Picture supply: Getty Photos

AstraZeneca (LSE: AZN) is a UK inventory on effective type. It not too long ago notched a 52-week excessive of 13,290p not lengthy after the pharmaceutical big hit the milestone of changing into the FTSE 100‘s first £200bn firm.

Over 5 years, it’s up round 81%, demolishing the Footsie’s return. Throughout a decade, it’s nearly trebled, leaving underwhelming peer GSK within the mud.

I discover this spectacular contemplating the corporate isn’t enjoying within the high-growth GLP-1 weight-loss sandbox (at the very least not but). Plus, not like Covid vaccine friends Moderna and Pfizer, it’s managed to navigate and overcome the post-pandemic stoop in vaccine gross sales.

However this relentless rise greater has additionally made the share dearer. Does it nonetheless supply any worth in the present day? Let’s have a look.

Taking inventory

AstraZeneca trades on a ahead price-to-earnings (P/E) ratio of 21. Is that costly? Properly, in comparison with the FTSE 100 (round 12) and GSK (10.3), it most actually is.

However the firm is really world and appears low cost versus the ahead P/E multiples of Novo Nordisk (39.7) and Eli Lilly (57.8). That stated, these shares are arguably a bit frothy proper now attributable to investor pleasure across the GLP-1 increase. Merck is buying and selling on a ahead P/E of 19.7.

Primarily based on this metric, I’d say the inventory is pretty valued. It broadly aligns with massive healthcare companies within the S&P 500.

The dividend yield can also be typically utilized by buyers to match the attractiveness of various shares. On this entrance, AstraZeneca doesn’t supply tasty revenue prospects, with a fairly low dividend yield of 1.8%.

Oncology pioneer

In H1, complete income elevated 18% 12 months on 12 months to $25.6bn. Double-digit development was recorded throughout all 4 of its divisions.

- Oncology: up 22%

- Cardiovascular, Renal & Metabolism: 22%

- Respiratory & Immunology: 22%

- Uncommon Illness: 15%

AstraZeneca’s ambition is to remodel most cancers therapy for sufferers by changing chemotherapy and radiotherapy with extra focused therapies.

Consistent with this, it not too long ago acquired most cancers firm Fusion Pharma, which specialises in radioconjugates (a extra exact mechanism of most cancers cell killing in contrast with conventional radiation remedy).

Moreover, it goals to enter the profitable world weight problems market. It has licenced Eccogene’s ECC5004, a once-daily weight administration capsule that the corporate believes might in the end show extra in style than the present once-weekly injections (together with Wegovy).

In fact, there’s a risk these disruptive new therapies don’t work out. In the meantime, the agency is uncovered to regulatory danger and the excessive likelihood of some late-stage scientific trial failures.

My Silly takeaway

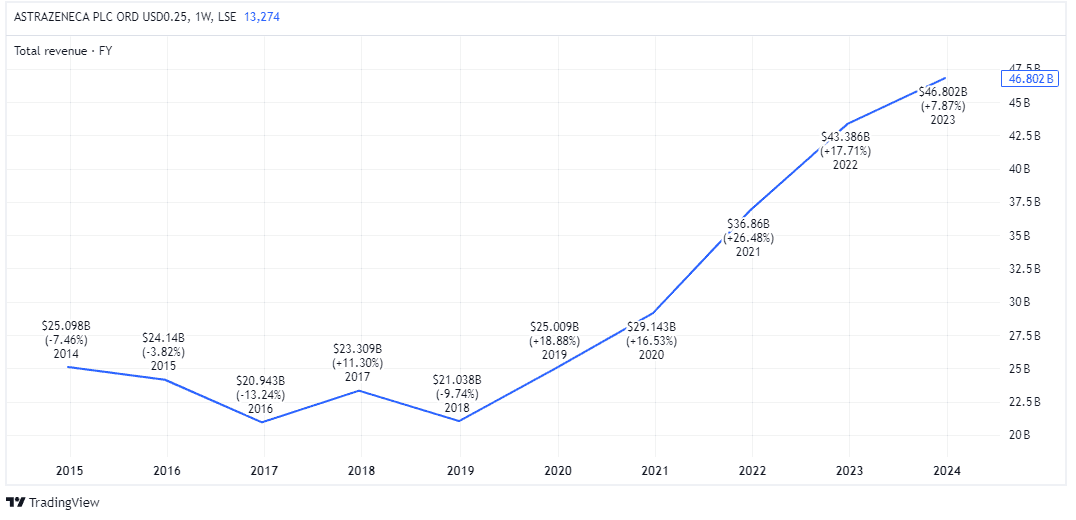

AstraZeneca has grown its income quickly lately, from $25bn in 2020 to $46bn in 2023.

By 2030, it’s aiming for $80bn in annual income. This shall be pushed by the anticipated launch of 20 new medicines, many with the potential to generate $5bn+ in peak annual gross sales.

CEO Pascal Soriot has referred to as this a “new era of growth”. That is no slow-moving pharma big.

Assuming the identical revenue margin is maintained, its earnings might exceed $10bn by then, up from slightly below $6bn in 2023.

That is why I turned a shareholder earlier this 12 months. But when I didn’t already personal the inventory, I’d nonetheless contemplate shopping for it in the present day to carry for at the very least the subsequent 5 years.