- The Bitcoin 2024 convention pushed BTC close to $70K but once more.

- Whales appear to have come to a standstill as bulls await BTC’s subsequent strikes with bated breath.

Bitcoin’s [BTC] dominance was rising because the king coin kicked off the week with a robust bullish bid, aiming for $70,000.

This bullish efficiency builds on the Bitcoin 2024 convention hype and politically charged pleasure that prevailed in the course of the weekend.

The Bitcoin 2024 convention had a momentous influence on demand, and particularly Bitcoin dominance.

The latter has been on an upward trajectory since mid-July, peaking at 56.76%, only a few factors shy from attaining a brand new 3-year excessive.

Bitcoin dominance peaked at 57.03% in April 2024. The final time that it was that top was in April 2021.

Supply: Tradingview

Will the FED’s upcoming announcement favor Bitcoin dominance?

A significant Federal Reserve announcement is simply days away, one other issue that might push Bitcoin dominance to new 2024 highs. The FED will announce its subsequent rate of interest choice on the thirty first of July.

The press time market sentiment recommended that 96% of analysts anticipated rates of interest to stay unchanged in August.

Supply: Tradingeconomics.com

Danger-on belongings like Bitcoin would expertise a surge in demand if the FED have been to announce a price minimize. The FED’s announcement could not have a lot of an influence on asset costs if charges stay unchained.

Market sentiment is overwhelmingly in favor of a price minimize by 25 BPS in September.

Extra market confidence?

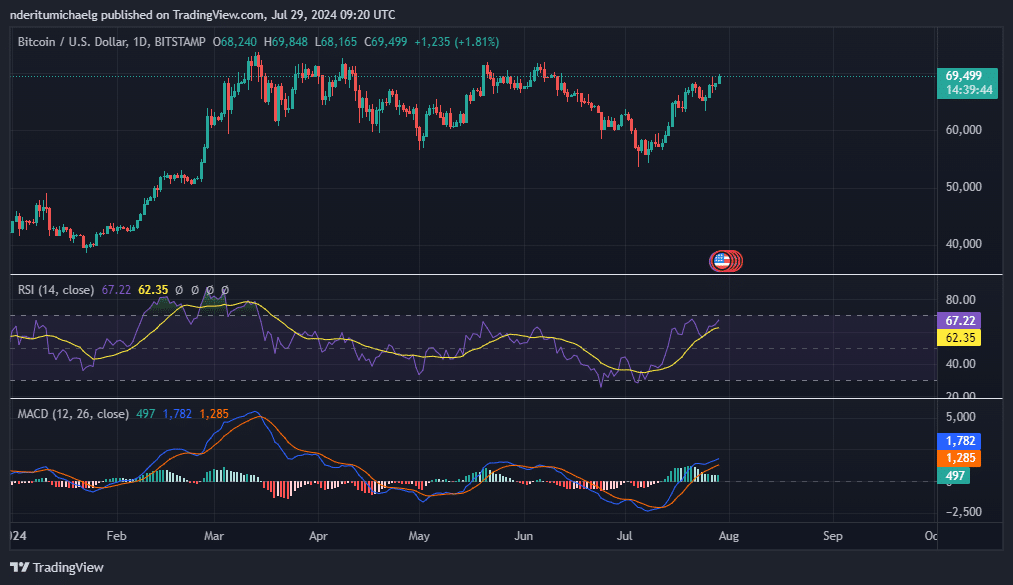

Bitcoin traded at $69,503 at press time, after a 1.81% rally within the final 24 hours. AMBCrypto is eager to see if it will probably drum up sufficient bullish confidence to push above the $70,000 vary.

This is a vital worth level as a result of BTC has been experiencing resistance and a resurgence of promote stress above this zone since March.

Supply: Tradingview

On the technical facet, a push above $70,000 may also topic BTC to overbought circumstances, as per the RSI. The MACD already recommended that bullish momentum was slowing down at press time.

These observations, alongside the upcoming resistance zone, signaled potential for a pullback, fueled by short-term profit-taking.

