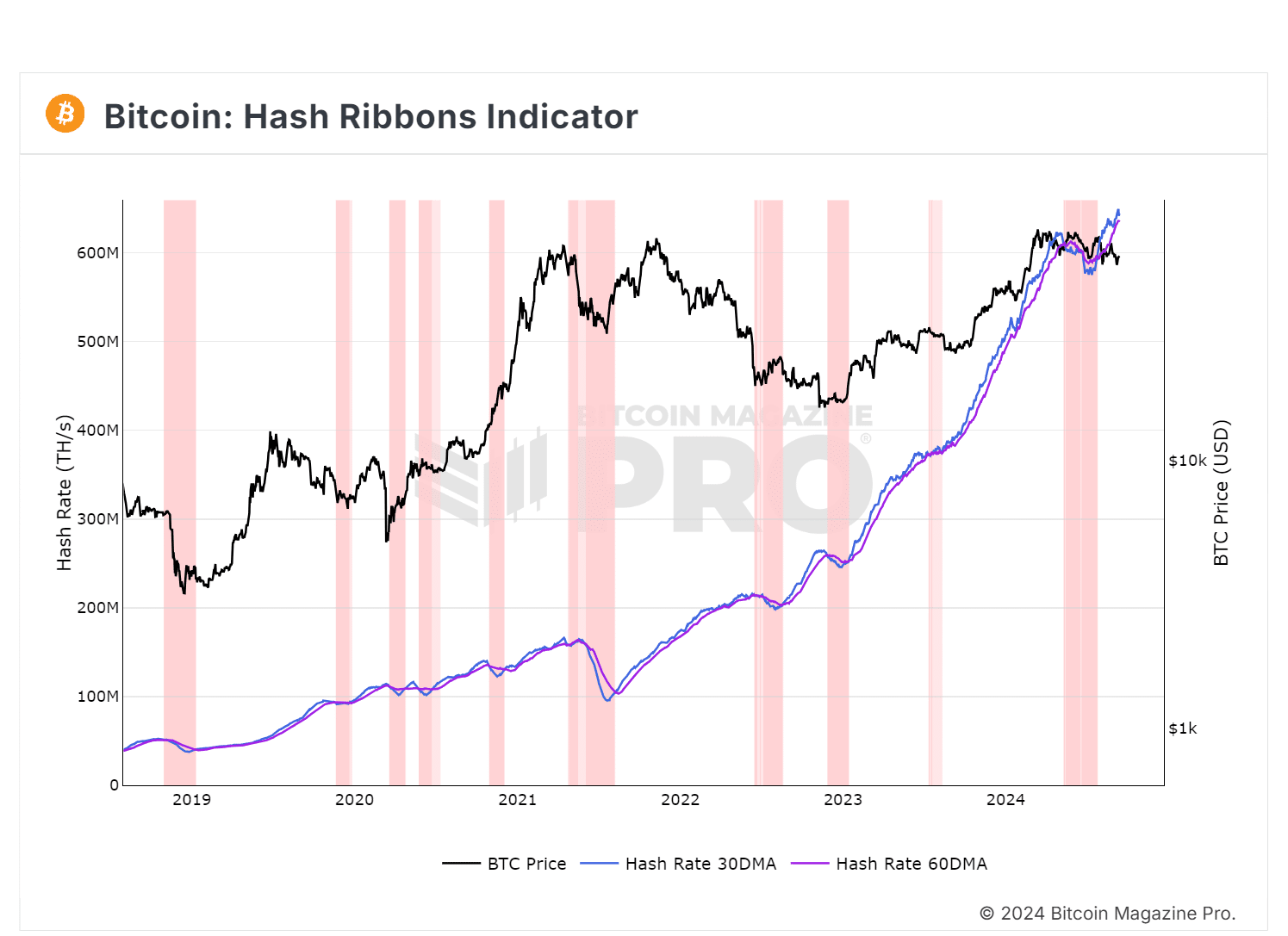

Supply : Bitcoin Journal Professional

The chart confirmed that the 30-day MA is above the 60-day MA, signaling a hash ribbon purchase sign. This advised mass miner capitulation might have ended, indicating miners are staying in regardless of volatility.

Nonetheless, a distinguished analyst famous that Bitcoin miners offered round 30K BTC after BTC briefly topped $58K, prone to lock in robust positive aspects.

Perhaps capitulation now alerts each market tops and bottoms. The hot button is to observe who capitulates first.

