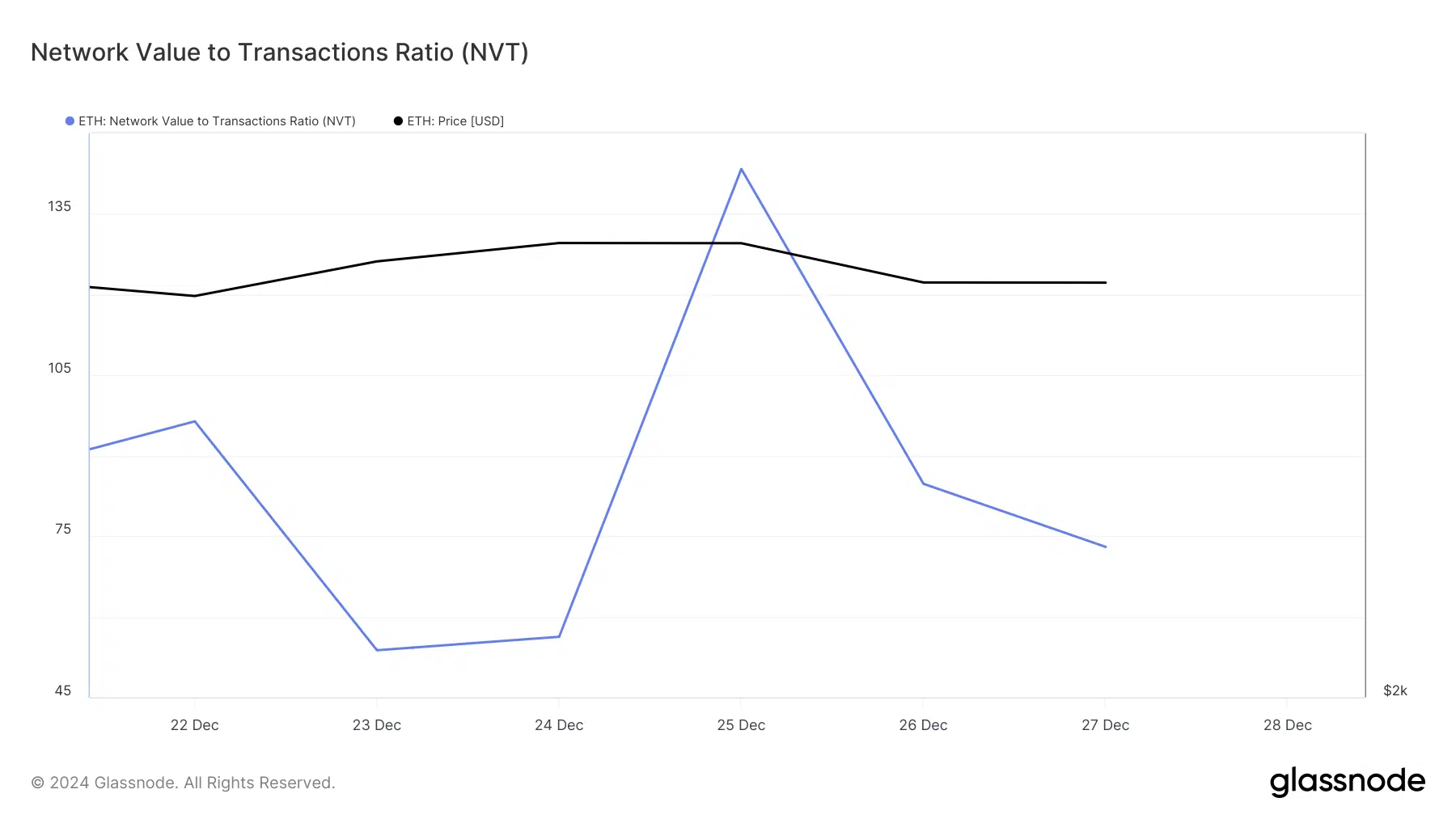

- ETH’s NVT ratio dropped, which means that the token was undervalued

- Market indicators revealed that promoting stress on ETH was excessive

Altcoins’ buying and selling volumes fell sharply within the remaining days of this 12 months, and Ethereum [ETH] additionally fell sufferer to this drop. Nevertheless, will this spark a bear rally as we depend the remaining days of 2024?

Ethereum’s present state

ETH‘s worth dropped marginally over the past 7 days. On the time of writing, the altcoin was buying and selling at $3,333.2 with a market capitalization of over $401 billion. Within the meantime, Santiment shared a tweet revealing fairly a number of related updates.

In line with the identical, within the remaining days of 2024, buying and selling quantity fell throughout all crypto sectors. General, there was a fall of 64% over the previous week, in comparison with the earlier week. The tweet talked about,

“The trading downtrend of trading, particularly among speculative altcoins, is not a surprising development. With the holidays here and traders getting their year-end finances in order, the final week of December is often one of the least active times of each year.”

With all of this stated, if whales proceed exhibiting their robust accumulation pattern, the dearth of retail participation may very well result in a minimum of one remaining huge sudden 2024 pump. All whereas retail pays little consideration.

The place is ETH heading?

The NVT ratio dipped over the previous few days. What this urged was that Ethereum could also be undervalued, hinting at a worth hike within the coming days.

Supply: Glassnode

Other than this, ETH’s change internet circulation has additionally been growing. This meant that internet deposits on exchanges had been excessive, in comparison with the 7-day common. Larger deposits may be interpreted as increased promoting stress.

Ethereum’s lengthy brief ratio registered a downtick too. This meant that there have been extra brief positions available in the market than lengthy positions – An indication of rising bullish sentiment available in the market.

Quite the opposite, shopping for stress on Ethereum elevated currently and this could push the coin’s worth up. The token’s purchase quantity touched 100 too. A quantity nearer to 100 implies that buyers are contemplating shopping for a token.

Supply: Huyblock Capital

Technical indicators continued to be within the bears’ favor although. The Chaikin Cash Stream (CMF) registered a downtick. Equally, the Cash Stream Index (MFI) additionally moved south. Each these metrics meant that promoting exercise was rising, which may have an effect on Ethereum’s costs negatively on the charts.

Learn Ethereum [ETH] Value Prediction 2025-2026

In case of a sustained downtrend, ETH may drop to $3k once more. Nevertheless, within the occasion of worth hike, buyers may count on the token to maneuver in direction of $4k once more.

Supply: TradingView