The long-term outlook remained bullish, nonetheless, particularly after the Bitcoin convention. The thrill across the occasion has drummed up extra confidence in different markets.

For instance, Japanese agency Metaplanet has reportedly bought Bitcoin price over 1 billion Yen.

Metaplex’s inventory has reportedly rallied by over 1,300% to date this yr. A considerable quantity of its inventory worth good points occurred in July, as the corporate ramped up its Bitcoin purchases in July. At press time, it held 246 BTC.

Whereas this underscores some market confidence, Bitcoin’s means to push above its present resistance zone is dependent upon the extent of demand that it will probably maintain above these ranges.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

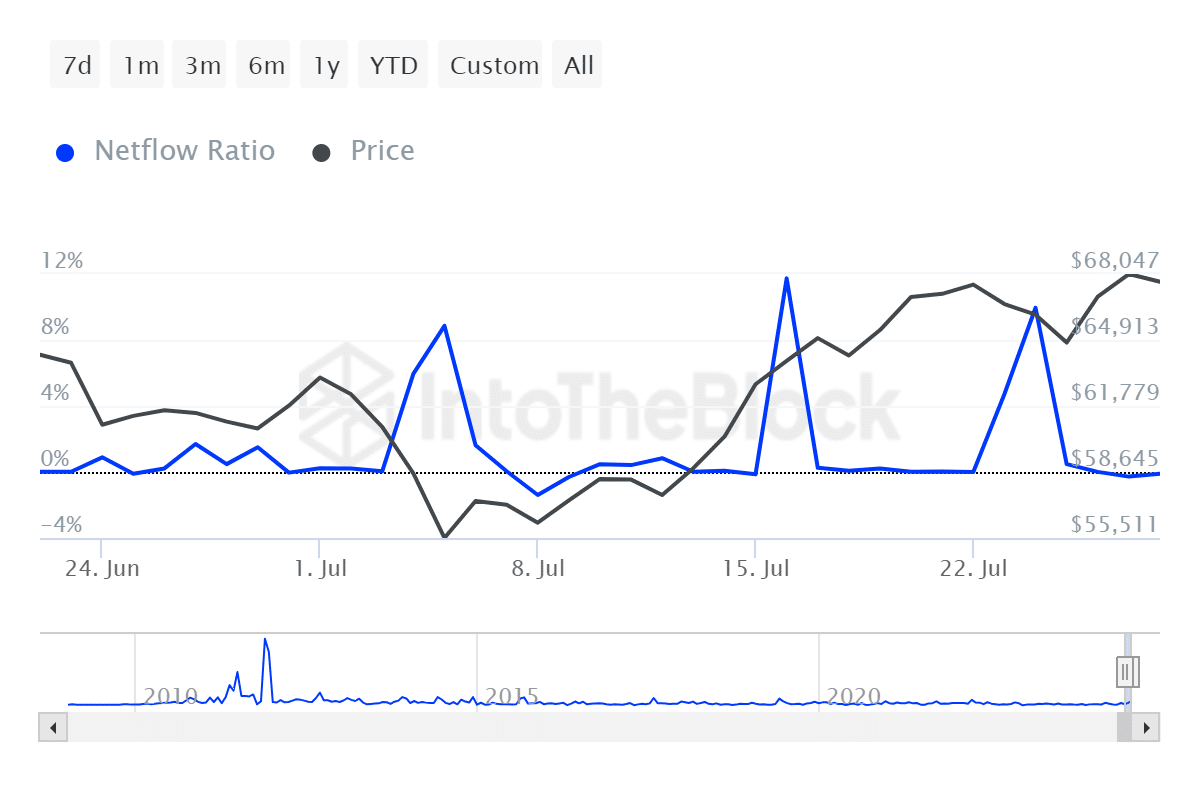

Bitcoin’s massive holder netflow to trade netflow ratio indicated that whales is probably not transferring a number of their funds to date.

AMBCrypto will preserve monitoring this indicator to evaluate the potential flows that might affect Bitcoin dominance and worth within the subsequent few days.

Supply: IntoTheBlock