- Amid the continued worth correction, whales and establishments have moved Bitcoin price a whole bunch of hundreds of thousands

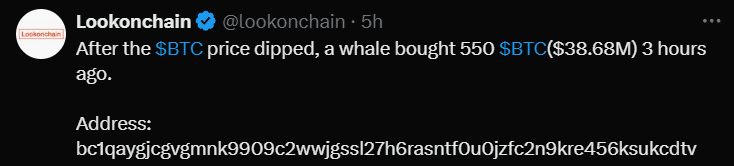

- A crypto whale purchased the dip, including 550 BTC price $38.68 million

After a notable rally, Bitcoin (BTC), the world’s largest cryptocurrency by market cap, registered a serious worth correction on the charts. Between 26 – 29 October, the cryptocurrency attracted vital consideration owing to its 11% worth rally. Nonetheless, this wasn’t to final.

Will Bitcoin’s worth correction proceed?

Proper now, traders and merchants ought to perceive {that a} worth correction after a notable rally is a constructive signal for the long run. Particularly since it may possibly help a possible worth surge in the long run.

Therefore, such a worth correction could have been anticipated by some too. Within the backdrop of the aforementioned correction, some whales and establishments have additionally moved belongings price a whole bunch of hundreds of thousands.

Whales’ and establishments’ latest motion

In response to the blockchain-based transaction tracker Lookonchain, through the morning hours of the Asian buying and selling session, Mt. Gox’s pockets, which holds practically 45,000 BTC price $3.11 billion, transferred 500 BTC price roughly $35.04 million.

Supply: X

Moreover, one other whale purchased the dip, including 550 BTC price $38.68 million as the worth declined to its essential help stage.

Supply: X (Beforehand Twitter)

Bitcoin technical evaluation and key stage

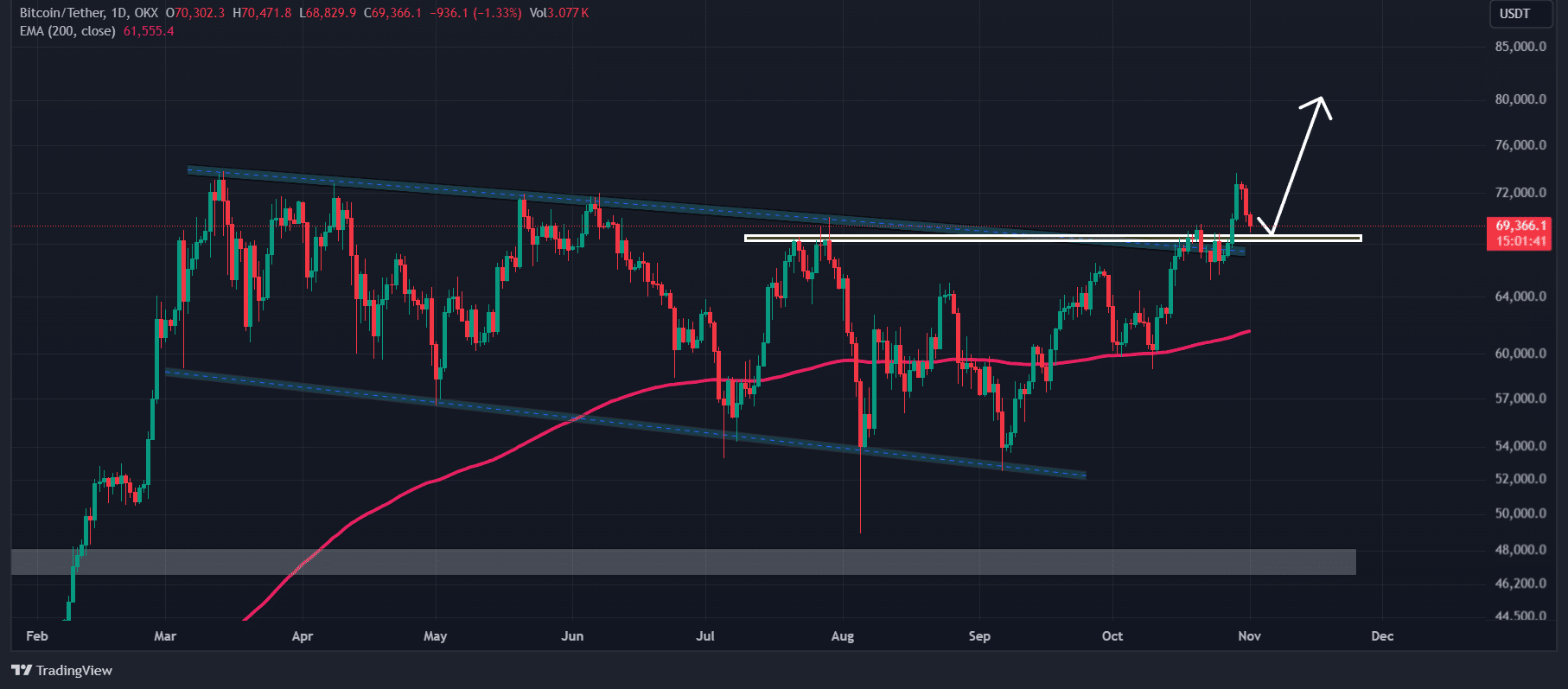

In response to AMBCrypto’s technical evaluation, BTC, at press time, gave the impression to be retesting its breakout stage of $69,235 of the decline channel worth motion sample.

Supply: TradingView

Primarily based on its latest worth motion and historic momentum, if BTC holds this stage, there’s a sturdy risk it might rally considerably within the coming days. In any other case, this breakout might be thought of a fakeout.

On the time of writing, BTC was buying and selling above the 200 Exponential Shifting Common (EMA) on the each day timeframe, indicating an asset pattern that’s on an uptrend. In the meantime, its Relative Energy Index (RSI) urged a possible upside rally, because it remained within the impartial space (neither oversold nor over-bought).

Bullish on-chain metrics

Bitcoin’s constructive outlook was additional supported by its on-chain metrics. In response to the on-chain analytics agency Coinglass, BTC’s Lengthy/Quick ratio had a press time worth of 1.09, indicating sturdy bullish sentiment amongst merchants.

Moreover, Open Curiosity surged by 17% – An indication of rising curiosity within the asset amongst merchants.