Falling reserves can sign market high

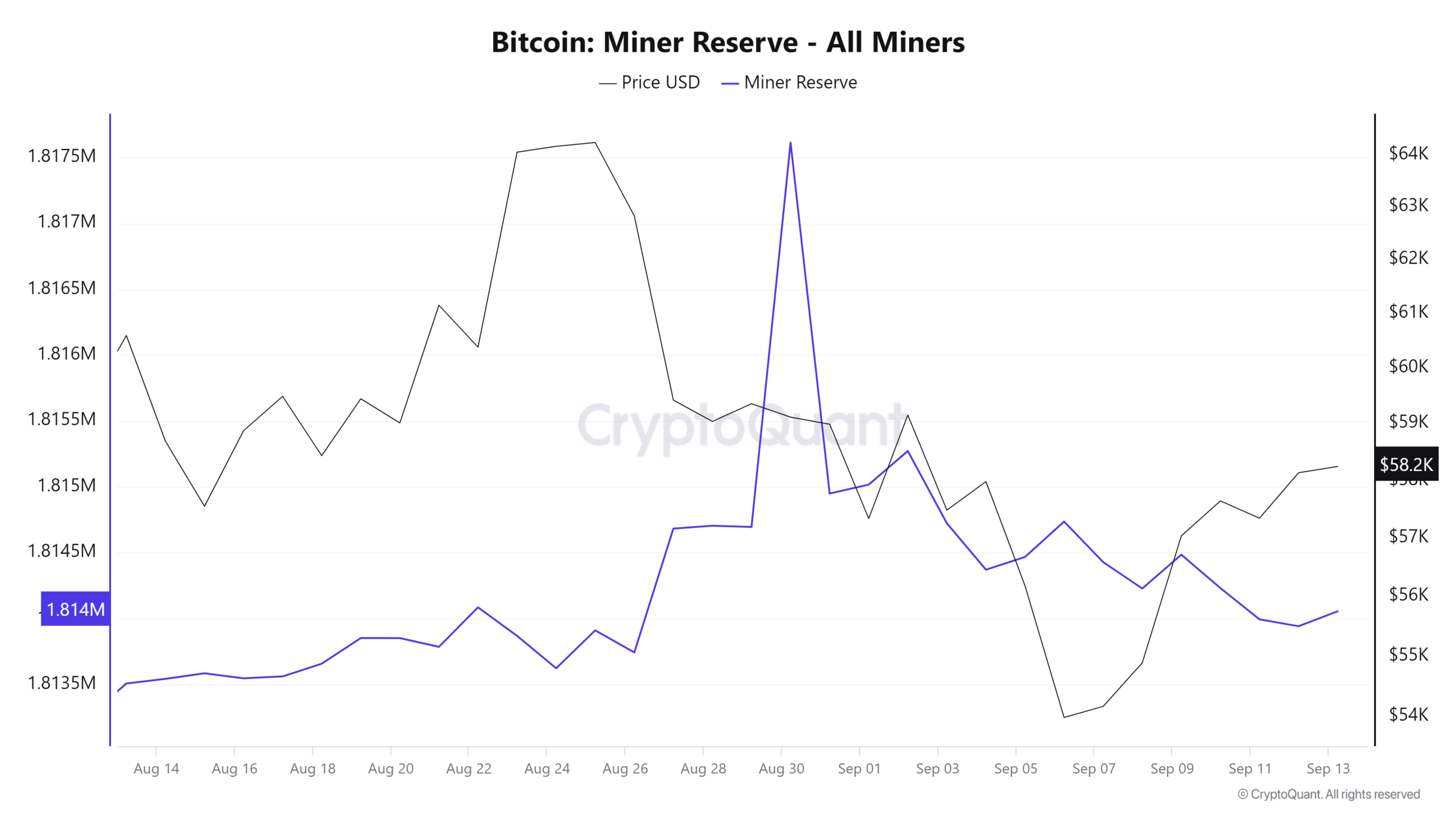

Whereas the chart above advised that miners exiting usually happens at market bottoms, AMBCrypto examined whether or not approaching a worth high may set off miner exits.

Curiously, as BTC nears $60K, Bitcoin miners are lowering their reserves, presumably to lock in earnings, reinforcing this speculation.

Supply : CryptoQuant

As mining issue hits an all-time excessive, many miners is likely to be cashing in on positive aspects to cowl their bills. This might create promoting strain as BTC approaches its subsequent market high.

Nonetheless, those that can climate the volatility might proceed to carry their Bitcoin, as indicated by the purchase sign.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The actual concern is that if BTC hits a market backside and fails to carry the $57K vary; miner capitulation may intensify.

On this situation, Bitcoin miners would possibly offload giant quantities of BTC, not as a result of low earnings however to mitigate better losses.