- BTC fell by 6.31% over the previous week.

- An analyst famous additional draw back, citing the Pi Cycle MA.

Whereas October is normally related to an uptrend, Bitcoin’s [BTC] latest value motion has did not replicate it. As such, BTC has skilled a pointy decline over the previous week. In actual fact, at press time, Bitcoin was buying and selling at $61,436.

This marked a 6.31% decline in weekly charts.

Nevertheless, the previous 24 hours noticed a slight restoration on BTC value charts, rising by 0.92%. Additionally, on month-to-month charts, Bitcoin has been in an uptrend, mountaineering by 8.18%.

Subsequently, the shortage of clear course with value motion has left the crypto group speaking. One among them is the favored crypto analyst Rekt Capital, who prompt that BTC is ready for an additional downtrend.

A take a look at the market sentiment

In his evaluation, Rekt Capital posited that BTC is regularly going through rejection from the PI Cycle MA.

Supply: X

In keeping with this evaluation, so long as PI Cycle MA is performing because the resistance, BTC will proceed to type a downtrend. Thus, BTC will affirm the downtrend if it tags the sunshine blue downtrend, particularly if the present development persists.

Nevertheless, the analyst additionally famous that consumers are beginning to accumulate whilst the value continues to say no. This was demonstrated by the truth that BTC is beginning to type a 4-hour bullish divergence.

In context, repeated rejections from this stage point out that consumers are struggling to push the costs above the resistance.

Subsequently, each rejection provides to bearish stress, highlighting that Bitcoin is at present going through a provide barrier, thus halting its momentum.

Thus, based mostly on this instance, BTC is ready to expertise additional decline on its value charts if the present market sentiment persists.

What do BTC charts counsel?

Notably, the evaluation above supplies an in depth bearish outlook for Bitcoin. Nevertheless, it’s important to find out what different market indicators say.

Supply: Cryptoquant

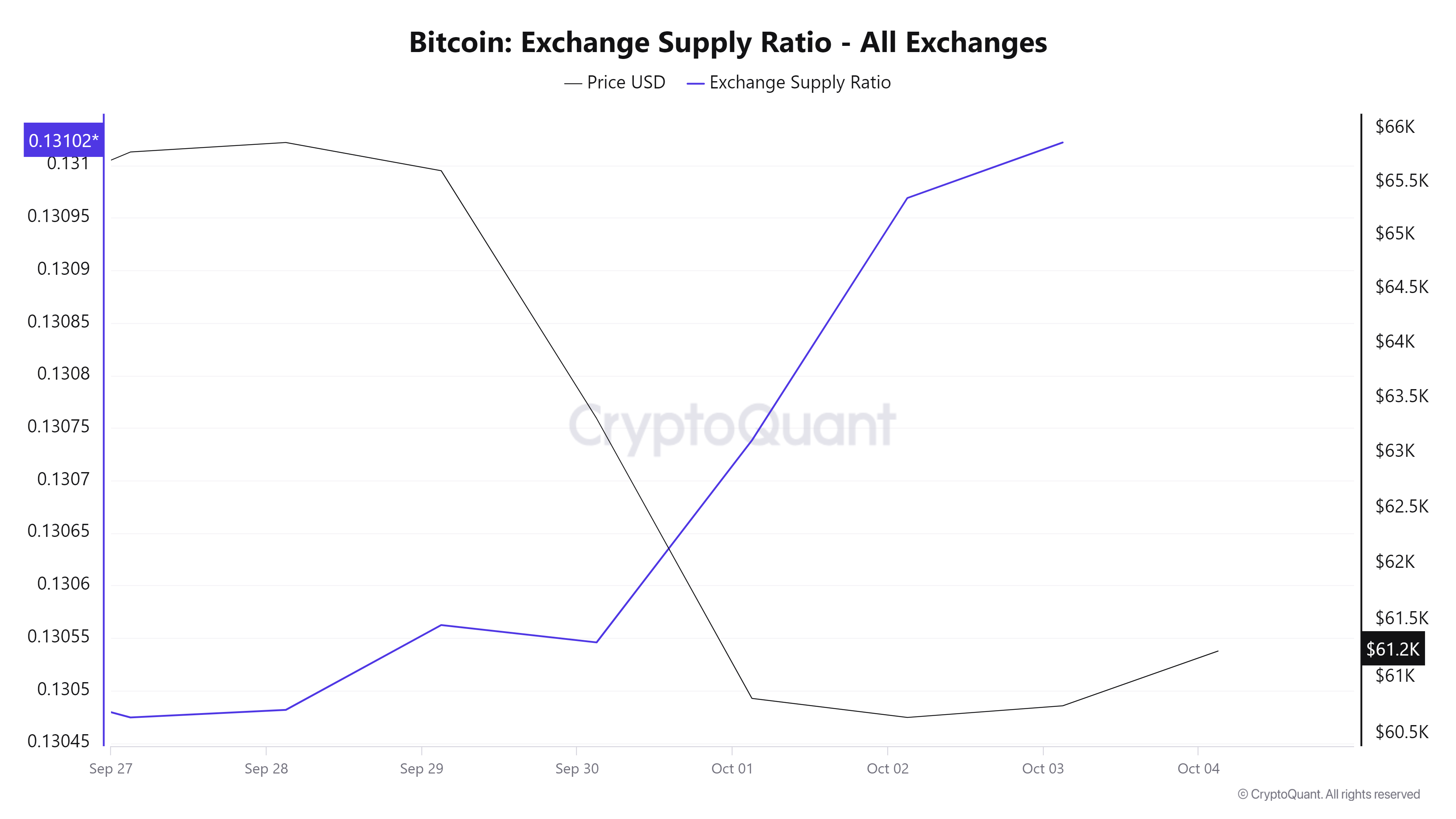

Firstly, Bitcoin’s alternate provide ratio has spiked over the previous couple of days, mountaineering from 0.1304 to 0.131.

The spike in alternate provide implies that buyers are depositing their property into exchanges to promote. Such market habits causes downward value stress, particularly if promoting actions intensify.

Supply: Santiment

Moreover, Bitcoin’s MVRV Lengthy/Quick distinction has been declining over the previous 7 days, dropping from a excessive of 4.3% to three.2%.

This decline alerts weaker confidence amongst long-term holders as their profitability margins decline. The shift suggests bearish sentiment as long-term holders are much less incentivized to carry their positions.

Supply: Santiment

Additional, this insecurity amongst buyers is illustrated by a declining Open Curiosity(OI) per alternate. OI has dipped from $6.1 billion to $5.2 billion. Such a decline means that buyers are closing their positions with out opening new ones.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Merely put, the present market sentiment is bearish.

Subsequently, if these circumstances maintain, Bitcoin will discover the subsequent assist across the $58272 resistance stage. Subsequently, a development reversal will see BTC reclaim $62700.