Picture supply: Getty Photographs

It’s a easy undeniable fact that Brits aren’t setting apart sufficient cash to assist them fund their retirement. The rising value of dwelling means the quantity we’ve got to save lots of or make investments — reminiscent of by shopping for UK progress and dividend shares — is on the decline.

Scottish Widows’ newest annual ‘Retirement Report’ underlines the size of the issue. After interviewing 5,072 UK adults, the pensions big mentioned that “38% of individuals at the moment are on observe for dwelling requirements in retirement beneath the minimal stage“.

That’s 3% increased than 2023’s survey. To place that in perspective, it means an additional 1.2m persons are on track to take pleasure in a sub-minimum lifestyle once they retire.

Right here’s my plan

So what would life like appear to be underneath this life commonplace class? Scottish Widows’ has used the Pensions and Lifetime Financial savings Affiliation’s (PLSA) definition of the minimal dwelling commonplace, which for a single individual permits for:

- £50 per week for groceries, and £25 a month for consuming out

- No automotive, and £10 per week for taxis and £100 a yr for trains

- Per week-long UK vacation every year

- A primary TV and broadband package deal

- £630 a yr to spend on clothes and footwear

To me, it is a fairly chilling prospect. I don’t plan to spend most of my life working solely to then stay on the breadline once I ultimately retire. I’m certain you are feeling the identical!

So I make investments as a lot as I can each month to try to construct a wholesome nest egg for retirement, even throughout this cost-of-living disaster. The sooner all of us start our journey, the higher.

However I consider that high-yield dividend shares — just like the one described beneath — might assist even those that start investing later in life to take pleasure in a cushty retirement.

7.2% dividend yield

Aviva (LSE:AV.) has one of many largest ahead dividend yields on the FTSE 100 as we speak. At 7.2%, it’s double the index common of three.6%.

Monetary companies companies may be weak throughout financial downturns when shopper spending falls. However due to its formidable money reserves, Aviva appears in good condition to proceed paying massive dividends for the foreseeable future.

Its Solvency II capital ratio was a formidable 206% as of March. This even allowed the enterprise to purchase again a whopping £300m of its shares earlier this yr.

I’m assured Aviva may have the means to steadily develop dividends over time, too. Demand for its pensions, financial savings, and safety merchandise ought to rise significantly due to beneficial demographic adjustments.

A £30k+ passive revenue

If I had £5,000 to put money into Aviva shares, I might count on to make an annual passive revenue of £360 this yr. That’s based mostly on the corporate’s 7.2% dividend yield for 2024.

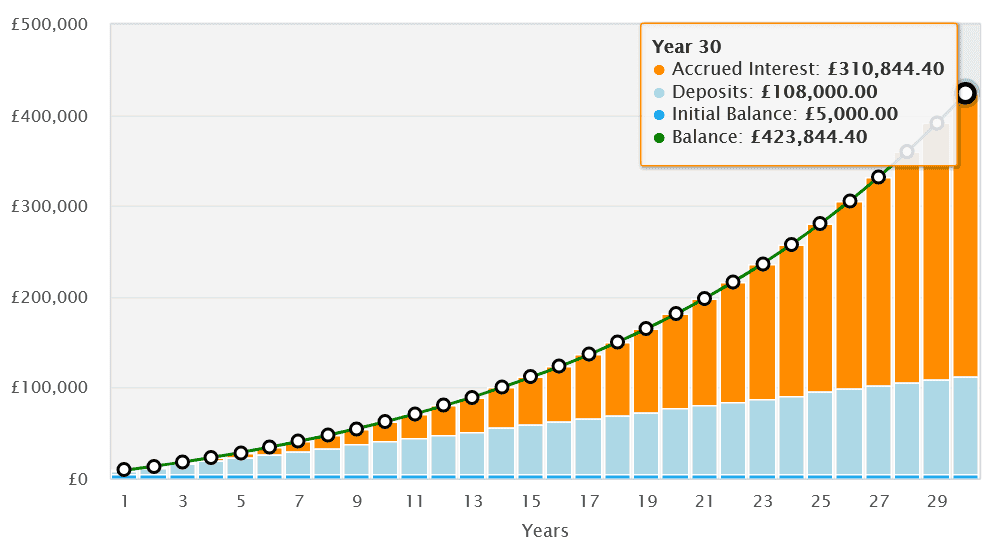

If dividends stay the identical together with the share worth, my £5k lump sum would flip into £43,077 after 30 years with dividends reinvested. If I supplemented this preliminary funding with an additional £300 a month, I might flip this into £423,844 by 2049.

At this level I’d be incomes an annual passive revenue of £30,517. Mixed with the State Pension, this may very well be greater than sufficient to permit me to retire in consolation.